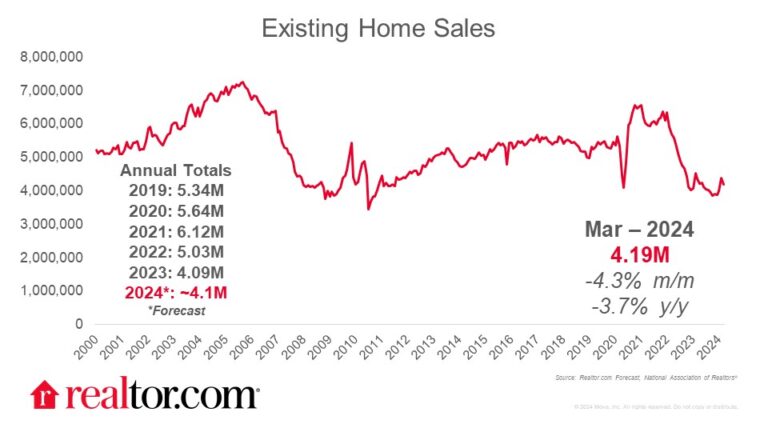

March 2024 Existing-Home Sales

Sales Slip After Highest Monthly Gain in 12 Months

Existing-home sales eased back in March after February’s big jump. Sales slipped 4.3% from February to a pace of 4.19 million, and trailed the year-ago figure by 3.7%. Mortgage rates tumbled from late October through mid-January, holding through early February at some of the lowest rates since May 2023. By mid-February, however, a pick-up in inflation reset expectations, putting mortgage rates back on an upward trend, and more recent data and comments from Fed Chair Powell have only underscored inflation concerns. Thus, these March home sales figures reflect a different set of expectations for the economy, inflation, and mortgage rates than buyers and sellers are likely bringing to the market today, and sales data over the next few months is likely to reflect the impact of now higher mortgage rates.

Despite Rising Prices, First-time Buyers Made Headway

The median sales price rose further in March, mirroring listing prices that continue to climb. The typical home sold for $393,500, up 4.8% from the prior year. Prices rose in all four regions, with the biggest gains in the Northeast (+9.9%) followed by the Midwest (+7.5%) and West (+6.7%). The South saw home prices rise just 3.4% from last year, perhaps in part to the influx of lower priced inventory that occurred in both February and March, according to Realtor.com data. A jump in lower-priced homes for sale may also have contributed to gains for first-time buyers, who made up 32% of sales in March, up from 26% in February and 28% one year ago while investors made up a smaller share of purchasers.

What This Data Means for What’s Ahead

Despite climbing sales and list prices, Realtor.com data show that sellers are approaching the housing market with more realistic expectations this spring even as we approach the week that Realtor.com has identified as the Best Time to Sell a home. Only 12% of sellers expect to see a bidding war compared with 27% in 2023, and just 15% of sellers expect to see an above-asking price offer compared with 31% in 2023. Consistent with a more temperate outlook, sellers who have already listed homes are resorting to price reductions more often than historical data suggest is normal for this time of year, putting the trend back on par with pre-pandemic norms and making this one of the few aspects of the housing market that is comparable to that earlier period. It’s worth noting that there is significant variation in this trend across local markets. While just over 1 in 5 homes in Austin had a price reduction in March, this share is down from the more than 1 in 4 that had a reduction one year ago. Conversely, Florida markets like Miami, Orlando, Jacksonville, and Tampa are seeing a rising share of for-sale homes with price reductions.