What does the data show?

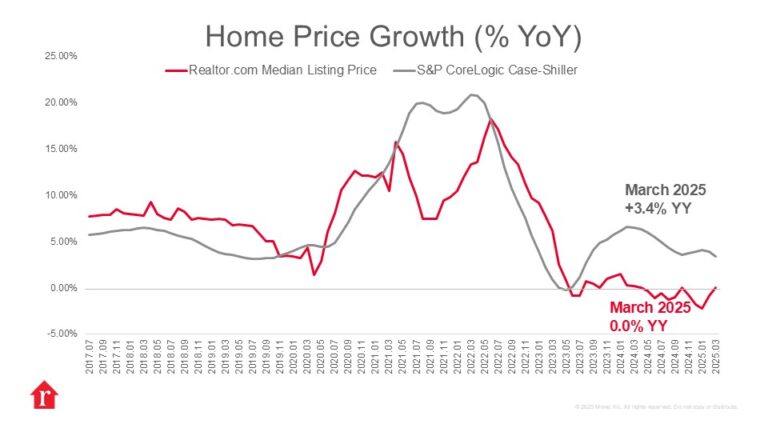

The S&P CoreLogic Case-Shiller Index increased 3.4% year over year in March, down from 3.9% last month. The 10- and 20-city indices also posted year-over-year gains of 4.8% and 4.1%, respectively, slowing from 5.2% and 4.5% in February. This month’s release covers home sales in January, February, and March—a period in which buyers enjoyed growing inventory and easing mortgage rates. After peaking at 7.04% in January, mortgage rates fell to 6.65% by the end of March. (Rates have since risen and now sit above 6.8%.) This period of rate relief was not quite enough to spur many sidelined buyers into action.

Month-over-month price changes signal a slower start to the spring selling season. The national index shows a 0.3% monthly decline, while the 10-city index shows a -0.12% change, both on a seasonally adjusted basis.

How did trends vary by region?

The housing market varies significantly by region. The affordable Midwest and less affordable Northeast housing markets continue to thrive, while the well-supplied South and West regions show signs of cooling. New York City led with a 7.96% annual gain in March, the biggest among the 20 cities, followed by Chicago (+6.5%) and Cleveland (+5.9%). Tampa experienced a 2.16% year-on-year decline in March, marking the lowest return among the top 20 cities.

Popular Midwest destinations attract buyers looking for more affordability, which has kept upward pressure on home prices. Strong demand and challenging selling conditions have kept inventory levels in the Northeast from recovering, driving home prices higher. The recently released State Report Cards reveal that much of the Northeast is unaffordable and that new construction activity is struggling to keep up with demand, worsening the home supply gap.

What is ahead for housing?

The spring selling season is here, and inventory is well above year-ago levels, offering buyers plenty of options in many areas. The market is softer than usual this spring due to a multitude of demand-side factors, including economic uncertainty, continued higher interest rates, and declining consumer sentiment.