The share of financial planners scaling up their use of alternative investments over the past year has shown significant jumps, according to the 2025 Trends in Investing Survey conducted by the Financial Planning Association and the Journal of Financial Planning. Survey responses revealed double-digit year-over-year growth in the share of advisors using alternative assets ranging from publicly-traded REITs to private debt and precious metals. These shifts toward more alternative allocations were driven by greater economic uncertainty and market volatility, financial planners revealed.

“When I look at 2024 to 2025, I am encouraged by the increased use of alternative investments as a complement to passive strategies executed through exchange-traded funds. That suggests to me that advisors are thinking about asset class diversification beyond traditional stocks and bonds,” said Paul J. Brahim, FPA’s 2025 president. “All of us know, as certified financial planners, that the way to really drive wealth is to have more consistent returns without larger swings in asset values. And that increase in alternative investments as part of the allocation strategy helps to smooth those returns and create more consistent [performance] over time.”

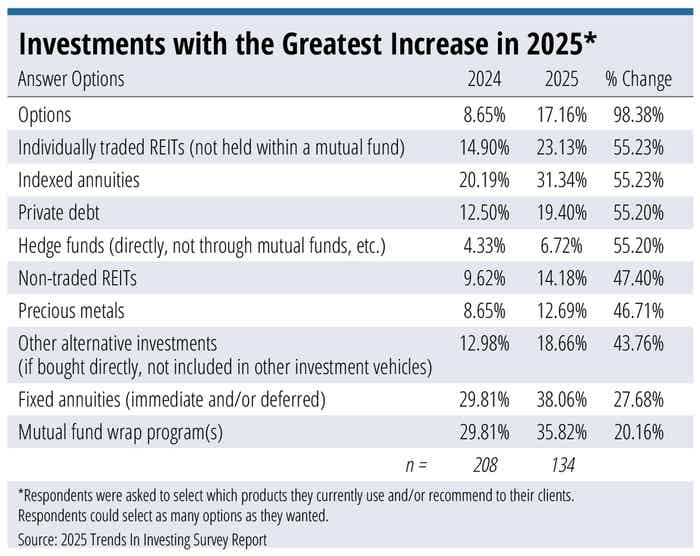

Options saw the biggest jump in usage among survey respondents over the past year, with 17.16% reporting using them in 2025, a 98.38% change from 2024.

“Options can provide hedging strategies against really big swings in the market. The most common strategies used are a combination of covered call options and protected puts,” noted Brahim. “That form of portfolio insurance is becoming more and more popular for clients and advisors who are concerned about market volatility.”

The share of planners using individually traded REITs increased to 23.13%, indicating a 55.23% change. Planners using private debt now make up 19.4% of those surveyed, up 55.2% year-over-year. Non-traded REITs experienced a 47.4% increase in usage from 2024, with 14.18% of planners reporting they now incorporate these investments.

To be sure, financial advisors’ adoption of alternative investments has been increasing for some time, as has their access to such assets. Alternative asset managers have been adding private wealth divisions over the past few years to pursue advisors and their clients, and launching new products aimed at the private investor market. In addition, new tools have emerged to help advisors navigate the alternative investment landscape, including alternative investment platforms such as CAIS and iCapital, model portfolios that incorporate alternative products and evergreen funds launched specifically with retail investors in mind.

But not everyone is sold on alternatives as a proper investment vehicle for all clients. In a recent study entitled The Demise of Alternative Investments, longtime consultant Richard Ennis wrote that “alts bring extraordinary costs but ordinary returns,” namely, to equity and fixed income assets. They “cost way too much for what you get. It’s that simple.”

When survey respondents who reported recently re-evaluating their asset allocation strategies were asked about which factors drove their decisions, 69% said they were guided by the anticipation of changes in the economy. Another 63% pointed to current market volatility, while 37% were guided by inflation. An additional 26% were re-evaluating strategies as a response to new legislation.

“We are always concerned about what goes on in the near term, so we can manage behavior and expectations with clients. But in the longer term, we know that our economy and markets are resilient and that businesses find a way to thrive in almost all economic conditions,” said Brahim. “And we also know that the true value of diversification is to own things that behave differently at the same time.”

The survey was conducted between March 23 and May 4 of this year and included 195 responses. More than half (51.5%) of survey respondents are independent IARs/RIAs. Another 20.4% are dually registered advisors, and 16.7% are registered rep independent advisors affiliated with a broker/dealer.