Title tech provider expects $85 million merger with Dallas, Texas-based title insurance underwriter Title Resources Group to close later this year.

Whether it’s refining your business model, mastering new technologies, or discovering strategies to capitalize on the next market surge, Inman Connect New York will prepare you to take bold steps forward. The Next Chapter is about to begin. Be part of it. Join us and thousands of real estate leaders Jan. 22-24, 2025.

In what could be the company’s final earnings report as a publicly traded company, title tech provider Doma said double-digit revenue growth helped it cut its adjusted loss in half during the second quarter.

With revenue up 18 percent from Q1 to $78 million and expenses rising 12 percent to $88.7 million, Doma’s operating loss from continuing operations dropped 16 percent, to $11 million.

TAKE THE INMAN INTEL INDEX SURVEY FOR AUGUST

Doma’s adjusted loss on the basis of earnings before interest, taxes, depreciation and amortization (EBITDA) totaled $3 million, down 50 percent from $6 million in Q1.

Max Simkoff

“We are pleased with the continued progress our team is making toward achieving our strategic goals,” Doma CEO Max Simkoff said in a statement.

Doma announced an agreement in March to go private through an $83 million merger with Dallas, Texas-based title insurance underwriter Title Resources Group (TRG). With the TRG deal expected to close this year, Doma did not hold an earnings call or provide forward guidance.

Founded in 2016, Doma set out to revolutionize the title insurance industry using a machine learning platform, Doma, to automate the title and escrow processes.

Initially focused on supporting mortgage refinancing, Doma saw much of that business evaporate as mortgage rates began climbing in 2022.

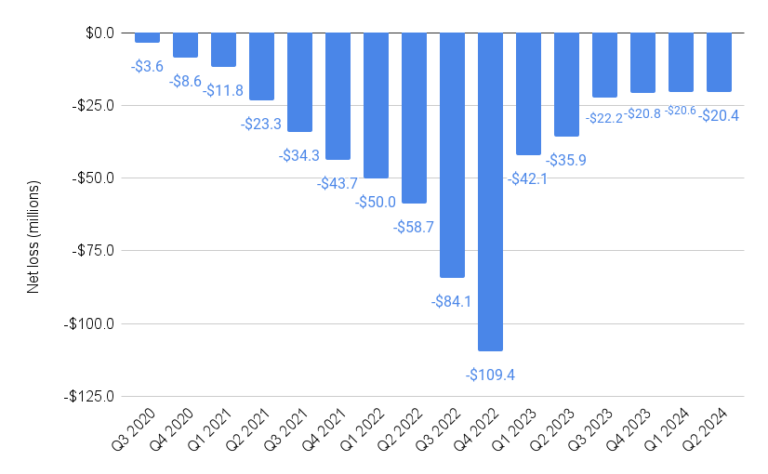

Doma raised less than anticipated when it went public in a 2021 merger with a special purpose acquisition company (SPAC) and has racked up $660 million in cumulative losses through June 30 as it pivoted to adapt its technology to enable “instant underwriting” of title insurance for purchase loans.

Source: Doma earnings reports.

Doma finished the quarter with $73.1 million in cash and cash equivalents and restricted cash; $7.4 million in held-to-maturity debt securities; and $41.7 million in available-for-sale debt securities.

Using generally accepted accounting principles (GAAP), which includes interest on the company’s debt, Doma’s Q2 2024 net loss was $20.4 million, down from $20.6 million in Q1 and $35.9 million in Q2 2023.

Doma laid off more than 1,000 workers in 2022, and, after selling its retail title agency and operations centers and getting out of that business, employed 239 workers at the end of last year, or about 12 percent of its previous workforce.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.