What were the employment trends in January 2025?

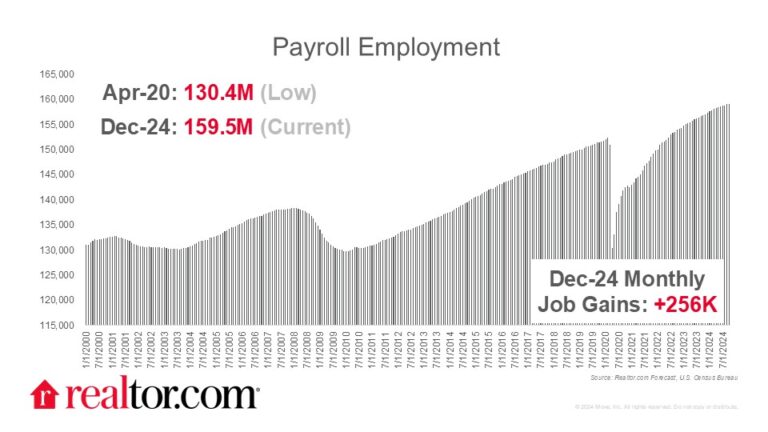

The January jobs report showed ongoing payroll job growth with a net 143,000 jobs added to payrolls. Although this was less than half of the revised December gain (307,000), wage growth rose by 4.1%, and the unemployment rate dipped to 4.0%.

After the annual benchmarking update, payroll data show smaller average job gains for 2024 of 166,000, but job growth is still robust enough to keep the unemployment rate low and wages on an upward trajectory. There was mixed performance across industries, with sectors such as health care, retail trade, and social assistance adding jobs while payrolls declined in mining. Construction jobs were little changed while earnings of construction workers rose.

What else do we know about today’s job market?

Other recent job market data showed a smaller, but still sizable number of job openings in December. Job openings tallied 7.6 million, down from both the prior month and prior year. The job openings rate also slipped to 4.5% falling back below pre-pandemic highs (4.8%). Job quits, which can be a gauge of worker confidence, ticked up slightly to 3.2 million in December, down from 3.5 million one year ago. The job quits rate of 2.0% was unchanged and continues to hover below pre-pandemic highs (2.4%). Month-to-month momentum was mixed according to these indicators, but the labor market clearly has more slack than it did one year ago.

What does today’s data mean for homebuyers, sellers, and the housing market?

Existing home sales closed out 2024 with a strong upswing, but mortgage rates have hovered near 7% since then, putting a question mark on the upcoming spring housing season as pending home sales pulled back in December. Early 2025 housing data from Realtor.com showed healthy seller engagement, but affordability remains a challenge that is acutely felt by younger households who have seen homeownership rates slip. Majorities still say that homeownership is part of the American Dream, but younger households are less likely to do so and also less likely to say that homeownership is achievable for them.

A healthy labor market that provides younger workers with opportunities is essential, but it isn’t enough on its own to make homeownership achievable. The U.S. has a housing shortage estimated by Realtor.com to be between 2.5 and 7.2 million homes. States that can build more housing and also provide economic opportunity for residents are going to have an edge. On these dimensions, Realtor.com research found that Texas has been a model state, attracting people looking for affordable housing, jobs, and a desirable climate. The report was conducted in conjunction with the company’s relocation of its headquarters to Austin, TX.

Subscribe to our mailing list to receive updates on the latest data and research.