What happened this quarter

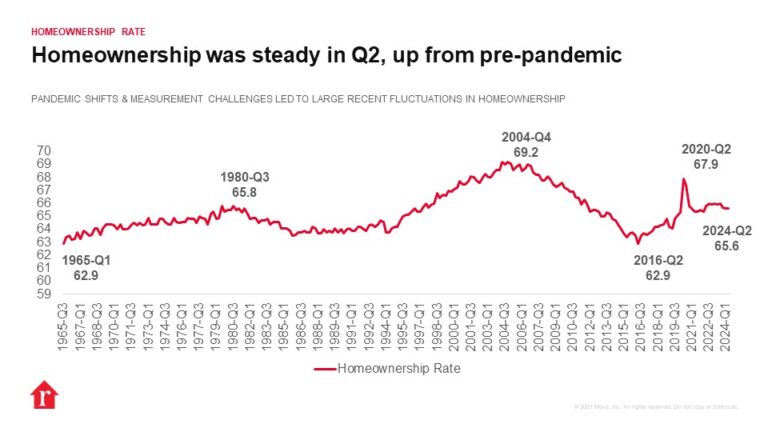

In the second quarter of 2024, the homeownership rate held steady at 65.6%, the same as the previous quarter and the previous year.

Homeownership has leveled off over the past year as the housing market remained relatively unchanged with still-high home prices and elevated mortgage rates.

For-sale inventory continues to improve annually but remains well below pre-pandemic levels, which has kept upward pressure on prices in many markets.

The homeowner vacancy rate ticked up 0.1 percentage point from last quarter and 0.2 percentage point from the previous year, to 0.9%. Homeowner vacancy has remained below 1% since the first quarter of 2021 as a rapid pickup in buyer activity meant fewer homes sat empty than in the years before the pandemic.

Still-scarce inventory has kept homeowner vacancy historically low over the past three years. However, the situation varies from region to region.

The Northeast had the lowest homeowner vacancy rate this quarter with a rate of 0.7% (flat year over year), followed by 0.8% in the West (+0.1 percentage point year over year), 0.9% (+0.3pp YoY) in the Midwest, and 1.2% (+0.3pp YoY) in the South. The South has seen inventory levels recover more significantly than other regions, contributing to the uptick in homeowner vacancy as still-high prices and mortgage rates sap buyer enthusiasm.

The rental vacancy rate hovered at 6.6% for the fourth quarter in a row, 0.3 percentage points higher than one year prior. An influx of multifamily home completions allowed the rental vacancy rate to creep higher since 2021, but limited for-sale inventory and high homebuying costs mean would-be buyers are likely opting to rent until conditions improve, preventing the rental vacancy rate from returning to pre-pandemic levels.

Rental vacancy was highest in the South (8.4%), followed by the Midwest (5.7%), the West (5.5%), and the Northeast (5.5%). Only the Midwest saw the rental vacancy rate fall annually in the first quarter (-1.4 pp). While the South sees softening rents, the Midwest has seen rent levels continue to climb, suggesting that renter competition is pushing rents higher and vacancy lower in the region.

A recent Realtor.com analysis found that many of the best rental markets are currently in the South, where renters can take advantage of stable economies and plenty of rental inventory.

Different outcomes by race/ethnicity

The homeownership rate increased for White householders and Asian, Native Hawaiian, and Other Pacific Islander householders relative to the previous quarter, but only Asian householders saw an annual increase. Homeownership fell both quarterly and annually for Black households and Hispanic households.

Despite improvement over the past four years, only 45.3% of Black householders and 48.5% of Hispanic householders owned their home in Q2 of 2024, compared with 74.4% of White householders. The homeownership gap persists for householders of color, with Black, Hispanic and Asian, Native Hawaiian and Pacific Islander households owning at a lower rate than White households. The gap narrowed through the COVID-19 pandemic, but Black homeownership is still 28.3 percentage points lower than White homeownership. This gap has improved but is still higher than pre-2009. Similarly, Hispanic homeownership is 29.1 percentage points lower than White homeownership and 20.3 percentage points lower than the national average.

The homeownership rate gap is one reflection of the challenges many Americans face in getting access to housing and related services. The Asian homeownership rate was the next highest after White homeownership, but the gap was still 11.6 percentage points in Q2.

Different outcomes by income

In the first quarter, 79.2% of households with a family income at or above the national median owned their home, a 0.4 percentage point increase over both the previous quarter and the previous year. Just 52.1% of households with a family income below the median owned, a 0.4 percentage point drop from the previous quarter and a 0.9 percentage point drop year over year.

As home prices and mortgage rates remain elevated, financing a home purchase will remain prohibitively expensive for many households, especially those earning less than the national median income.

Different outcomes by age

In the first quarter of the year, homeownership for householders aged 34 and younger fell both quarterly (-0.3 pp) and annually (-1.1pp), reaching 37.4%, the lowest level since Q1 2020. The homeownership rate increased 0.8pp quarterly, but fell 0.9pp annually for 35- to 44-year-olds, reaching 62.2%. The 45–54 age group saw homeownership improve both quarterly and annually, reaching 71.1% in Q2 2024.

Purchasing a home continues to be challenging for younger households, especially first-time buyers. Homeownership for households 35 and younger is still higher than pre-pandemic, but down from pandemic-era highs, when low mortgage rates enabled home purchasing.