What were the employment trends in April 2025?

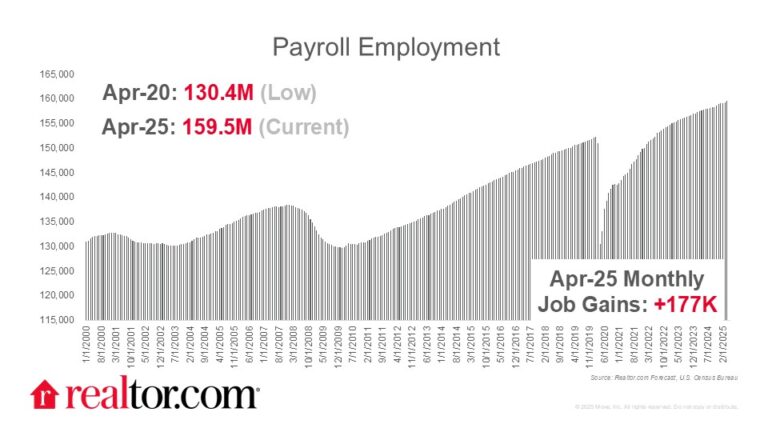

The April jobs report showed roughly steady payroll job growth with a net 177,000 jobs added to payrolls, down only modestly from the downwardly revised 185,000 jobs added in March 2025. The unemployment rate held steady at 4.2%. The impact of Federal cuts from the Department of Government Efficiency was somewhat more pronounced in the April data which showed a decline of nine thousand federal jobs in the last year compared with a gain of three thousand in March.

Although job market concerns have risen among consumers, as expectations for the future dim, the data have not yet signaled a concerning shift. Wage growth, which weakened in March, held steady at 3.8%, above pre-pandemic highs of 3.6%. This may help to offset consumer anxiety about how tariffs and rising prices will impact their budgets.

What else do we know about today’s job market?

Earlier this week, the job openings and labor turnover report that reveals the gains and losses that drive the net numbers showed modestly higher churn as slack lessened. In March, we saw a second monthly decline in the number of job openings while the rate tied its September 2024 low (4.3%), matching the lowest since June 2020. Job openings totaled 7.2 million, down from both the prior month (7.5M) and prior year (8.1M). Job quits, which can be a gauge of worker confidence, rose somewhat to 3.3 million in March, tying the year ago figure. The job quits rate of 2.1% was the highest since July 2024. Even though the data signal that workers still feel confident making changes, the number of available opportunities is shrinking.

What does today’s data mean for homebuyers, sellers, and the housing market?

In Realtor.com April housing data, we saw some growing advantages for buyers who had more options, more time to make decisions, and even more price cuts in many markets. But we also saw that home prices and the amount of income it takes to buy a home remain significantly higher than pre-pandemic, which partially explains the relatively sluggish home sales pace in early spring. Ongoing job creation and wage growth is essential, and the April jobs report was reassuring. In the months ahead we’ll see whether consumers shrug off tariff and job concerns or adjust their homebuying plans instead.

Subscribe to our mailing list to receive updates on the latest data and research.