What were the employment trends in November?

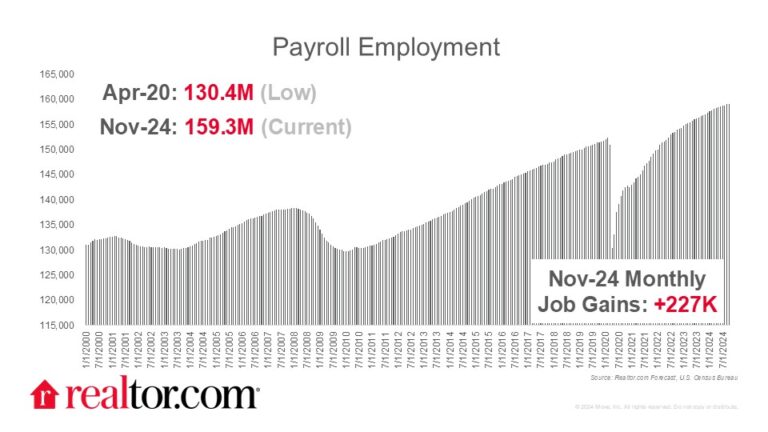

After a stumble in October, the November jobs report showed more robust payroll job growth, with 227,000 jobs added in the month. Importantly for homebuying demand and the housing market, average hourly earnings grew by 4.0% in the last year–continuing above the pre-pandemic range that topped out at 3.6%. The unemployment rate edged up to 4.2%, remaining in the 4.1% to 4.3% range we’ve seen in the last 6 months.

What else do we know about today’s job market?

Other recent job market data showed a good number of job openings in October. Job openings tallied 7.7 million, down from 8.7 million in October 2023. The job openings rate of 4.6% was down from 5.2% in October 2023, and fell at the upper end of the pre-pandemic range, which topped out at 4.8% in January 2019. Job quits, which can be a gauge of worker confidence, were up to 3.3 million in October, but down by 308,000 from one year ago, and the rate of 2.1% was an uptick, but fell below pre-pandemic highs (2.4%). In the big picture, the job market continues to slow, with monthly variation around that trend, but workers are still in a good position, with unemployment low and wages growing.

What does today’s data mean for homebuyers, sellers, and the housing market?

A healthy economy and labor market are likely to give the Fed the confidence to continue normalizing monetary policy later this month, and this bodes well for the housing market in the year ahead. But despite an uptick in inventory from more sellers and new construction, homebuyers in 2025 are expected to continue to contend with tough affordability conditions as income growth and a fairly modest decline in mortgage rates usher in only a small drop in the share of income required to buy the typical for-sale home. As a result, we expect home sales to eke out only a 1.5% gain in 2025. However, the policy wild card is an important one that could add or subtract from this baseline expectation, both directly and because of indirect effects on economic growth. Whether housing gets a Trump bump or not, will depend on the specific details and timing of policies adopted by the new administration and Congress.

Subscribe to our mailing list to receive updates on the latest data and research.