What happened to mortgage rates this week

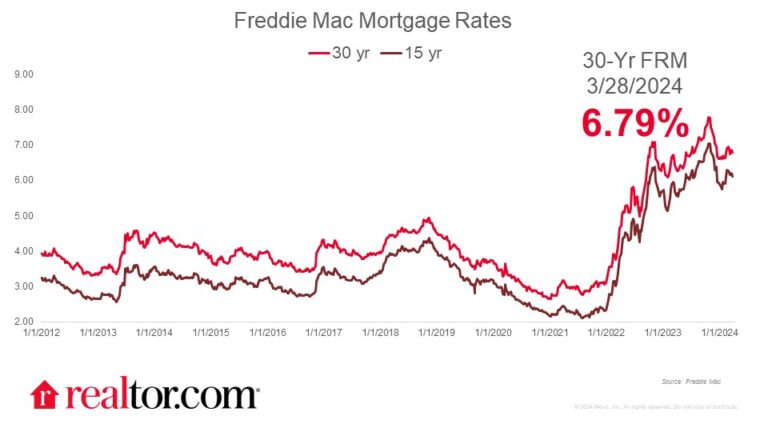

The Freddie Mac fixed rate for a 30-year mortgage bumped up 3 basis points to 6.82%, maintaining the 6.6-7% range it has occupied since last December. In order for rates to decline meaningfully and sustainably, inflation needs to be convincingly on a path to the Fed’s 2% target. As investors search for clues on the likely path for inflation and the economic outlook among incoming data, this week’s indicators offered a mixed bag. Although the price component of the ISM manufacturing index moved higher, the price component of the ISM services index fell, but remains above 50. Longer-term treasury investors have braced for more inflation, pushing yields up past 4.35% and could mean mortgage rates climb further, depending on the strength of Friday’s job report and next week’s consumer price index inflation data.

What it means for the housing market

Elevated mortgage rates have been a persistent market challenge, holding back first-time homebuyers and repeat homebuyers alike, albeit for different reasons. First-timer buyers tend to take on more debt and are sensitive to the affordability impact of higher rates, which have combined with prices to make renting a better month-to-month deal than buying a starter home in all 50 markets according to the Realtor.com February 2024 Rental Report. Meanwhile, although existing home owners are sitting on near-record high home equity that helps offset the impact of higher rates, roughly 90% of currently mortgaged homeowners would have to give up a lower rate to move in today’s housing market. A higher mortgage rate has been a deal breaker for many over the last year, but an increasing number of homeowners are choosing to sell as we approach what is the ideal time–the week of April 14-20– according to the Relator.com Best Time to Sell report. The number of homes actively for sale is at its highest level for this time of year since 2020, according to the Realtor.com March 2024 Housing Trends Report.