What happened this quarter

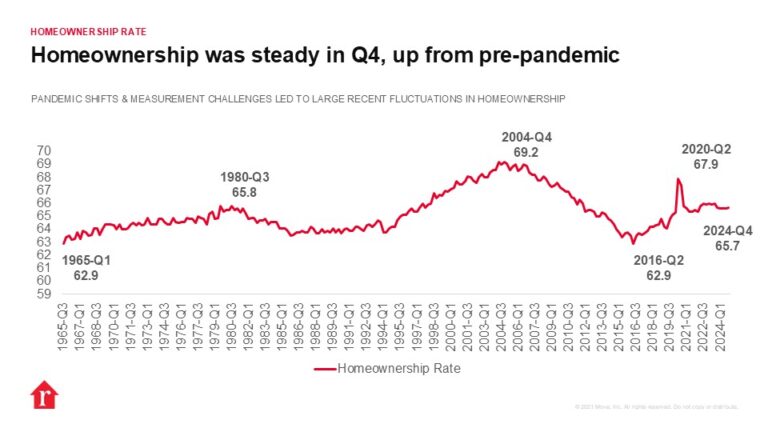

The homeownership rate in the United States held steady in the fourth quarter of 2024 at 65.7%, 0.1 percentage points higher than last quarter and level with Q4 2023. Homeownership rates have held steady between 65.6% and 65.7% over the last year, down from recent highs, but higher than the norm in the years before the pandemic. Homeownership peaked before the Great Recession and fell steadily through roughly 2017 before picking up a bit more steam during the pandemic. Lower-than-peak homeownership is likely due in large part to housing affordability and availability, which go hand-in-hand, and have both suffered over the last decade. For-sale inventory is back to early 2020 levels, offering eager home buyers ample options, but buyers, especially first time buyers, continue to face stubbornly high home prices and near-7% mortgage rates.

The homeowner vacancy rate ticked up slightly, to 1.1% compared to 1.0% in Q2 and 0.9% in 2023Q4. Homeowner vacancy has been on a consistent decline since 2011 and stayed at or below 1.0% from the second quarter of 2020 through last quarter. Growing for-sale inventory has pushed homeowner vacancy to the highest rate since the first quarter of 2020, though it is still well below pre-pandemic levels and historical norms.

The rental vacancy rate leveled off this quarter at 6.9%, the same as the previous quarter and 0.3 percentage points higher than one year prior. The slackening rental market suggests that falling median asking rent is likely to persist, and builders will continue to focus activity in the single-family space. Multifamily construction starts have fallen annually for 11 of the last 12 months as rental demand eased.

Rental vacancy, much like multi-family construction, varies regionally. The rental vacancy rate is highest for the South region, at 8.7%, compared to 7.2% for the Midwest, 5.9% for the West, and 4.2% for the Northeast. The Northeast was the only region to see a falling vacancy rate in Q4, the South saw the rate hold steady, and the Midwest and West saw climbing rental vacancy. Midsized to large Southern metros like Austin, Dallas, Memphis and Nashville are experiencing a supply glut, with much of the excess newly-built, and make for attractive destinations for renters.

Different outcomes by race/ethnicity

Homeownership rates by race and ethnicity were relatively steady year-over-year, coming in at 74.4% for Whites (+0.6 percentage pts YY), 46.4% for Blacks (+0.5 ppts YY), 48.8% for Hispanics (-1.0 ppts YY), 62.7% for Asians, Native Hawaiians, and Other Pacific Islanders (-0.3ppts YY), and 58.0% for all other races (-0.4 ppts YY) in the fourth quarter of 2024. Though these numbers have been quite stable recently, Black homeownership reached its highest level since Q3 of 2020 this quarter, though it remains the lowest of the groups studied.

Different outcomes by age

Homeownership rates by age showed downward movement for younger groups this quarter as buyers contend with challenging market conditions. Homeownership among those under 35 years old was 36.3% (-1.8 percentage pts YY), among those 35 to 44 years old is 61.4% (-0.6 ppts YY), 45 to 54 years old is 71.0% (+0.7 ppts YY), 55 to 64 years old is 76.3% (+0.3 ppts), and 65 and older is 79.5% (+0.5 ppts YY). The large jump between the first two categories supports the recent data showing that the typical age of first-time homebuyers is 38. Younger home shoppers face affordability headwinds as the homeownership rate for age 35 and under fell to the lowest level since pre-pandemic.