What were the employment trends in October?

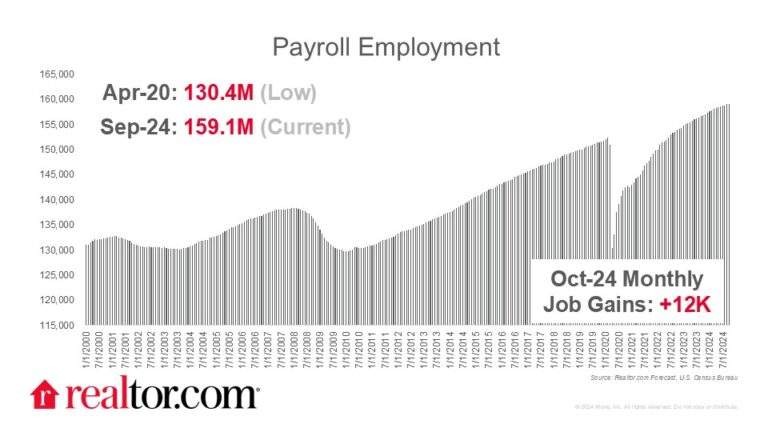

The October jobs report showed a net gain of just 12,000 jobs in October, less than one-tenth of the average monthly gain of 194,000 jobs over the last 12 months, due in part to the month’s job strikes and Hurricanes Helene and Milton. After a blockbuster September report, this month’s job growth data shows a sharp slowdown, though the unemployment rate remained unchanged at 4.1%. Mortgage rates climbed through October in response to the red-hot September employment data and still-strong core inflation. The climb could cut off budding housing market optimism as buyers take to the sidelines in hopes of lower rates in the future. We expect mortgage rates to settle down and end the year in the low 6% range, but the trajectory will be highly dependent on incoming employment and inflation data, as well as the result of next week’s presidential election.

What else do we know about today’s job market?

Other recent job market data showed strong job openings data in September. Job openings were steady month-over-month, but the general trend is lower, evidenced by the decline to 7.4 million job openings from 9.3 million openings one year ago. The job openings rate was 4.5%, slightly lower than in August, and 1.1 percentage points below last September. Job quits, which reflect employees’ willingness to leave their job, were down to 3.1 million in September, about 100,000 below August, and the rate of 1.9% was the lowest seen since 2015 (excepting the pandemic-disrupted spring/summer of 2020). The jobs market is still generally favorable, but slowing compared to one year ago.

What does today’s data mean for homebuyers, sellers, and the housing market?

Buyers enjoyed a boost in buying power in September as mortgage rates dropped as low as 6.08%. The September pending home sales data showed a surge in contract signings in the month as eager buyers took advantage of the brief reprieve in mortgage rates. October housing data shows a more buyer-friendly market with climbing inventory and flat prices on an annual basis. Both new listings and pending listings picked up in October, signaling that buyers and sellers alike responded enthusiastically to lower rates. Despite improving market conditions, housing activity could ease once again in the coming months if mortgage rates remain elevated.

Subscribe to our mailing list to receive updates on the latest data and research.