January 2024 Existing Home Sales:

Sales Rise to Highest Pace Since August 2023:

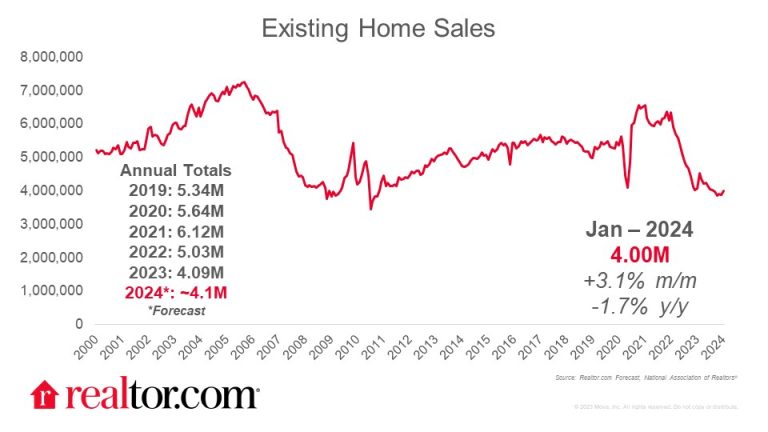

Existing home sales ticked up in January. Sales rose 3.1% from December to a pace of 4.0 million–their highest since August 2023. Sales still lagged the year ago pace by 1.7%. Mortgage rates tumbled from late October through mid-January, propelling sales as shoppers capitalized on lower costs.

Pending home sales, which are based on contract signings, an earlier stage in the sales process that tend to lead existing home sales by a month or two, saw a big pop in December and grew over the prior year for the first time since May 2021. Despite the pickup, both pending and existing home sales remain historically low, coming off the heels of 2023, which saw the lowest total home sales tally in nearly 30 years as high costs stemming from high prices and mortgage rates continue to remain a challenge for many shoppers.

Home Prices Continue to Climb as Shelter Costs Drive Inflation:

The median existing home sales price rose further, by 5.1%. With inflation surprising on the high side and shelter inflation continuing to be the major driver, housing costs are front and center. Although home sales prices grew, the latest Realtor.com January Rental Trends Report showed that rents softened again, nationwide. Despite the pull-back, rents remain up 18.3% above 2019, highlighting the long-run impact of inflation on costs–what goes up in this case doesn’t tend to come back down (by much). While starts for multi-family homes fell in January, completion gains mean that more multi-family homes are entering the market for rent, helping to better balance supply with demand and stem rental cost gains, as anticipated in Realtor.com’s 2024 Housing Forecast.

Mortgage Rates and Local Economies Drive Regional Sales:

Regionally, all areas saw sales growth from December except in the Northeast where sales were flat in January. Sales trail year-ago pace in all regions except the West, where sales were up 2.8% above the prior year pace. This trend is in line with the anticipation that Southern California housing markets would begin to rebound as outlined in Realtor.com’s Top Housing Markets for 2024 report. With scarcity still a dominant theme, home prices rose in all four regions of the country, with the Northeast seeing a double-digit (+10.1%) jump in prices.

What This Data Means for What’s Ahead:

Recent surveys indicate that consumers expected additional mortgage rate drops in 2024, but a hot jobs report followed closely by an elevated inflation reading in the consumer price index has ended the dip in mortgage rates for now, which could mean slower seasonally adjusted sales as the heart of homebuying season approaches. First-time buyers have struggled in this environment, with the share of first-time buyers slipping to 28% in January, down from 29% in December and 31% in January 2023. Younger buyers, however, say they are less dissuaded by the potential of higher mortgage rates. In a recent Realtor.com survey of home shoppers, nearly half (47%) of Millennial home shoppers said they would still buy a home even if mortgage rates went above 8%, signaling their determination. Older generations were far less likely to be willing to buy with a rate above 8%, likely reflecting their anchoring to an existing lower-rate mortgage.