No one can predict the future of real estate, but you can prepare. Find out what to prepare for and pick up the tools you’ll need at Virtual Inman Connect on Nov. 1-2, 2023. And don’t miss Inman Connect New York on Jan. 23-25, 2024, where AI, capital and more will be center stage. Bet big on the future and join us at Connect.

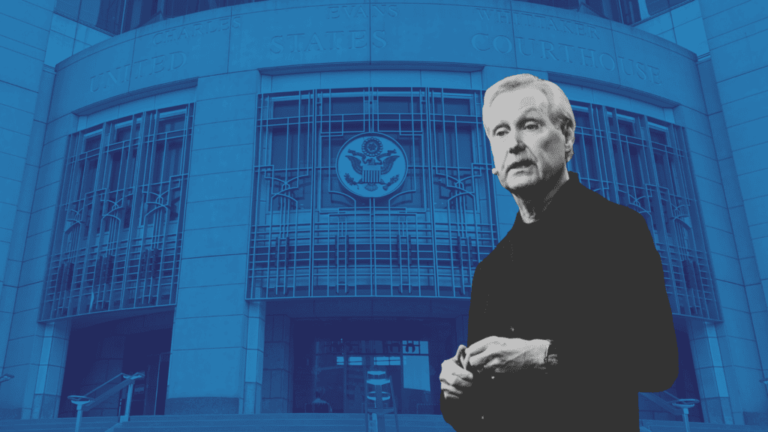

A trial with the potential to shake up the real estate industry got officially underway Tuesday with opening statements from each side and testimony from heavy hitters Keller Williams co-founder Gary Keller, HomeServices of America CEO Gino Belfari and National Association of Realtors CEO Bob Goldberg.

In their opening statements, each side had the job of educating a nine-person jury — some homeowners, some not — on the ins and outs of the real estate industry. At the same time, they had to try to convince them of the merits or the evils of a NAR policy known as the Participation Rule, which requires listing brokers to make an offer of compensation to buyer brokers in order to submit a listing to a Realtor-affiliated multiple listing service.

Plaintiffs’ attorney Michael Ketchmark, of Ketchmark and McCreight, kicked off opening statements.

“This is a refund case,” Ketchmark told a room of about 100 people.

The plaintiffs want the defendants to “return the money” they believe was unlawfully taken as a result of the alleged conspiracy between the defendants. The number of homes sold during the relevant time period was 265,297, and the homesellers paid an average of $6,700 to the buyer’s agent in the sales, adding up to $1.78 billion in damages, according to Ketchmark.

“It’s about letting the free market decide,” Ketchmark said. “Why is this a mandatory rule? If it’s so good, make it voluntary. Don’t put it in the MLS where everyone can see if it’s being followed.”

Ketchmark homed in on deposition testimony from Keller, whose remarks Ketchmark called “brazen.”

Ketchmark noted that Keller had written a book in which he said the industry had “evolved into a system of cooperative competition” or “co-opetition.”

“That’s not competition,” Ketchmark said.

Later, when the plaintiffs got to start presenting their case, the first person Ketchmark called to testify was Keller, who appeared via video deposition. Keller confirmed that Keller Williams requires its affiliated agents to join NAR in order to have access to local MLSs.

Keller’s exchange with Ketchmark in the deposition got testy, as Keller resisted saying that he had talked about commissions at Keller Williams events.

Ketchmark showed Keller a video from a KW Family Reunion in which Keller showed a slide showing the average commissions KW agents had earned between 2002 and 2019. Despite the slide, Keller said,” We didn’t talk about commissions. I reported the numbers and walked off the stage.”

He added that the presentation was “not a conversation about what you charge” but “a model to describe the flow of money.”

Similarly, when Ketchmark pointed to a page in Keller’s book, The Millionaire Real Estate Agent, where he mentions that each side in a real estate transaction gets an average 3 percent commission, Keller said, “It’s only an example so I can show how money goes. This is simply a model for the flow of money.”

“Nowhere in that book do I talk about commissions except to explain the flow of money. And I say average,” Keller added.

Ketchmark asked if Keller believed that agents steering buyers away from listings that offer lower buyer broker commissions was wrong.

“I believe it’s wrong,” Keller said.

“I’ve never seen evidence of it,” he added.

Ketchmark pointed to a Keller Williams training script that a similar antitrust case known as Moehrl has called out as evidence that the Austin-based brokerage and franchisor steers buyers away from listings offering low commissions and discourages sellers from offering lower buyer broker commissions because of steering, thereby keeping buyer broker commissions at a standard level of around 3 percent.

Ketchmark presented to the jury a Keller Williams University “Scripts Catalog” for “Working with Sellers” that includes this recommended script:

Image of a Keller Williams training script

In the deposition, Keller said, “I’ve never seen this document.” He added that he didn’t see anything wrong with telling a seller that there might be a “singular agent” who could steer and that it’s “fair” to say that an agent should explain all contingencies and help sellers make the best decision for themselves.

“I’m pretty offended with your characterization that a real estate agent would ever try to scare a seller, so I’m going to object to that,” Keller said.

He said the training script was one of probably dozens and that it wasn’t telling agents how to do something but rather “an example of how someone has done something.”

Ketchmark asked Keller about an Inman article with data about commission rates from Keller Williams’ research department. He pointed to an email in which Keller told his staff “Nice job” after that article published, noting that the data had come from that department.

“Why did you want Inman to publish this?” Ketchmark asked. “Did you want your competitors to know you were keeping your part of the bargain?”

“Uh, no,” Keller replied.

Ketchmark noted that Keller had previously said that he and others in the industry weren’t supposed to talk about commissions.

“Then why publicly release this information?” Ketchmark asked.

Keller responded that he didn’t know where Inman had gotten the information, despite his own email.

Ketchmark also played deposition testimony from Blefari. In it, Ketchmark played a training video in which Blefari tells agents that he pre-writes listing agreements with a 6 percent commission, and if a seller inquires asking if commissions are negotiable, he says they are “but I can only go up.”

“I was showing them what I did so they can learn from that,” Blefari told Ketchmark in the deposition.

“I certainly don’t believe that fixing commissions is appropriate. I do believe training is essential.”

Ketchmark asked if it wasn’t “quintessential price-fixing” to get competitors together and train them to write 6 percent in a contract and then tell sellers they can only go up from there.

“No, it’s just negotiating,” Blefari replied in the deposition.

To the jury, Ketchmark said, “We’ll prove to you that it’s not.”

Blefari subsequently said that at the time, he was working for a broker who had a minimum commission requirement of 6 percent. Ketchmark then pointed out that he did not explain that to the training video’s audience.

In the training video, Blefari also told agents that “the only way you can eliminate competition is to include them,” adding with a chuckle that “our legal team would want me to say eliminating from consumers’ consideration rather than physically disposing of them.”

In the deposition, Ketchmark asked Blefari if he agreed that the unilateral offer of compensation is the chief rationale for the MLS and Blefari said,” Yes.”

He asked Blefari if he believes it’s appropriate for a HomeServices affiliate to only charge 6 percent commissions and split them with buyer agents, to which Blefari also said, “Yes.”

In Goldberg’s deposition testimony, Ketchmark zeroed in on NAR’s Real Estate Services (RES) group, which Ketchmark said was listed as a committee on NAR’s website, but which Goldberg said was an advisory group.

RES members include high-level executives from the defendants and other industry players. For example, in an April 2018 email Goldberg wrote to Keller, urging him to be part of the group, Goldberg listed members such as Blefari, Sherry Chris of Better Homes & Gardens Real Estate, The Realty Alliance CEO Craig Cheatham and Mike Ryan of RE/MAX.

Ketchmark noted that former NAR CEO Dale Stinton had said that the group should not keep meeting minutes in order to ensure that what happened at the meetings remained confidential — despite NAR itself saying that minutes should be kept for all committees to ensure it could be proven that no illegal conduct occurred.

“It’s easier to hatch a conspiracy without minutes, right?” Ketchmark quipped.

Goldberg denied the allegation, saying the decision not to keep minutes was “made to foster open conversation” and that “there was no nefarious conversation that happened in this group.”

It’s not yet the defendants’ turn to defend themselves in the trial, but, during opening statements, Ethan Glass, an attorney for NAR, made the case that NAR is a voluntary association of 1.6 million people whose average member is a 60-year-old woman with her own business.

“These are people who live and work in our communities,” Glass said.

Glass stressed that “NAR doesn’t set commissions of any type,” doesn’t force sellers to pay anything and that “everyone has the right to know how much they’re going to get paid before they do work.”

“The rule has been around for 25 years and it’s been public” and on NAR’s website, Glass said.

“What kind of conspiracy is out in public? There isn’t one.”

“They’re trying to twist something good” that benefits sellers by increasing demand for their listing, he added.

Attorney Robert MacGill gave the opening statements for HomeServices and its subsidiaries BHH Affiliates and HSF Affiliates.

He maintained that the HomeServices companies never directed anyone to follow or enforce NAR’s commission rule and the rule itself caused no injury “of any kind.”

Attorney Timothy Ray spoke on behalf of Keller Williams and stressed that the homeseller plaintiffs entered into contracts in which they benefited from the work their agents did, agreed to a “fair commission” and understood that it would be split with the buyer’s agent.

“Yet here in this lawsuit, the plaintiffs want a do-over,” Ray said.

Keller Williams did not work with NAR or any of the other defendants to follow and enforce the NAR rule, according to Ray.

“Keller Williams has always followed its own path in the industry,” he said.

“They claim Gary Keller is telling thousands of agents what they should charge,” Ray added.

“They’re asking you to believe that agents in Missouri blindly follow what Gary Keller says. Nothing could be further from the truth.”

He said Keller Williams would be asking the jury to award $0 in damages.

The trial ended shortly after 5 p.m. and is set to commence again at 8:30 a.m. on Wednesday.

“I’m happy on behalf of 500,000 Missourians to have this finally coming to trial,” Ketchmark told Inman in a phone interview after the court adjourned for the day.

“It’s clear to me that the corporate defendants are desperately trying to hang on to this system. The jury’s going to have a chance to break up this cartel.”

He said a Realtor in the audience had come up to him at the end of the day, given him a hug and said, “Thank you.”

“She asked if I would represent Realtors in a class-action lawsuit against these defendants,” Ketchmark said, adding that right now he was focused on his homeseller clients.

“But the idea that these large corporations and NAR are the voice of Realtors is just not true.”

Case in point: On Wednesday, Ketchmark plans to present testimony from real estate broker and whistleblower Linda O’Connor who, back in 2012 when she was a member of NAR’s Professional Standards Committee, warned the trade group that its commission rule was “the ultimate form of restraint of trade” and should be eliminated.

“In a lot of ways she’s a real hero in this story,” Ketchmark said.

“She tried to stop this a long time ago and was shut down.”