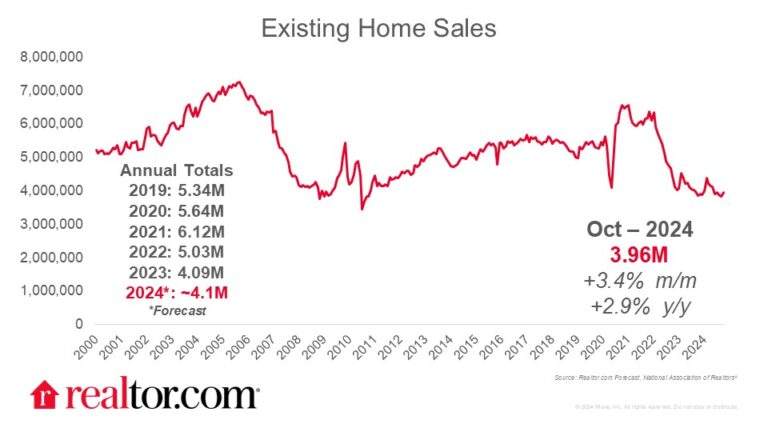

Existing-home sales picked up

Existing-home sales picked up in October, rising 3.4% in the month to a pace of 3.96 million. They also notched the first year-over-year gain (+2.9%) since July 2021. Homebuyers benefited from an uptick in newly listed for-sale homes and increased buying power from mortgage rates that dropped in August to hit a two-year low in September.

Home prices rose while months supply shows balance

The median home sales price climbed 4% compared with one year ago, to $407,200, exceeding $400,000 for a seventh straight month. Unsold housing inventory rose 0.7% from a year ago; however, because of the stronger sales uptick, months supply slipped to 4.2. Still, this marks a fifth consecutive month of a “balanced” reading in this metric that has been in seller-friendly territory for years.

Regionally, prices and sales are affected by inventory

Home prices climbed in all four regions, with far more modest gains in the South (+0.9%) and West (+4.4%) than in the Northeast (+7.6%) and Midwest (+7.2%). Sales were stronger in regions with more modest price growth, jumping 8.5% from a year ago in the West and 2.3% in the South, compared with 1.1% in the Midwest and holding flat from a year ago in the Northeast.

The availability of homes for sale is the likely explanatory factor. According to the Realtor.com October Housing Trends report, the South and West have seen the biggest gains in available housing inventory and have recovered the most relative to the pre-pandemic inventory benchmark.

Mortgage rates impact activity

October data shows that mortgage rates continue to be an important mediator of home sales activity. The sharp uptick in mortgage rates since September despite the Fed’s rate cuts is likely to weigh on home sales activity early in 2025.

Home shoppers eligible for VA loan benefits have an edge

At a time when housing affordability is lacking for many buyers, home shoppers who are eligible for VA loan benefits might have an edge. Realtor.com research shows that buyers who used Veterans Affairs loans made lower down payments, had lower credit scores, and had lower mortgage rates than similar buyers who used a conforming loan. These benefits translate into real savings on monthly mortgage costs for eligible buyers who know about them and leverage them.