Is it a good time to sell a house? Selling a house is a big decision that requires careful consideration, especially in today’s uncertain economic climate. Given the dramatic rise in mortgage rates over the past year, this is a question on the minds of many sellers who are considering selling their homes.

The housing market has been heavily impacted by the rise in mortgage rates, causing many consumers to question whether now is a good time to sell their homes. Let’s take a closer look at the factors that can influence whether it’s a good time to sell your house.

Understanding the Fannie Mae Home Purchase Sentiment Index

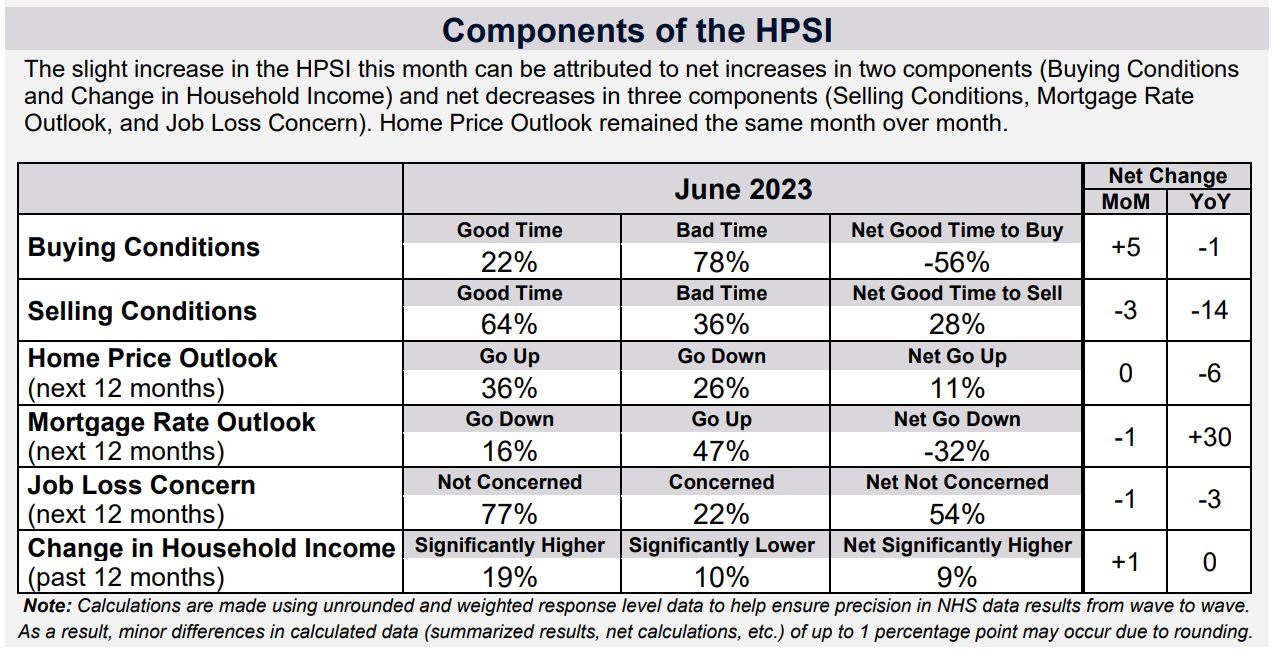

The Fannie Mae Home Purchase Sentiment Index is a comprehensive metric that gauges consumer perceptions about the housing market. Comprising six distinct components, this index provides a holistic view of how people view the market conditions and their outlook for the future. The index is calculated from answers to questions about whether it’s a good or bad time to buy or sell a house, expectations about home prices and mortgage rates, concerns about job loss, and changes in household income.

Consumer Perceptions on Housing Market:

In August, the HPSI remained relatively stable, reflecting a continued low-level plateau in consumer confidence towards housing. Here’s an overview of the key components and consumer sentiments:

1. Good/Bad Time to Buy: 18% of consumers believe it’s a good time to buy a home, while 82% think it’s a bad time.

2. Good/Bad Time to Sell: 66% of consumers perceive it as a good time to sell a home, indicating a positive sentiment towards selling.

3. Home Price Expectations: 41% of respondents anticipate home prices to rise in the next 12 months, while 26% believe they will decrease.

4. Mortgage Rate Expectations: 18% of consumers expect mortgage rates to decrease in the coming year, with 46% anticipating an increase.

5. Job Loss Concerns: 78% of respondents are not concerned about losing their job in the next 12 months, reflecting some confidence in job stability.

6. Household Income: 22% of respondents state that their household income is significantly higher than it was a year ago.

Expert Insights and Analysis:

According to Doug Duncan, Fannie Mae’s Senior Vice President and Chief Economist, consumer pessimism persists due to elevated mortgage rates, reaching a 22-year high in August. This has impacted consumer sentiment, especially towards homebuying conditions.

Existing homeowners are likely to hold on to their historically low mortgage rates, affecting inventory levels and supporting home prices. The market is currently witnessing a unique situation where demand is shifting towards newly constructed homes due to challenges in finding affordable existing home options.

The housing market is experiencing a ‘tale of two markets’, marked by significant home price appreciation and rapid mortgage rate increases. While consumers are cautious, homebuilders are thriving due to the demand for new home construction, influenced by various dynamics in the existing home space and shifting labor market trends.

Overall, the housing market’s current state is unusual, driven by a range of factors affecting consumer perceptions and behaviors.

Should I Sell My House Now or Wait?

So, the question remains, should you sell your house in 2023 or wait until 2024? The answer is not straightforward, as it depends on a number of factors specific to your personal situation. Some of the key considerations are discussed below. Selling a house is a major decision that requires careful consideration of various factors, including market conditions, personal circumstances, and financial goals.

Assess Current Market Conditions

The first step in deciding whether to sell your house now or wait is to evaluate the current state of the real estate market in your area. Consider the following:

- Local Housing Market: Research recent sales data for homes similar to yours in your neighborhood. Are properties selling quickly or languishing on the market? A seller’s market, characterized by high demand and low inventory, might be favorable for selling now.

- Home Prices: Monitor trends in home prices in your area. If prices have been steadily increasing, it could be an advantageous time to sell.

- Interest Rates: Keep an eye on mortgage interest rates. Lower rates might attract more buyers to the market, potentially leading to a quicker sale.

Evaluate Your Financial Goals

Your personal financial goals and needs play a significant role in the decision-making process:

- Profit Margin: Consider how much equity you have in your current home. If you’ve built substantial equity and can sell at a profit, it might be a good time to capitalize on your investment.

- Downsizing or Upsizing: Are you planning to downsize or upsize? Your plans for your next home can influence the timing of your sale. If you’re downsizing, the current market conditions might align well with your goals.

Life Circumstances

Your personal circumstances should also be factored in:

- Job Relocation: If you’re moving for a new job or career opportunity, the timing of your move might be determined by external factors.

- Family Changes: Life events like marriage, divorce, or growing families can impact your housing needs. Consider how your changing family circumstances play into your decision.

Market Trends and Projections

While it’s impossible to predict the future with certainty, researching market trends and projections can provide insights into potential market shifts. Consult with real estate professionals who can offer expert opinions on where the market might be headed.

Real estate professionals, including real estate agents and financial advisors, can offer invaluable guidance. An experienced real estate agent can provide a Comparative Market Analysis (CMA) to help you understand your home’s value in the current market. Financial advisors can help you evaluate the financial implications of selling now versus waiting.

Examining the current housing market trends and data provided by Realtor.com, it’s essential to evaluate whether it’s an opportune moment to sell a house or if waiting might be a strategic move. Let’s delve into the key findings to make an informed decision:

Market Trends and Analysis:

1. Home Listing Prices: Home listing prices are on an upward trend, influenced by higher mortgage rates and an ongoing existing home inventory crunch.

2. Affordability Challenges: The combination of high mortgage rates and elevated home prices is impacting homebuyer affordability, potentially affecting the demand for buying homes.

3. New Home Sales: Affordability concerns have led to a decline in new home sales, despite some relief from new construction.

4. Rental Market Trends: Decreasing rental prices are reducing the sense of urgency for potential homebuyers, leading more households to opt for renting and saving for future home purchases.

5. Optimal Timing for Buyers: Historical data indicates that the first week of October could be an optimal time for those determined to finalize their home purchases, with potential dips in home prices and increased housing inventory compared to the busy summer months.

Key Data Points:

- Median Listing Price: The median listing price has grown by 1.1% over the last year, maintaining a steady or upward trend.

- New Listings: New listings, indicating homes for sale, have consistently declined over the past 64 weeks, with a 7.5% decrease compared to the previous year.

- Active Inventory: The number of homes available for sale has lagged by 3.7% compared to the previous year, contributing to limited inventory.

- Days on Market: Homes are spending the same number of days on the market compared to the previous year, indicating a stable market despite affordability challenges.

Expert Insights and Recommendations:

Considering the upward trend in home listing prices and the ongoing challenges of high mortgage rates and limited inventory, potential sellers might find strategic advantages in waiting for the market to stabilize further. However, for those seeking to sell this year, the indicated optimal timing in early October could be beneficial.

It’s crucial for potential sellers to carefully evaluate their individual circumstances, and market conditions, and consult with real estate experts to make an informed decision that aligns with their goals and objectives.

Conclusion: A Balanced Approach

Deciding whether to sell your house now or wait involves a careful evaluation of the market data and your individual circumstances. The current real estate landscape appears to offer some advantages to sellers due to limited inventory and potential pricing power. However, it’s essential to consider your financial goals, personal timeline, and local market conditions when making this decision. Consulting with a real estate professional who can interpret the data in the context of your specific situation can help you make an informed choice that aligns with your needs and objectives.

Sources

- https://www.fanniemae.com/research-and-insights/surveys-indices/national-housing-survey

- https://www.realtor.com/research/articles/