What were the employment trends in February 2025?

The February jobs report showed ongoing payroll job growth of 151,000, down marginally from the 168,000 average pace in the last 12 months. The unemployment rate remained roughly steady, ticking up to 4.1%. Although government job cuts have made headlines recently, on net federal government employment declined by 10,000 jobs, or 0.3% at the time of this mid-February reading.

Wage growth remained in its goldilocks range with average hourly earnings up 4.0% in the last year. This is high enough to propel real wage growth, but not so high as to raise inflation concerns.

What else do we know about today’s job market?

This month the employment summary precedes the job openings and labor turnover report that contains information on the churn within the net numbers that are reported Friday. In December, we saw a smaller, but still sizable number of job openings. Job openings totaled 7.6 million, down from both the prior month and prior year. The job openings rate also slipped to 4.5% falling back below pre-pandemic highs (4.8%). Job quits, which can be a gauge of worker confidence, ticked up slightly to 3.2 million in December, but are down from 3.5 million one year ago. The job quits rate of 2.0% was unchanged and continues to hover below pre-pandemic highs (2.4%). Month-to-month momentum was mixed according to these indicators, but the labor market has loosened in the last year.

What does today’s data mean for homebuyers, sellers, and the housing market?

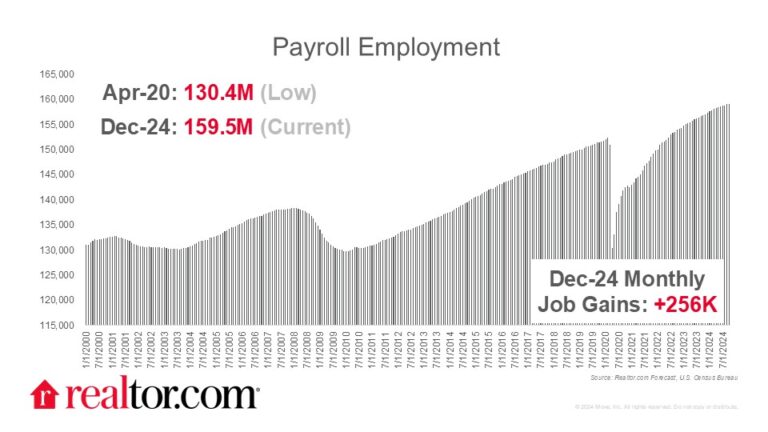

Labor market health is vital to the housing market. A still-low unemployment rate, ongoing wage growth, and net increases in the number of jobs mean opportunities for workers who will need a place to live, driving up housing demand. But higher demand alone is not enough, and lagging housing supply in the face of strong demand has meant a lack of affordability and inventory that needs to be addressed, a topic I’ll be discussing with others at SXSW in Austin in the next few days.

The interaction between the jobs market and housing is also understood by those who are asking what will happen to the housing market in cities where the Federal government is a major employer. This includes our nation’s capital, Washington, D.C., but also markets like Virginia Beach, Oklahoma City, Baltimore and San Diego. Fortunately, unemployment rates in these markets were lower than in many other areas in the most recent prior data, which is likely to help workers adapt to changes. In Realtor.com February housing data, we did not see any correlation between housing market trends and the share of federal workers, but it is a lens through which we will track markets in our monthly and weekly data updates

Subscribe to our mailing list to receive updates on the latest data and research.