Key takeaways

- Having their financial ducks in a row and rate shopping when applying for a mortgage can save borrowers up to nearly 150 basis points (1.5 percentage points) on their mortgage rate. On a $500,000 home purchase, that’s a difference of just under $400 per month, or $4,800 per year.

- Improving one’s credit score from Bad (under 600 FICO) to Very Good (750–800) can lower one’s mortgage rate by 39 basis points.

- Reducing one’s loan-to-value ratio from over 95% to under 80% can lower one’s mortgage rate by 18 basis points.

- Reducing one’s debt-to-income ratio from above 43% to below 30% has a relatively small effect on mortgage rates (5 basis points) when controlling for the impact doing so has on one’s credit score.

- Shopping around can have the largest impact on one’s mortgage rate with a difference of 86 basis points, on average, between the least expensive and most expensive lenders.

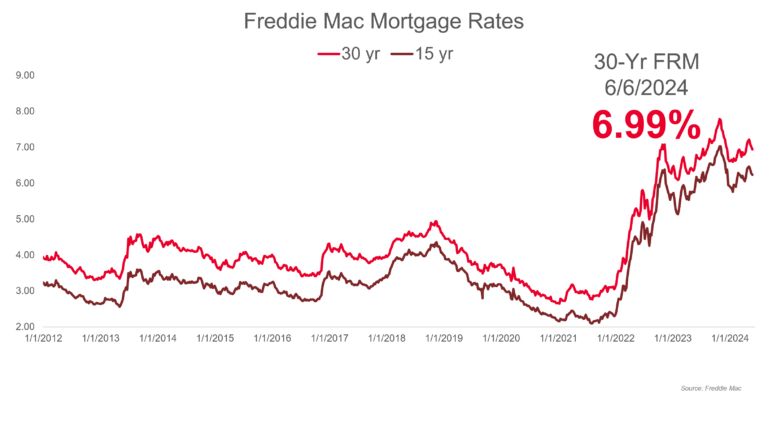

This summer has brought hot temperatures and even hotter mortgage rates, but homebuyers shouldn’t feel helpless. That’s because although mortgage rates are hovering around two-decade highs, borrowers can take action to lower their mortgage rates by up to 150 basis points. That’s the difference between getting a rate of 7.5% and 6.0%, which can add up to a nontrivial difference in their monthly mortgage payment.

To calculate these estimates, we combed through loan-level mortgage records to determine what borrower, property, and lender characteristics have the largest and smallest impacts on one’s mortgage rates.

Our model analyzed over 2 million mortgage originations between 2022 and 2023 from Freddie Mac’s Single-Family Loan-Level Dataset using statistical methods that allow us to identify what factors best determine—all else being equal—one’s mortgage rate at origination. Our findings suggest homebuyers who aren’t in a hurry should focus on increasing their credit score and their down payment, while when the time comes to pick a lender, everyone should focus on shopping around.

Lining up financial ducks can save some bucks (62 basis points)

On the financial side of things, we’ve found the biggest impact one can have on their mortgage rate is improving their credit score from below 650 to 750 or above. On average, borrowers with a Very Good or Excellent credit score (above 750) receive mortgages that are 39 bps lower than borrowers with Bad credit scores (less than 650).

Next up, borrowers looking to lower their mortgage rates should reduce their loan-to-value ratio. Buyers would do this by making a larger down payment or reducing the price of the home purchased so that the down payment funds make up a larger share of the purchase price.

We’ve found that, on average, mortgage applicants with a loan-to-value ratio of less than 80% receive mortgage rates that are 18 basis points lower than applicants with a loan-to-value ratio of over 95%.

What’s more, reducing loan-to-value ratios to below 80% comes with additional savings from eliminating the need for mortgage insurance. For borrowers taking out a 30-year fixed-rate mortgage, this can amount to saving from 0.19% to 1.68% of the original mortgage balance every year until the loan-to-value ratio falls below 80%.

Surprisingly, reducing one’s debt-to-income ratio doesn’t move the mortgage rate needle that much. We’ve found that, on average, mortgage applicants with debt-to-income ratios of less than 30% receive mortgage rates that are just 4.5 basis points lower than applicants with a debt-to-income ratio of over 43%.

Though the direct benefit of lowering one’s debt-to-income ratio is small, it’s important to note this doesn’t mean that one shouldn’t try to minimize it. This is because there are likely indirect benefits that accrue since debt-to-income and credit scores are highly correlated. For example, a borrower with a higher debt-to-income ratio is also likely to have a lower credit score, so reducing debt can indirectly lead to better mortgage rates via the direct improvement in credit score.

All up, improving one’s credit score, lowering loan-to-value ratios, and reducing debt can lead to reductions of 38 basis points, 18 basis points, and 4.5 basis points, respectively, for a total impact of just under 62 basis points for lining up your financial ducks in a row.

Rate shopping can lead to rate chopping (86 basis points)

When it comes to getting the best rate, perhaps the best bang-for-your-buck tactic is to shop around for mortgage rates. Across the largest lenders in the country, there is over a 75 bps spread. And remember, our analysis controls for the characteristics of the borrower, such as the size of their down payment, existing debt, and credit score. So this means that, all else being equal, the same borrower would get a 7% rate with the most expensive lender and a 6.25% rate with the least expensive lender.

Investment, vacation, and manufactured homes will cost you

While the factors covered above focus on actions that borrowers can take themselves to help lower their mortgage rates, there are also several “fixed” mortgage determinants that borrowers are unable to do anything about. Among these, three stick out: whether the home being purchased is going to be used as a rental, whether it is going to be used as a second/vacation home, and whether it is a manufactured home.

While some may argue that borrowers can determine whether to buy an investment, vacation, or manufactured home, we classify these as fixed-rate determinants conditional on the assumption that the decision to buy such a property has already been made.

We’ve found that, on average, mortgage applicants who plan on using the home as an investment property receive mortgage rates that are 55 basis points higher than applicants who will be owner-occupiers. Furthermore, we’ve found that, on average, mortgage applicants who plan on using the home as a second residence/vacation property receive mortgage rates that are 32 basis points higher than applicants who will be owner-occupiers. Last, we’ve found that buyers of manufactured homes have, on average, mortgage rates that are 20 basis points higher than buyers of single-family homes.

Methodology

We analyzed over 2 million mortgage originations between 2022 and 2023 using Freddie Mac’s Single-Family Loan-Level Dataset using statistical methods that allow us to determine what factors best influence—all else being equal—a borrower’s mortgage rate at origination.

Specifically, we employ an Ordinary Least Squares regression model predicting an individual borrower’s actual received mortgage rate as a function of a variety of borrower characteristics. The borrower characteristics include the following: borrower FICO score, cumulative loan-to-value, debt-to-income ratio, original loan amount, property type, units in the structure, loan purpose, occupancy status, number of co-borrowers, loan term, loan channel, first-time homebuyer status, the 10-year Treasury yield during the month of origination, the metropolitan area of origination, and lender name. The full set of regression model results are available upon request.