The California housing market has been a focal point of interest, particularly in recent months. In this report, we delve into the latest data from August, shedding light on the trends and dynamics affecting the housing market in the Golden State.

California August Home Sales and Price Report

The latest data released by the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) presents a detailed overview of the California housing market in August. Let’s dissect the key findings.

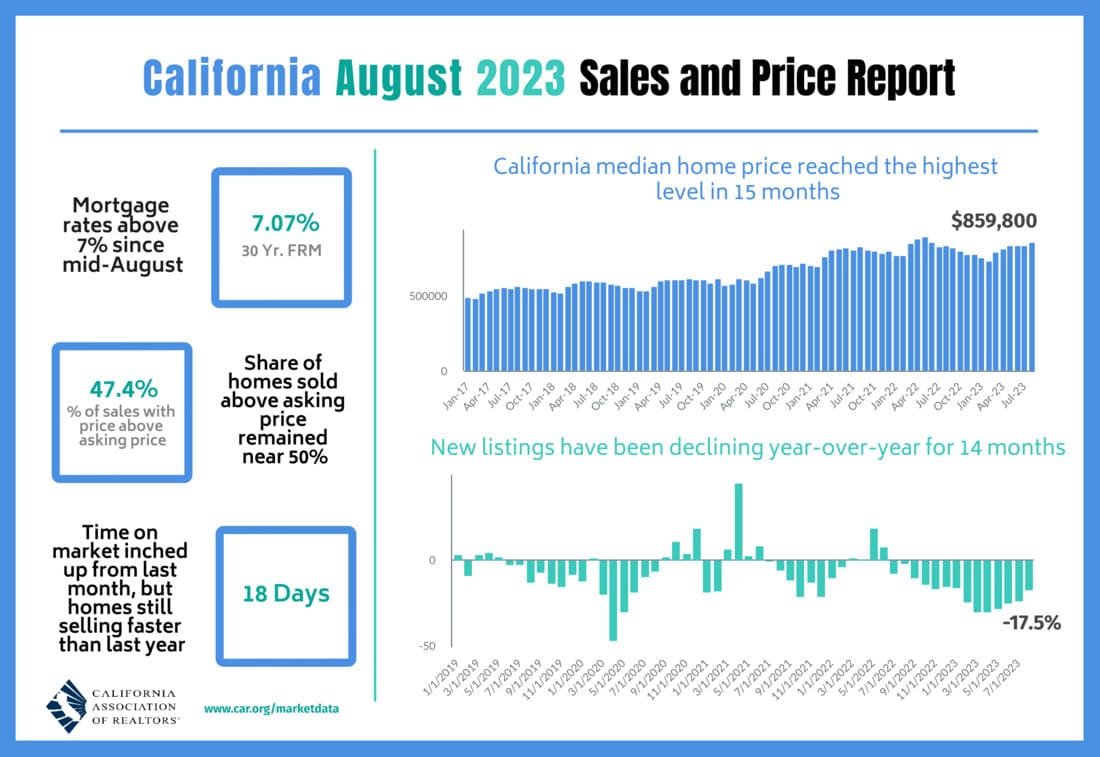

Median Home Price Reaches 15-Month High

In August, the statewide median home price in California reached a remarkable $859,800, marking a 3.3% increase from July and a significant 3.0% rise from the same period in 2022. This surge in median price is the highest recorded in 15 months, underlining the robustness of the California housing market despite prevailing challenges.

Impact of Mortgage Rates and Home Sales

Rising mortgage rates, coupled with a persistent shortage of available homes, have contributed to a 5.3% decline in home sales from July to August. Year-to-year, home sales were down by 19.0% from August 2022. However, despite these challenges, interest from potential buyers remains strong, hinting at the resilience of the California housing market.

Regional Trends and Price Variances

Across various regions in California, double-digit sales declines were witnessed in August on a year-over-year basis. The Central Valley region recorded the steepest decline at 19.0%, followed by the San Francisco Bay Area at 18.3%. However, regions like the San Francisco Bay Area and Southern California saw price gains from the previous year, showcasing the diversified dynamics within the California housing market.

Housing Inventory and Supply

With mortgage rates remaining elevated, the housing supply in California continued to shrink in August. The statewide unsold inventory index was 2.4, reflecting a 14.3% decline from the previous year. Active listings also saw a significant year-over-year decline, with several counties experiencing a drop of more than 20%.

Closing Thoughts

While challenges persist in the California housing market, including rising mortgage rates and dwindling inventory, the market remains remarkably resilient. As we move forward, the balance between supply and demand will be crucial, and the potential moderation of interest rates may provide the impetus needed for a more balanced and vibrant housing market in California.

ALSO READ: Will the US Housing Market Crash?

California Housing Market: Regional Trends – August 2023

In August 2023, the California housing market exhibited notable trends across different regions. Let’s delve into the median sold prices of existing single-family homes and sales data for various regions and counties.

Los Angeles Metro Area

In this prominent area, the median sold price for existing single-family homes was $792,500 in August 2023, showing a modest month-to-month (MTM) increase of 0.3%. Year-to-year (YTY), this marked a significant increase of 3.6%. However, despite this increase in prices, home sales experienced a MTM decrease of 9.3% and a YTY decrease of -13.4%.

Central Coast

On the Central Coast, the median sold price for existing single-family homes stood at $950,000 in August 2023. This reflected a MTM decrease of -3.6% and no change (0.0%) YTY. Home sales in this region saw a MTM decrease of 1.0% and a YTY decrease of -17.9%.

Central Valley

The Central Valley region witnessed a median sold price of $485,000 for existing single-family homes in August 2023. This indicated a slight MTM decrease of -0.8%, but a YTY increase of 3.2%. However, home sales experienced a MTM increase of 4.0%, albeit with a substantial YTY decrease of -19.0%.

Far North

In the Far North region, the median sold price for existing single-family homes was $369,000 in August 2023. This marked a MTM decrease of -1.6% and a YTY decrease of -2.4%. Home sales showed a MTM increase of 0.7%, yet a YTY decrease of -15.7%.

Inland Empire

The Inland Empire region saw a median sold price of $569,990 for existing single-family homes in August 2023. This reflected a MTM decrease of -0.9%, but a YTY increase of 0.8%. Home sales, on the other hand, experienced a MTM increase of 10.8%, but a YTY decrease of -15.7%.

San Francisco Bay Area

In this bustling area, the median sold price for existing single-family homes was $1,260,000 in August 2023. This showed a MTM increase of 0.4% and a substantial YTY increase of 5.0%. However, home sales experienced a MTM increase of 4.3% while showing a YTY decrease of -18.3%.

Southern California

Finally, in Southern California, the median sold price for existing single-family homes remained steady at $830,000 in August 2023. There was no MTM change (0.0%), but a notable YTY increase of 4.4%. Home sales saw a MTM increase of 7.9%, however, a YTY decrease of -13.9% was recorded.

These insights into the regional trends for August 2023 provide a comprehensive understanding of the California housing market, showcasing both the variations in median sold prices and the fluctuations in home sales across different regions.

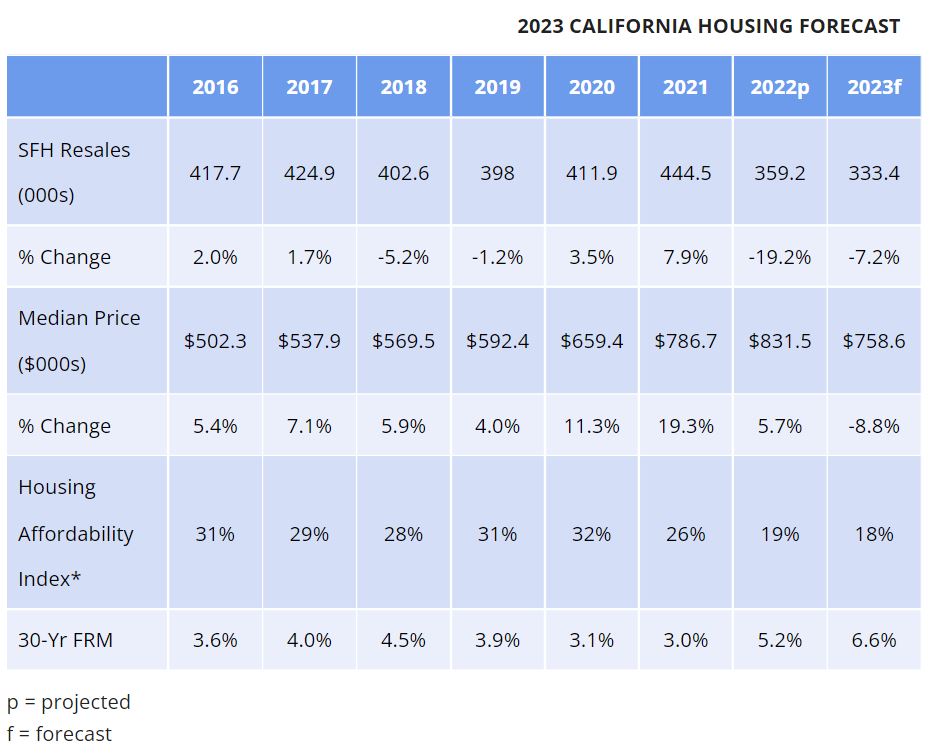

California Housing Market Forecast 2023: Recently Revised

Based on the latest data and market conditions, the California Association of Realtors (C.A.R.) has revised its Housing Market Forecast for 2023. The forecast provides insights into the projected trends and expectations for the housing market in the state. Overall, it indicates a challenging market environment in California, with a decline in home sales and a projected decrease in median home prices compared to the previous year.

The revised Housing Market Forecast, released in April 2023, differs from the California Housing Forecast released by the C.A.R. on October 12, 2022. Here are the key differences between the two forecasts:

Existing Single-Family Home Sales:

- October 2022 Forecast: The forecast projected existing single-family home sales to total 333,450 units in 2023, representing a decline of 7.2% from the projected pace of 359,220 units in 2022.

- April 2023 Revised Forecast: The revised forecast estimates a steeper decline in existing single-family home sales, with 279,900 units projected to be sold in 2023. This reflects an 18.2% decrease compared to the 342,000 units sold in 2022.

Median Home Price:

- October 2022 Forecast: The forecast predicted a decline in California’s median home price by 8.8% to $758,600 in 2023, following a projected 5.7% increase to $831,460 in 2022.

- April 2023 Revised Forecast: The revised forecast also expects a decline in the median home price, but the projected figure is slightly higher at $776,600, reflecting a 5.6% decrease from the median price of $822,300 recorded in 2022.

Overall, the revised forecast released in April 2023 indicates a more pessimistic outlook for the California housing market compared to the October 2022 forecast. It predicts a steeper decline in home sales and a slightly higher median home price decrease. These adjustments likely reflect the changing market conditions and factors influencing the California housing market over time.

The revised forecast takes into account various factors influencing the housing market, such as mortgage rates, inventory levels, buyer demand, and economic conditions. The decline in home sales is primarily attributed to higher mortgage rates and the limited availability of homes on the market. These factors have contributed to a decrease in buyer activity and overall sales volume.

Despite the decline in sales, the median home price in California is expected to remain relatively high. The increase in market competition, with homes spending less time on the market and a higher percentage of homes selling above asking price, has influenced the rise in median home prices.

It is important to note that the forecasted figures are based on current market conditions and historical trends. However, unforeseen events or changes in economic factors can influence the actual performance of the housing market throughout the year.

Here’s the snapshot of the California Housing Forecast for 2023 which was released by the C.A.R. on October 12, 2022.

Housing Market Forecast for California Metro Areas

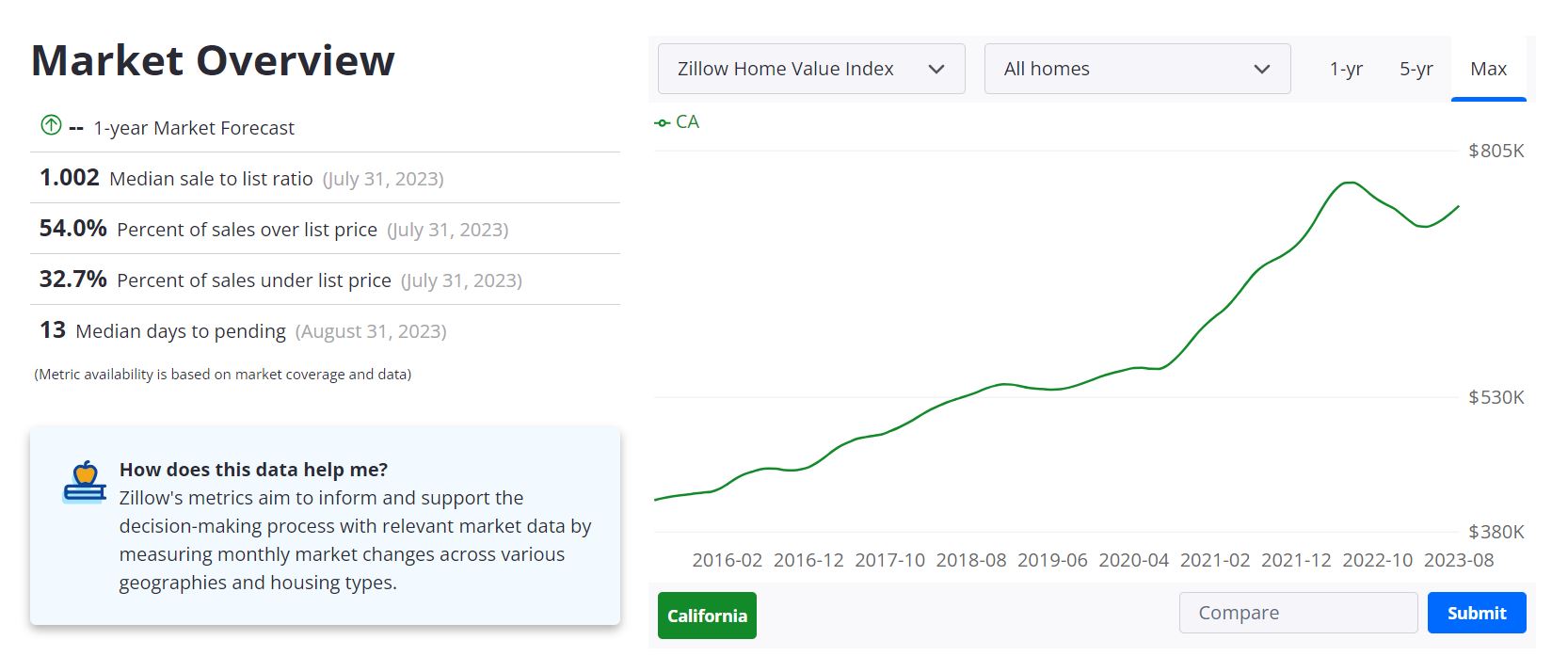

Zillow, a prominent real estate platform, provides valuable insights into the California housing market through their extensive data analysis. Here’s a glimpse of their recent findings as of August 31, 2023.

Current Market Overview

The average home value in California is estimated at $744,280. Over the past year, there has been a slight decrease of 2.8% in this value, indicating a nuanced market trend. Additionally, homes go to pending status in approximately 13 days, showcasing the quick pace at which properties are being snatched up by buyers.

Here are some key metrics as of July 31, 2023:

- Median Sale to List Ratio: 1.002

- Percent of Sales Over List Price: 54.0%

- Percent of Sales Under List Price: 32.7%

- Median Days to Pending: 13

Future Projections: Top 10 Metros for Highest Home Price Growth by 2024

Zillow also forecasts the expected home price growth in various metros within California by the end of 2024. Here are the top 10 metros, along with their projected growth percentages:

- Riverside, CA: 5.7%

- Santa Maria, CA: 5.6%

- Bakersfield, CA: 5.3%

- Madera, CA: 5.2%

- San Diego, CA: 5.1%

- Visalia, CA: 4.8%

- Hanford, CA: 4.7%

- Fresno, CA: 4.5%

- Salinas, CA: 4.4%

- San Luis Obispo, CA: 4.3%

These projections offer valuable insights for potential buyers, sellers, and investors, allowing them to anticipate and strategize for the evolving dynamics of the California housing market.

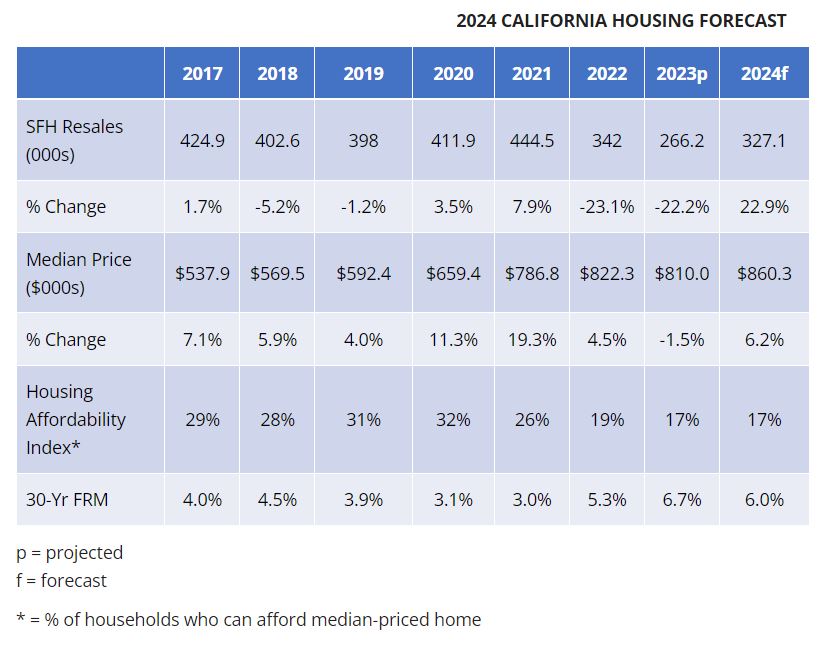

California Housing Market Forecast 2024 [By C.A.R.]

On September 20, 2023, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) released its highly anticipated “2024 California Housing Market Forecast,” outlining key projections for the state’s housing market in the upcoming year.

Positive Rebound in California Housing Market

In 2024, the California housing market is expected to experience a rebound, primarily attributed to a decrease in mortgage rates. The forecast predicts a substantial increase of 22.9 percent in existing, single-family home sales compared to the projected pace of 2023.

Sales and Prices Projection

The forecast estimates a total of 327,100 units in single-family home sales for 2024, showcasing a promising rise from the projected 266,200 units in 2023. Additionally, California’s median home price is anticipated to climb by 6.2 percent to $860,300 in 2024.

Market Environment and Factors Influencing the Forecast

Factors like slower economic growth and cooling inflation are anticipated to bring down mortgage interest rates, creating a more favorable market environment to stimulate California home sales in the coming year. A housing shortage and competitive market are expected to continue exerting upward pressure on home prices.

Economic Indicators and Job Growth

The forecast takes into account economic indicators, predicting a modest 0.7 percent increase in the U.S. gross domestic product for 2024. The state’s nonfarm job growth rate is estimated to be 0.5 percent. However, the unemployment rate is expected to slightly increase to 5.0 percent in 2024 from the projected 4.6 percent in 2023.

Impact on Mortgage Rates and Housing Supply

With the expected softening of the economy in 2024, the Federal Reserve Bank is predicted to loosen its monetary policy, leading to a downward trend in mortgage rates throughout the year. This could provide buyers with greater financial flexibility, resulting in increased housing demand and further upward pressure on home prices. Despite an expected increase in active listings, housing supply is projected to remain below the norm.

The “2024 California Housing Market Forecast” by C.A.R. paints an optimistic picture of the state’s housing market, anticipating a significant rebound in home sales and a notable increase in median home prices. This forecast considers various economic factors and market conditions, providing valuable insights for both buyers and sellers. As the year unfolds, the actual market performance will undoubtedly shed more light on the accuracy of these projections.

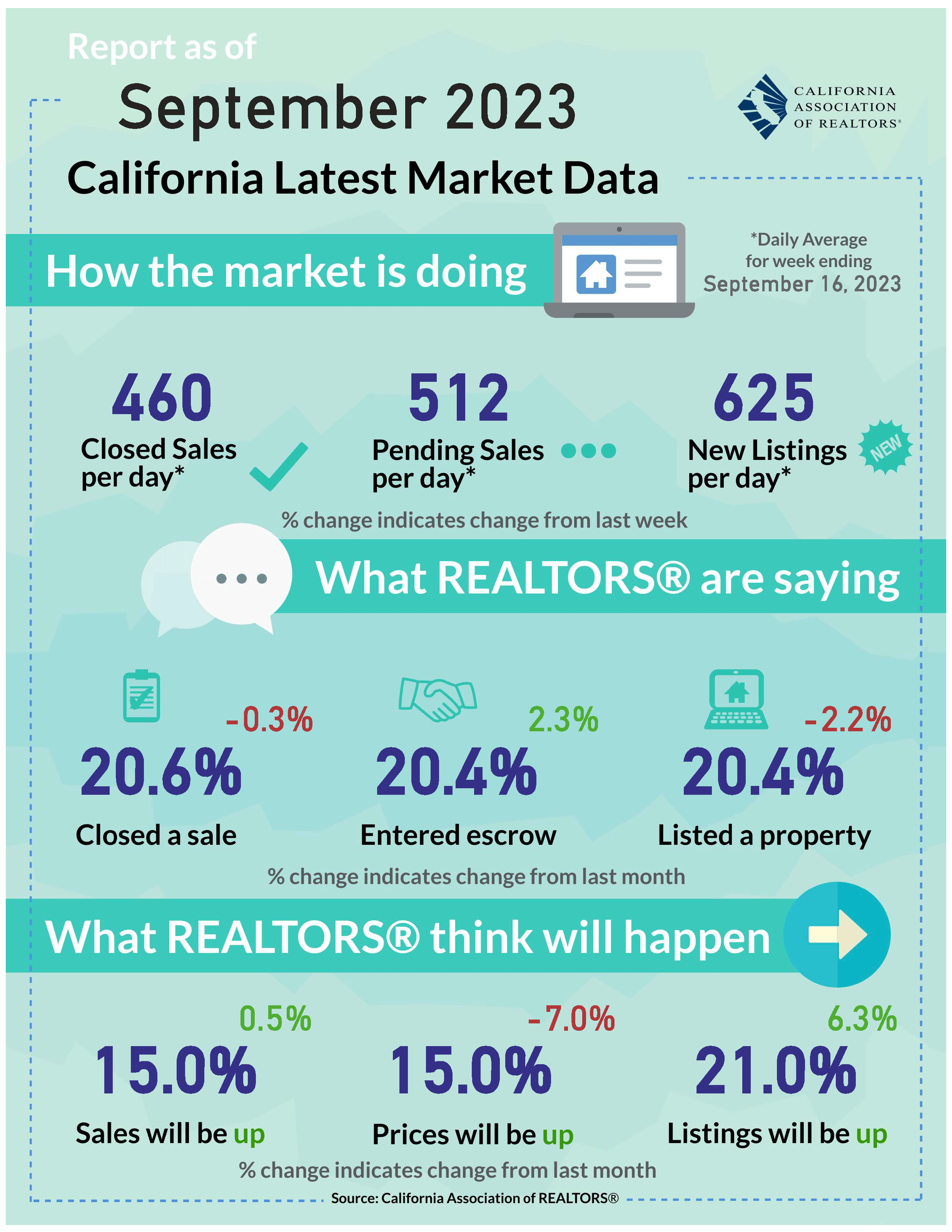

California Housing Market – Weekly Report

Providing insights into the pulse of the California housing market, this weekly report provided by the CALIFORNIA ASSOCIATION OF REALTORS® covers key developments and trends shaping the real estate landscape in the state. Here’s a snapshot of the latest updates as of September 18, 2023.

Market Overview

In August, California witnessed a softening of home sales due to a surge in interest rates, reaching the highest level in 22 years before slightly stabilizing in the past two weeks. Despite this, home prices are showing resilience, maintaining a year-over-year gain for the second consecutive month.

The primary factor preventing a price decline is the persistently tight supply, which has been a challenge for over a year now. The housing shortage is dampening sales, and the situation may worsen before it improves.

With retail activity staying solid and core inflation not cooling fast enough, rates are expected to remain relatively high in the near term, influencing a potential slow month for home sales in September. However, a rebound in sales is anticipated in October and November, driven by potential lower mortgage rates in Q4 2023.

California Home Sales Trends

Sales of existing homes in California saw a dip on a year-over-year basis, coinciding with a surge in borrowing costs. This dip marks the 26th consecutive month of annual declines, with the sales pace in August hitting its lowest level in seven months. Despite this, sales remained above the recent low point recorded in November of the previous year.

The ongoing elevated mortgage rates are expected to keep sales subdued in the coming months. Pending sales took a significant hit in August, declining by almost 25%. This suggests that closed sales in California will likely dip again in September before showing signs of recovery in October.

Home Price Resilience

California’s home prices continued their recovery trajectory, marking the biggest year-over-year gain in fourteen months. August witnessed the highest median price in 15 months, reaching levels last seen in May of the preceding year.

Despite mortgage rates remaining approximately 200 basis points higher than the previous year, tight housing supply and a highly competitive environment have provided consistent support to home prices.

The share of sales with sold prices above asking remained elevated, emphasizing the upward pressure on home prices. While the market is expected to ease towards the year-end, positive year-over-year gains are projected to persist as rates begin to moderate in Q4 2023.

Housing Supply and Consumer Dynamics

The lock-in effect has been a major factor in keeping inventory low throughout the summer. Housing supply in California has been consistently declining year-over-year, exacerbated by elevated mortgage rates.

Active listings have been on a downward trend for five consecutive months, with a year-over-year decline exceeding 20% each month. While the number of new listings is expected to shrink in the usual seasonal trend, the rate of decline could be influenced by potential rate moderation in the coming months.

On another note, consumer prices experienced the largest increase since June of the previous year, primarily due to a surge in gasoline prices in August. Despite higher-than-expected monthly gains, core inflation has been showing a marked downshift since earlier in the year. Retail sales surpassed expectations, driven by spending at gas stations, though headwinds may challenge consumers in the upcoming months.

This weekly report offers a comprehensive look at the California housing market, shedding light on market dynamics and providing valuable insights for all stakeholders involved.

Is It a Good Time to Buy a Home in California?

In the dynamic California housing market, the decision to buy a home is influenced by a myriad of factors, including market sentiment and predictions provided by real estate professionals. As potential buyers contemplate whether it’s a good time to enter the market, recent data from the California Association of REALTORS® (C.A.R.) sheds light on current perceptions within the industry.

Considering the current dynamics of the California housing market as of the week ending September 16, 2023, let’s analyze if it’s a good time to consider buying a home in the state.

Market Activity

For the week ending September 16, 2023, the daily average figures reflect a certain level of activity:

- Closed Sales: 460 per day

- Pending Sales: 512 per day

- New Listings: 625 per day

These figures indicate a reasonably active market, with a healthy number of both closed and pending sales, as well as new listings coming up daily.

Realtors’ Insights

Realtors’ perspectives provide valuable insights into the market’s trajectory:

- Realtors Anticipating Increase in Sales: 15%

- Realtors Anticipating Increase in Prices: 15%

- Realtors Anticipating Increase in Listings: 21%

Realtors’ anticipation of a potential increase in sales and listings is noteworthy. This suggests a positive outlook for market activity, indicating that more homes might become available for prospective buyers.

However, it’s essential to consider the relatively low percentage of Realtors anticipating an increase in prices. A decrease of 7% from previous data indicates a level of caution regarding price hikes in the immediate future.

Is It a Good Time to Buy?

Given the current scenario, with an active market, a reasonable number of listings, and a cautious outlook on price increases, it could be a decent time to consider buying a home in California. The potential increase in listings, as indicated by Realtors, provides a favorable environment for prospective buyers.

However, it’s crucial to monitor the market closely, especially considering the recent fluctuation in price expectations. Keeping a close eye on price trends and seeking guidance from real estate experts can help potential buyers make informed decisions.

Ultimately, the decision to buy a home depends on various factors, including personal circumstances, financial readiness, and long-term housing goals. Consulting with a real estate professional to evaluate your specific situation is highly advisable.

This analysis is based on the data available as of the week ending September 16, 2023, and the market dynamics are subject to change.

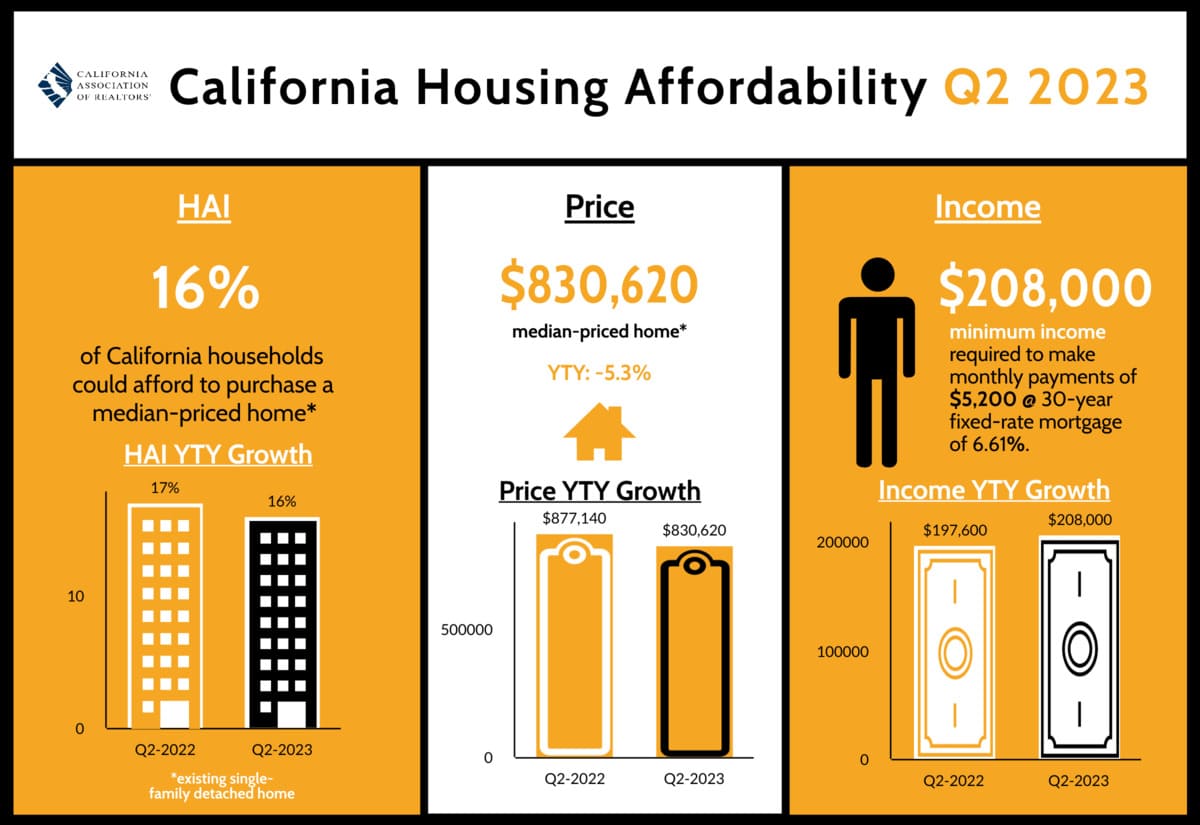

Housing Affordability Trends in California – 2nd Quarter 2023

The housing market in California has long been known for its high prices and competitive nature. The second quarter of 2023 brought some sobering news for potential homebuyers as housing affordability reached its lowest level in almost 16 years.

The California Association of Realtors (C.A.R.) recently released its Traditional Housing Affordability Index (HAI) report, revealing the impact of rising interest rates and ongoing supply shortages on the ability of Californians to afford homes. In this blog post, we’ll delve into the key findings of the report, shedding light on the challenges faced by aspiring homeowners.

- Sixteen percent of California households could afford to purchase the $830,620 median-priced home in the second quarter of 2023, down from 19 percent in first-quarter 2023 and down from 17 percent in second-quarter 2022.

- A minimum annual income of $208,000 was needed to make monthly payments of $5,200, including principal, interest and taxes on a 30-year fixed-rate mortgage at a 6.61 percent interest rate.

- Twenty-five percent of home buyers were able to purchase the $640,000 median-priced condo or townhome.

- A minimum annual income of $160,400 was required to make a monthly payment of $4,010.

The Affordability Crunch

Decline in Affordability

The report reveals that only 16 percent of California households could afford to purchase a median-priced home, which stood at $830,620 in the second quarter of 2023. This marks a decline from 19 percent in the previous quarter and 17 percent from the same period last year. This decline in affordability is attributed to the confluence of rising interest rates and persistently elevated home prices, driven by the shortage of available properties in the market.

Impact on Homebuyers

Minimum Income Requirements

To shed light on the economic implications of these affordability challenges, the report highlights the minimum annual income required to make mortgage payments for both single-family homes and condos/townhomes. For the median-priced single-family home, an annual income of $208,000 was necessary to make monthly payments of $5,200. On the other hand, a minimum annual income of $160,400 was required for the $640,000 median-priced condo or townhome.

Regional Variations

Diverse Affordability Landscape

Housing affordability varies widely across different regions and counties within California. The report shows that Lassen County, with an affordability index of 52 percent, was the most affordable county in the state. In contrast, Mono County had an affordability index of just 5 percent, making it the least affordable. The differences in affordability are influenced by factors such as local income levels, home prices, and interest rates.

National Context

California vs. the Nation

When compared to the national housing landscape, California faces a steeper affordability challenge. While only 16 percent of California households can afford the median-priced home, more than a third of the nation’s households can afford a $402,600 median-priced home. This disparity underscores the unique economic dynamics and supply-demand imbalances within the California housing market.

Therefore, we can see that as interest rates remain high and housing supply remains constrained, the second quarter of 2023 paints a challenging picture for Californians aspiring to become homeowners. Affordability has reached its lowest point in years, impacting a substantial portion of the population. While some counties maintain relatively higher affordability rates, others struggle to provide accessible housing options.

The housing market’s trajectory will likely continue to be influenced by various economic factors, including interest rates, home inventory levels, and overall economic growth. For now, prospective homebuyers will need to carefully assess their financial situations and explore creative solutions to navigate this complex landscape.

Sources:

- https://www.car.org/

- https://www.car.org/aboutus/mediacenter/newsreleases

- https://www.car.org/marketdata/data/countysalesactivity

- https://www.car.org/marketdata/marketforecast

- https://www.car.org/marketdata/marketminute

- https://www.car.org/marketdata/interactive/housingmarketoverview

- https://www.zillow.com/ca/home-values