What happened to mortgage rates this week

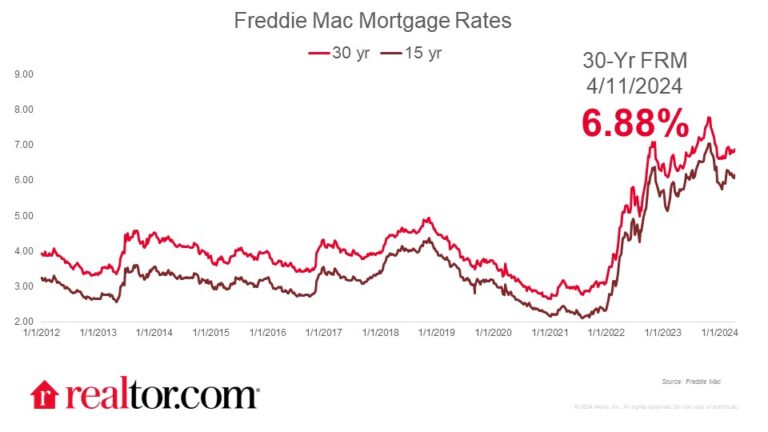

The Freddie Mac fixed rate for a 30-year mortgage jumped 6 basis points higher this week, to 6.88%, upon stronger-than-anticipated inflation and employment data.

Investor optimism faltered as the economy added 303,000 jobs in March and inflation ticked up to 3.5% in the month. After the March CPI data release, 10-year Treasury yields jumped roughly 15 basis points, from 4.35% to 4.5%, the highest level since November 2023.

Mortgage rates have remained in the 6.6% to 7% range since the beginning of the year, and will likely continue to hover in this range until inflation shows convincing progress toward the Fed’s 2% goal.

What it means for the housing market

Eager buyers and sellers are hoping to see more favorable housing conditions as the spring selling season kicks off. However, mortgage rates crept closer to 7% this week as economic data, measured by both inflation and employment, remained strong.

Inflation climbed in March in part due to a reversal in energy price trends, with gasoline prices up 5.5% since January after four months of declines. Climbing gas prices might spur some consumers to consider switching to an electric vehicle, which could generate more interest in EV-friendly housing markets.

Whatever they may be looking for, buyers are in luck as new listing activity picked up 15.5% annually in March, which means more fresh options on the market. Homeowners hoping to sell this year can look forward to the Best Time To Sell, which kicks off next week.