Shares in the mortgage giants soared Wednesday on expectations that the Trump administration and Congressional Republicans will revive efforts to privatize the companies.

Whether it’s refining your business model, mastering new technologies, or discovering strategies to capitalize on the next market surge, Inman Connect New York will prepare you to take bold steps forward. The Next Chapter is about to begin. Be part of it. Join us and thousands of real estate leaders Jan. 22-24, 2025.

Shares in mortgage giants Fannie Mae and Freddie Mac soared Wednesday on expectations that Donald Trump’s return to the White House — and potential Republican control of Congress — will revive efforts to privatize the companies.

During his first term as president, Trump began the process of “recapitalizing” Fannie and Freddie, which were placed in government conservatorship in 2008 as mortgage delinquencies and foreclosures climbed during the Great Recession of 2007-09.

But Democrats derailed the plan to privatize Fannie and Freddie after Trump lost the 2020 election, prompting top executives to depart from both companies.

The Wall Street Journal reported in September that former Trump administration officials and banking industry leaders were working behind the scenes to restart the privatization process.

Congress would need to get on board, but the process could be fast-tracked if Republicans control both chambers of Congress. While the GOP wrested control of the Senate from Democrats on Tuesday, control of the House remains up in the air, with a number of races too close to call, the Associated Press reported Wednesday afternoon.

Preferred shares in Fannie Mae and Freddie Mac, which were delisted in 2010 but still trade over the counter, were up more than 70 percent Wednesday, while prices for Fannie and Freddie common stock climbed by nearly 40 percent.

“The re-election of former President Donald Trump revives the effort to get Fannie Mae and Freddie Mac out of government conservatorship” but “a long process lies ahead,” Bloomberg Intelligence analyst Ben Elliott said in a note to clients. Elliott doesn’t envision privatization happening before 2026 or 2027.

At an August campaign rally, Vice President Kamala Harris claimed privatizing Fannie Mae and Freddie Mac could add $1,200 a year in additional interest costs to the typical mortgage.

The Harris campaign told PolitiFact that the $1,200-a-year estimate was based on a 2015 analysis by Moody’s Analytics and The Urban Institute.

Experts consulted by PolitiFact said that although privatization of Fannie and Freddie “would likely affect mortgages, it’s difficult to parse out with certainty how profound the changes would be.”

The National Association of Realtors and other real estate industry groups have advocated that the government continue to play a role in secondary mortgage markets. NAR has proposed that Fannie and Freddie could be replaced by a new private entity that’s regulated like a public utility.

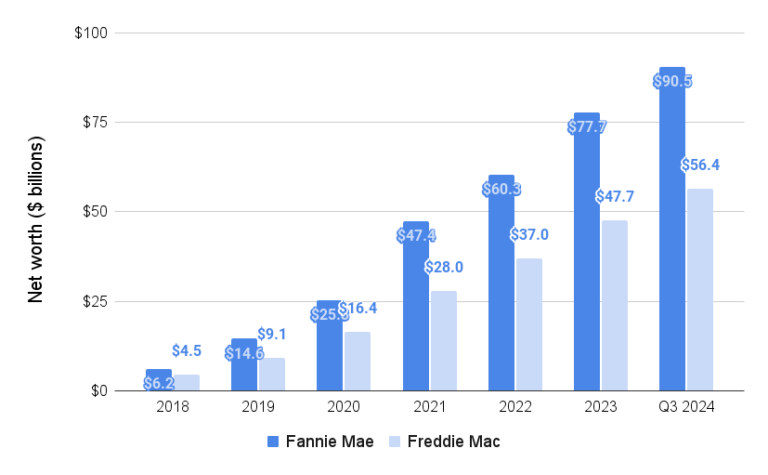

Fannie, Freddie grow net worths to $147 billion

Source: Fannie Mae and Freddie Mac earnings reports.

Since repaying a $191 billion taxpayer bailout, Fannie and Freddie have been gradually building their net worths since the Trump administration started allowing both companies to retain all of their earnings.

At $90.5 billion, Fannie Mae’s net worth as of Sept. 30 was up 16 percent this year, while Freddie Mac boosted its net worth by 18 percent over the same period, to $56.4 billion.

But Fannie and Freddie’s federal regulator, the Federal Housing Finance Agency, has estimated the mortgage giants would need a combined minimum of $319 billion in adjusted total capital to weather another big downturn.

Fannie and Freddie’s capital positions, “are improved from 2008, but are not robust enough to prevent a Treasury draw in the event of a large loss,” according to their annual report to Congress in June.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.