Home prices have continued their upward trend in Q4 2024, with 89 percent of U.S. metro areas seeing an increase in single-family existing-home prices, according to data released Thursday by NAR.

Turn up the volume on your real estate success at Inman On Tour: Nashville! Connect with industry trailblazers and top-tier speakers to gain powerful insights, cutting-edge strategies, and invaluable connections. Elevate your business and achieve your boldest goals — all with Music City magic. Register now.

Home prices have continued their upward trend in Q4 2024, with 89 percent of U.S. metro areas seeing an increase in single-family existing-home prices, the National Association of Realtors (NAR) reported Thursday.

That’s just a slight uptick from the previous quarter when 87 percent of metros registered price growth.

The median price for a single-family existing home rose 4.8 percent year over year to $410,100, compared to a 3.2 percent increase in Q3. Mortgage rates fluctuated between 6.12 percent and 6.85 percent during the quarter, which impacted affordability but also contributed to housing wealth gains.

Lawrence Yun | Chief economist at the National Association of Realtors

“Record-high home prices and the accompanying housing wealth gains are definitely good news for property owners,” NAR Chief Economist Lawrence Yun said. “However, renters who are looking to transition into homeownership face significant hurdles.”

According to NAR, some areas saw particularly steep price increases. 14 percent of metro areas recorded double-digit price gains, double the share from Q3.

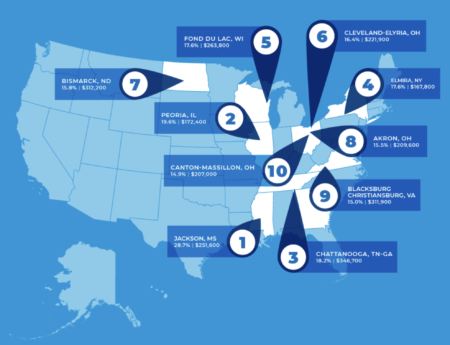

The Midwest dominated the list, with six of the top 10 markets with the highest annual median price gains of at least 14.9 percent.

Key markets included Jackson, Mississippi (28.7 percent); Peoria, Illinois (19.6 percent); Chattanooga, Tennessee-Georgia (18.2 percent); Elmira, New York (17.6 percent); and Fond du Lac, Wisconsin (17.6 percent).

Metro Areas With the Largest Percent Gain QQ4 | National Association of Realtors

Meanwhile, the South led in single-family existing-home sales, similar to Q3, making up 45.1 percent of the market with a 2.1 percent annual price increase.

Other regions saw sharper growth: Northeast prices jumped 10.6 percent, the Midwest 8.0 percent and the West 4.0 percent.

California remained home to eight of the 10 priciest markets, led by San Jose-Sunnyvale-Santa Clara ($1,920,000; 9.7 percent); Anaheim-Santa Ana-Irvine($1,360,000; 4.7 percent); San Francisco-Oakland-Hayward($1,315,600; 5.2 percent); San Diego-Carlsbad ($985,000; 5.7 percent); and Salinas ($943,900; -5.0 percent).

Despite rising prices in most places, nearly 11 percent of markets saw price declines, a slight improvement from 13 percent in the previous quarter.

“While recognizing many workers may not have the option to relocate, those who can or are willing to move may find more affordable conditions, especially given the wide variance in home prices nationwide,” Yun said.

Affordability has seen small improvements as mortgage rates edged lower, bringing the monthly mortgage payment on a typical existing single-family home with a 20 percent down payment to $2,124 – a 1.7 percent decrease from the previous year.

Families typically spent 24.8 percent of their income on mortgage payments, down from 25.2 percent in Q3 and 26.5 percent from 2023.

First-time buyers also caught a bit of a break. A typical starter home valued at $348,600 with a 10 percent down payment saw mortgage payments dip 0.9 percent from Q3 to $2,083. However, they still spent 37.4 percent of their income on mortgage payments, down slightly from 38.1 percent in Q3.

For many buyers, homeownership remains a stretch. To afford a 10 percent down payment mortgage, a household needed an income of at least $100,000 in 43.8 percent of U.S. markets, up from 42.5 percent in Q3. On the other hand, only 2.2 percent of markets had homes affordable for households earning under $50,000.