The Charlotte housing market has experienced a significant surge in demand over the past few years, fueled by a booming economy, job growth, and a desirable quality of life. Queen City is one of the fastest-growing cities in the country, attracting young professionals and families alike with its diverse neighborhoods, excellent schools, and vibrant cultural scene. As a result, the real estate market in Charlotte has remained highly competitive, with limited inventory and rising home prices.

In this article, we’ll explore the latest trends and data in the Charlotte housing market, including home prices, inventory, and sales activity. We’ll also provide a forecast for the year ahead, with insights for both buyers and sellers. Whether you’re looking to buy or sell in Charlotte, understanding the latest market trends and forecasts is crucial to making informed decisions about your real estate investments.

Charlotte Housing Market Trends for 2023

The Charlotte housing market, encompassing various counties in both North Carolina and South Carolina, has experienced notable changes in key metrics over the past year. Understanding these trends is crucial for buyers, sellers, and real estate professionals alike. Let’s delve into the latest data to gain insights into the state of the Charlotte housing market prepared by the “Canopy Realtor® Association.

The figures are for the ten-county Charlotte MSA which includes Cabarrus, Gaston, Iredell, Lincoln, Mecklenburg, Rowan, and Union Counties in North Carolina and Chester, Lancaster, and York Counties in South Carolina. The report compares key housing statistics of the Charlotte MSA between August 2023 and August 2022.

Local Market Overview

The Charlotte Metropolitan Statistical Area (MSA) encompasses several counties in North Carolina, including Cabarrus, Gaston, Iredell, Lincoln, Mecklenburg, Rowan, and Union, as well as Chester, Lancaster, and York Counties in South Carolina. Let’s take a closer look at the market’s performance for August 2023 and the year to date.

Key Metrics – August 2023

Here are the key metrics for August 2023 compared to the previous year:

- New Listings: There were 3,637 new listings, reflecting a 13.6% decrease from August 2022.

- Pending Sales: Pending sales amounted to 3,059, showing a 13.3% decrease from the previous year.

- Closed Sales: The number of closed sales was 3,120, marking a significant 17.9% decrease from August 2022.

- Median Sales Price: The median sales price was $400,000, with a minimal 0.4% decrease year-over-year.

- Average Sales Price: The average sales price stood at $489,341, representing a 3.4% increase.

Year-to-Date Comparison

Let’s examine the year-to-date figures to gain a comprehensive understanding of the market:

- New Listings: Year to date, there have been 27,367 new listings, indicating a 23.4% decrease.

- Pending Sales: The year-to-date pending sales figure is 25,121, down by 15.0%.

- Closed Sales: Closed sales for the year reached 23,720, showing a 20.6% decrease.

- Median Sales Price: The median sales price increased by 1.1% to reach $394,484.

- Average Sales Price: The average sales price saw a healthy 4.2% increase, totaling $477,135.

Market Trends and Analysis

The Charlotte housing market has experienced a decline in new listings, pending sales, and closed sales over the past year. However, despite these decreases, the median sales price has remained relatively stable, with a minor 0.4% dip. The average sales price, on the other hand, has shown healthy growth, increasing by 3.4% year-over-year.

One notable trend is the cumulative days on the market until sale, which has increased significantly by 123.5% for the year to date. This suggests that homes are taking longer to sell, indicating potential shifts in buyer behavior and seller expectations.

Market Forecast for 2023

Looking ahead, the market forecast for 2023 is crucial for both buyers and sellers in the Charlotte area. While the year has seen its share of challenges, including a decrease in inventory of homes for sale, there is optimism in the forecast. The average sales price has shown growth, and with a 1.4% decrease in months supply of inventory, the market may become more competitive.

Hence, the Charlotte housing market in August 2023 presents a mixed picture, with decreases in some key metrics and growth in others. Buyers and sellers should carefully analyze the data and consider their individual circumstances when making real estate decisions. Stay tuned for further updates as we monitor the dynamic trends in this market throughout the year.

Charlotte Rent Price Trends

The Zumper Charlotte Metro Area Report analyzed active listings last month across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The North Carolina one bedroom median rent was $1,230 last month. Charlotte was the most expensive city with one bedrooms priced at $1,600 while Hickory was the most affordable city with rent at $790.

The Fastest Growing Cities For Rents in Charlotte Metro Area (Y/Y%)

- Hickory had the fastest growing rent, up 9.7% since this time last year.

- Charlotte & Mooresville both saw rents increase 6.7%, making them tied for second.

The Fastest Growing Cities For Rents in Charlotte Metro Area (M/M%)

- Mooresville had the fastest growing rent last month, up 5.9%.

- Concord saw rent climb 5.8%, making it second.

- Charlotte was third with rent increasing 1.9%.

Charlotte Housing Market Forecast 2023-2024

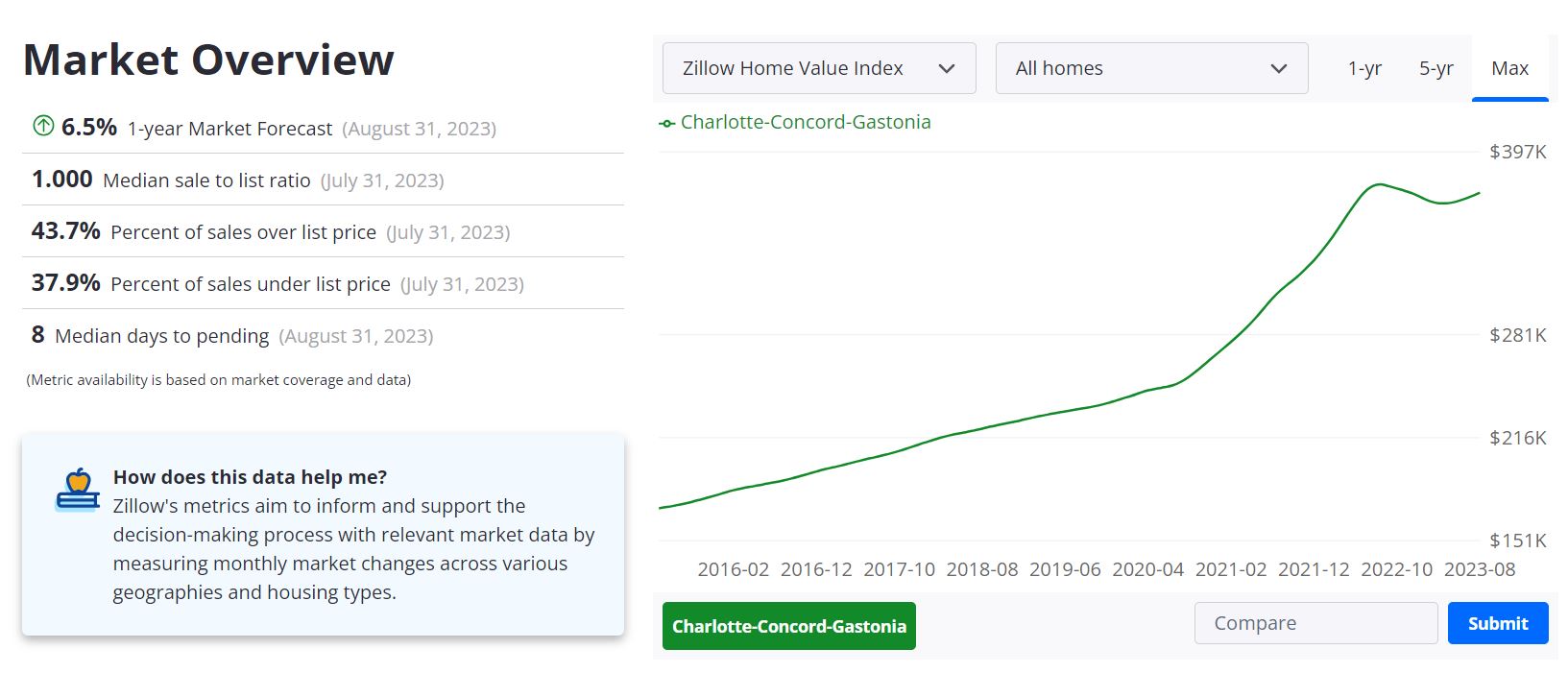

The Charlotte housing market, which includes the Charlotte-Concord-Gastonia metropolitan area, has experienced some fluctuations in key metrics over the past year. As we look ahead, it’s important to understand the forecasted trends and potential opportunities that lie ahead for buyers and sellers.

Zillow provides valuable insights into the housing market, including the Charlotte-Concord-Gastonia area. As of August 31, 2023, the average home value in this region stands at approximately $371,406. This figure represents a 1.4% decrease in home values over the past year.

Current Market Metrics

- Average Home Value: $371,406

- Median Sale to List Ratio (July 31, 2023): 1.000

- Percent of Sales Over List Price (July 31, 2023): 43.7%

- Percent of Sales Under List Price (July 31, 2023): 37.9%

- Median Days to Pending (August 31, 2023): 8 days

Market Forecast

Zillow’s 1-year market forecast for the Charlotte housing market, ending on August 31, 2023, predicts a growth of 6.5% in home values. This forecast indicates a positive outlook for the real estate market in Charlotte in the coming year.

Home Price Trends

Based on the provided data, it’s evident that the average home prices in the Charlotte-Concord-Gastonia area have experienced a 1.4% decline over the past year. However, the 1-year market forecast of 6.5% growth suggests a potential rebound and growth in home prices in the near future.

Charlotte Real Estate Investment Overview

Charlotte is a bustling city in North Carolina, known for its thriving economy, rich culture, and abundance of outdoor recreational activities. With a growing population and a strong job market, the real estate market in Charlotte is poised for steady growth in the coming years. The average home value in the Charlotte-Concord-Gastonia area is $369,442. Additionally, the 1-year market forecast predicts an 8.2% increase, making it a promising market for investors.

One of the top reasons to invest in Charlotte’s real estate market is the city’s strong job market. With a diverse range of industries and companies, including the headquarters of Bank of America and Duke Energy, Charlotte has a low unemployment rate and a growing population. This combination of factors is likely to continue to drive demand for housing in the city.

Another reason to consider investing in Charlotte’s real estate is the city’s attractive rental market. With a growing number of young professionals and families moving to the area, there is a strong demand for rental properties. The rental market in Charlotte is also experiencing significant growth and demand. With the influx of new residents and a strong job market, the demand for rental properties has been steadily increasing.

This has led to an increase in rental rates. One of the main factors contributing to the growth of Charlotte’s rental market is the high demand for housing in the city’s urban core. Many young professionals and families are seeking to live close to the city’s vibrant downtown area, and are willing to pay a premium for the convenience and amenities this area offers. This has led to a surge in new apartment developments and mixed-use properties being built in and around downtown Charlotte.

Another contributing factor to the growth of Charlotte’s rental market is the city’s strong job market. With the presence of major employers like Bank of America, Wells Fargo, and Lowe’s, many people are relocating to Charlotte for work and are looking for rental properties to live in while they establish themselves in the area.

Investing in rental properties in Charlotte can be a lucrative opportunity for real estate investors. With the city’s strong job market and population growth, there is a consistent demand for rental properties. Additionally, with the high demand for urban housing, investing in properties in or near downtown Charlotte can provide a steady stream of rental income and the potential for long-term appreciation.

Charlotte also offers a relatively affordable real estate market compared to other major cities in the United States. This makes it an attractive option for investors looking to enter the market or expand their portfolio.

Finally, Charlotte has a strong and growing economy, which bodes well for the future of the real estate market. As the city continues to attract new businesses and residents, the demand for housing is likely to increase, creating opportunities for investors to capitalize on this growth.

In summary, Charlotte’s real estate market offers investors a promising opportunity for long-term growth and income. With a strong job market, attractive rental market, affordable prices, and a growing economy, there are many reasons to consider investing in Charlotte’s real estate market.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Charlotte.

Consult with one of the investment counselors who can help build you a custom portfolio of Charlotte turnkey properties. These are “Cash-Flow Rental Properties” located in some of the best neighborhoods of Charlotte.

All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete Charlotte turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

Apart from Charlotte, you can also invest in the Durham real estate market. There are many reasons to buy investment properties in Durham. An unusual combination of features makes Durham attractive to real estate investors since it creates a large population of renters willing and able to pay more per month to live here because they cannot necessarily find their dream home. Durham is going to see heavy population growth over the next decade. Another seventy thousand people are expected to contribute to the demand for properties in the Durham real estate market overall.

Let us know which real estate markets you consider best for real estate investing!

Remember, caveat emptor still applies when buying a property anywhere. Some of the information contained in this article was pulled from third-party sites mentioned under references. Although the information is believed to be reliable, Norada Real Estate Investments makes no representations, warranties, or guarantees, either express or implied, as to whether the information presented is accurate, reliable, or current. All information presented should be independently verified through the references given below. As a general policy, Norada Real Estate Investments makes no claims or assertions about the future housing market conditions across the US.

References:

- https://www.zillow.com/Charlotte-nc/home-values

- https://www.zillow.com/Charlotte-Concord-Gastonia-nc/home-values/

- https://www.carolinahome.com/market-data/monthly-reports

- https://www.zumper.com/blog/charlotte-metro-report/

- https://www.neighborhoodscout.com/nc/charlotte/real-estate

- https://www.realtor.com/realestateandhomes-search/Charlotte_NC/overview