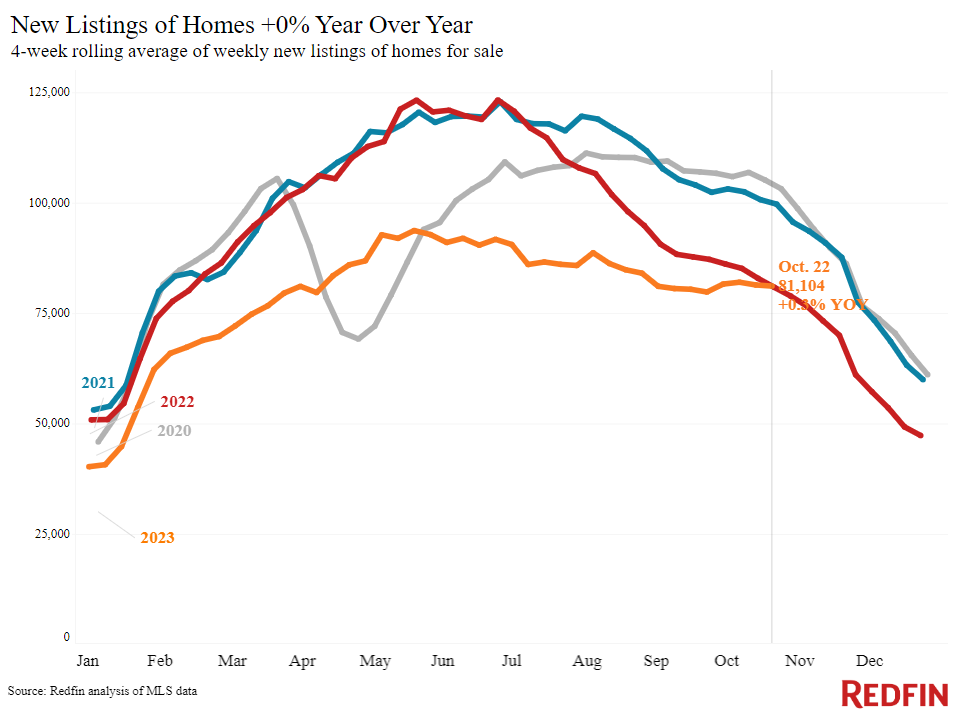

New listings have posted their first annual increase since July 2022 as some sellers tire of waiting for mortgage rates to come down and others worry that prices will decline.

New listings of homes for sale rose 0.3% from a year earlier during the four weeks ending October 22–a small increase, but the first since July 2022. More homeowners are putting their homes on the market as mortgage rates remain elevated near 8%. Some sellers are accepting that rates are unlikely to meaningfully decline anytime soon and finally parting with their relatively low rates, while others are nervous tepid demand could cause home prices to fall if they wait any longer. It’s also worth noting that new listings were falling fast at this time last year as mortgage rates rose.

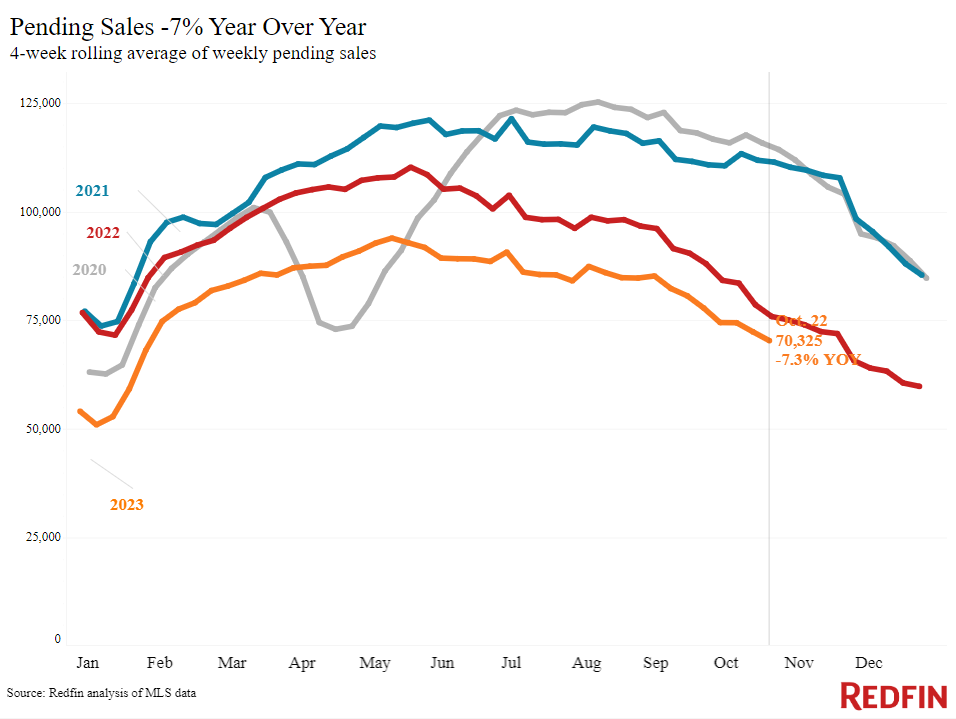

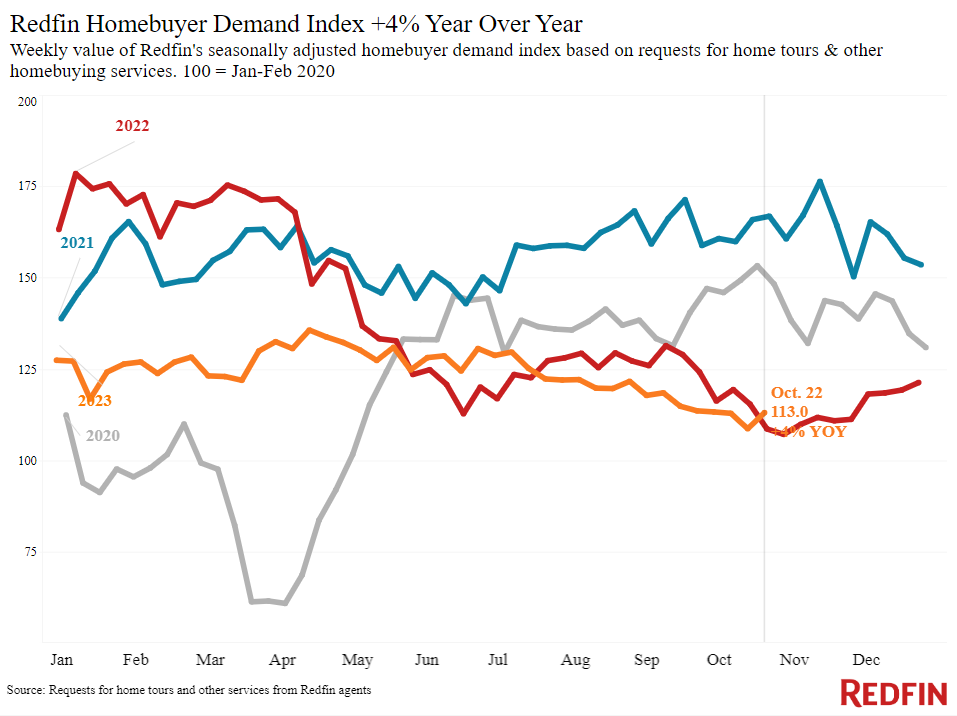

Buyers are welcoming even a small uptick in listings after nearly a year and a half of declines. Although many homebuyers are staying on the sidelines, with mortgage-purchase applications down 2% week over week to their lowest level in nearly 30 years, some house hunters are out there. Pending home sales posted their smallest annual decline in a year and a half (though that’s partly because pending sales were dropping at this time last year).

“Some people are selling right now because they’re concerned home values will go down, though that’s definitely not a foregone conclusion,” said Ali Mafi, a Redfin Premier agent in San Francisco. “Others are noticing an uptick in demand and testing the waters. My best advice for homeowners who are selling right now is to be realistic: Even though there are a few more buyers out there, this isn’t 2021. Price your home fairly so it will sell as fast as possible.”

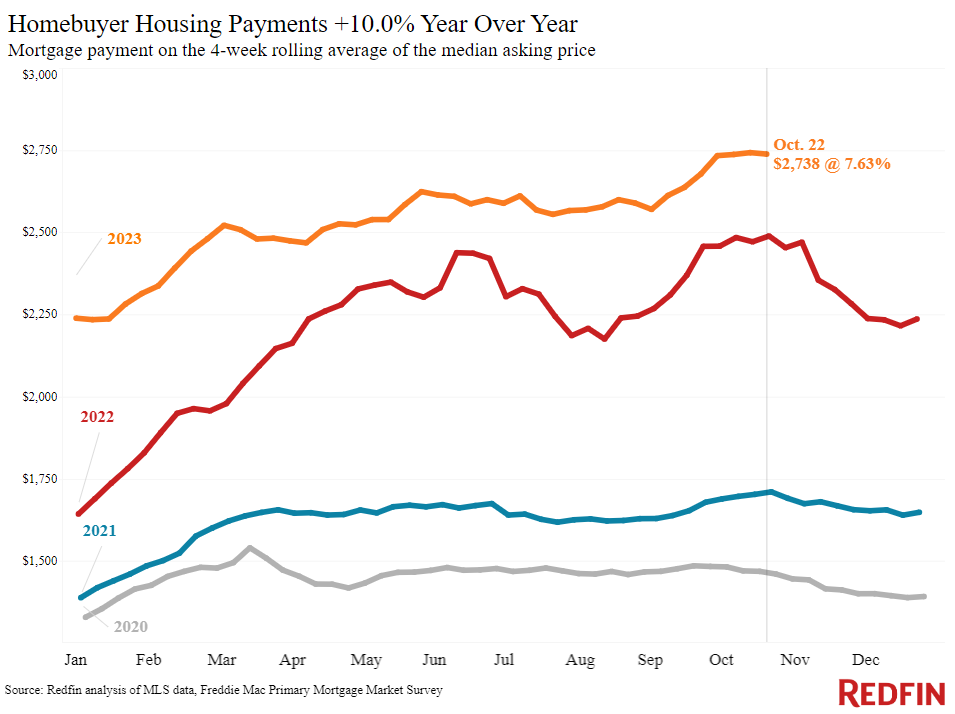

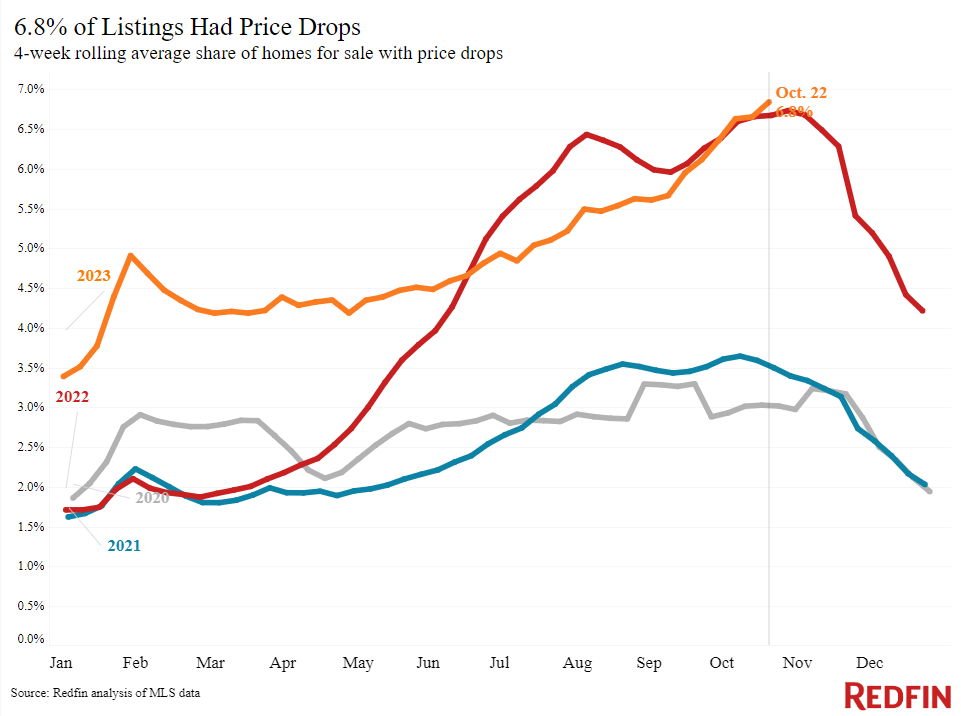

Buyers’ budgets continue to take a hit with prices rising in much of the country and persistently high mortgage rates. Declining affordability has led to price adjustments: Roughly 7% of U.S. homes for sale had a price drop during the four weeks ending October 22, on average, the highest share on record.

Leading indicators

| Indicators of homebuying demand and activity | ||||

| Value (if applicable) | Recent change | Year-over-year change | Source | |

| Daily average 30-year fixed mortgage rate | 7.98% (Oct. 25) | Down from 8% a week earlier, but still near its highest level in 23 years | Up from 7.29% | Mortgage News Daily |

| Weekly average 30-year fixed mortgage rate | 7.63% (week ending Oct. 19) | Highest level in 23 years | Up from 6.94% | Freddie Mac |

| Mortgage-purchase applications (seasonally adjusted) | Down 2% from a week earlier (as of week ending Oct. 20) | Down 22% to its lowest level in nearly 30 years | Mortgage Bankers Association | |

| Redfin Homebuyer Demand Index (seasonally adjusted) | Unchanged from a month earlier (as of the week ending Oct. 22) | Up 4% | Redfin Homebuyer Demand Index, a measure of requests for tours and other homebuying services from Redfin agents | |

| Google searches for “home for sale” | Down 12% from a month earlier (as of Oct. 21) | Down 12% | Google Trends | |

Key housing-market data

| U.S. highlights: Four weeks ending October 22, 2023 Redfin’s national metrics include data from 400+ U.S. metro areas, and is based on homes listed and/or sold during the period. Weekly housing-market data goes back through 2015. Subject to revision. | |||

| Four weeks ending October 22, 2023 | Year-over-year change | Notes | |

| Median sale price | $369,975 | 3.1% | Prices are up partly because elevated mortgage rates were hampering prices during this time last year |

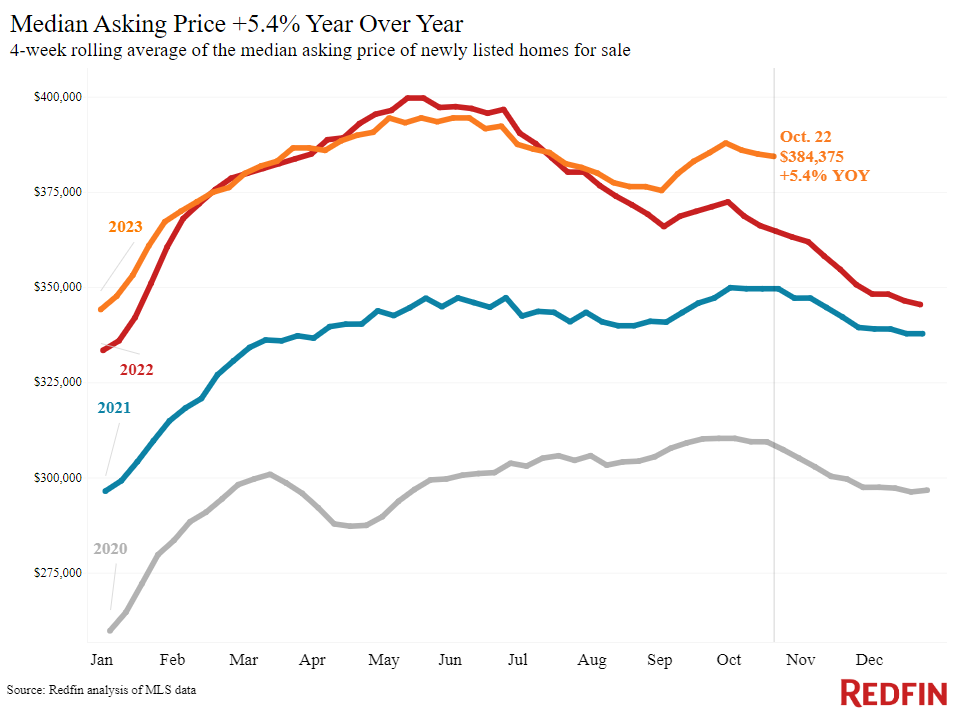

| Median asking price | $384,375 | 5.4% | Biggest increase in a year |

| Median monthly mortgage payment | $2,738 at a 7.63% mortgage rate | 10% | $5 shy of all-time high set a week earlier |

| Pending sales | 70,325 | -7.3% | Smallest decline since April 2022, partly because pending sales fell rapidly at this time in 2022 |

| New listings | 81,104 | 0.3% | First increase since July 2022 |

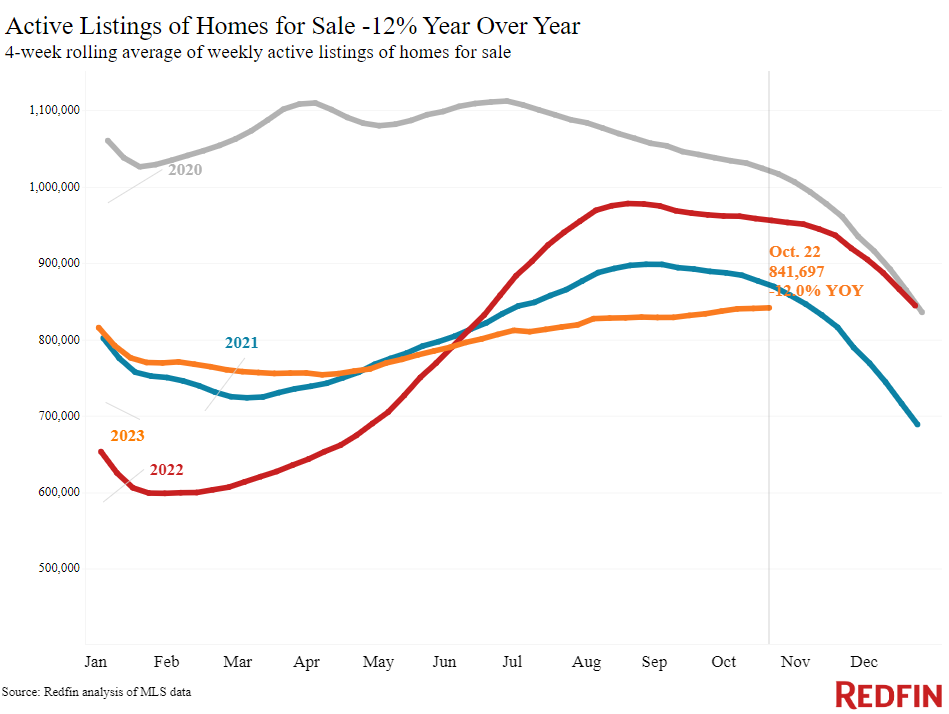

| Active listings | 841,697 | -12% | Smallest decline since July |

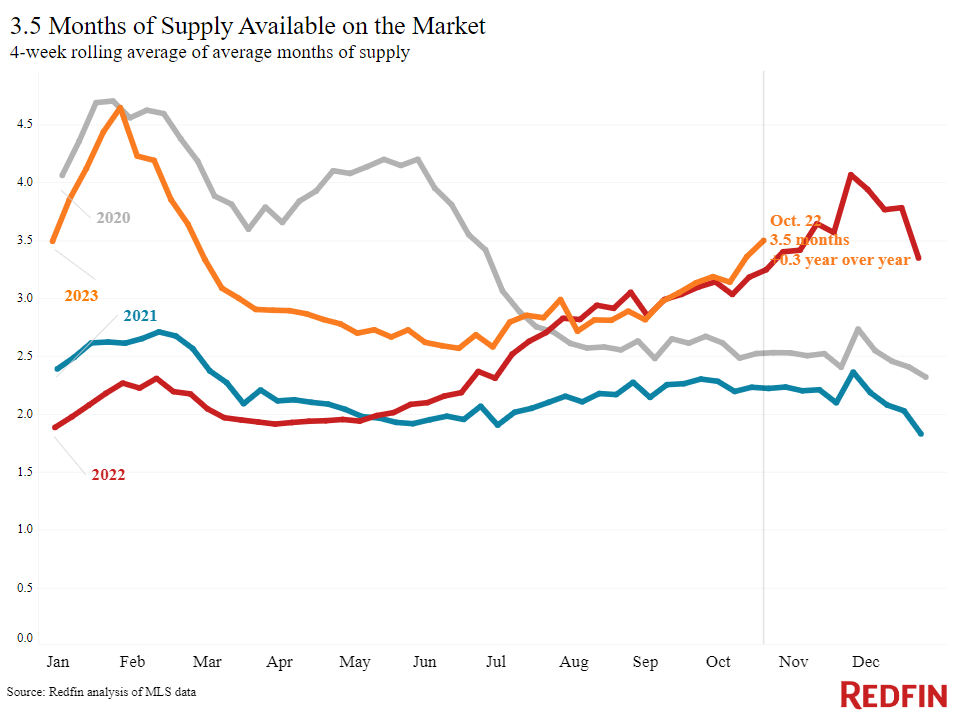

| Months of supply | 3.5 months | +0.2 pts. | Highest level since February 4 to 5 months of supply is considered balanced, with a lower number indicating seller’s market conditions. |

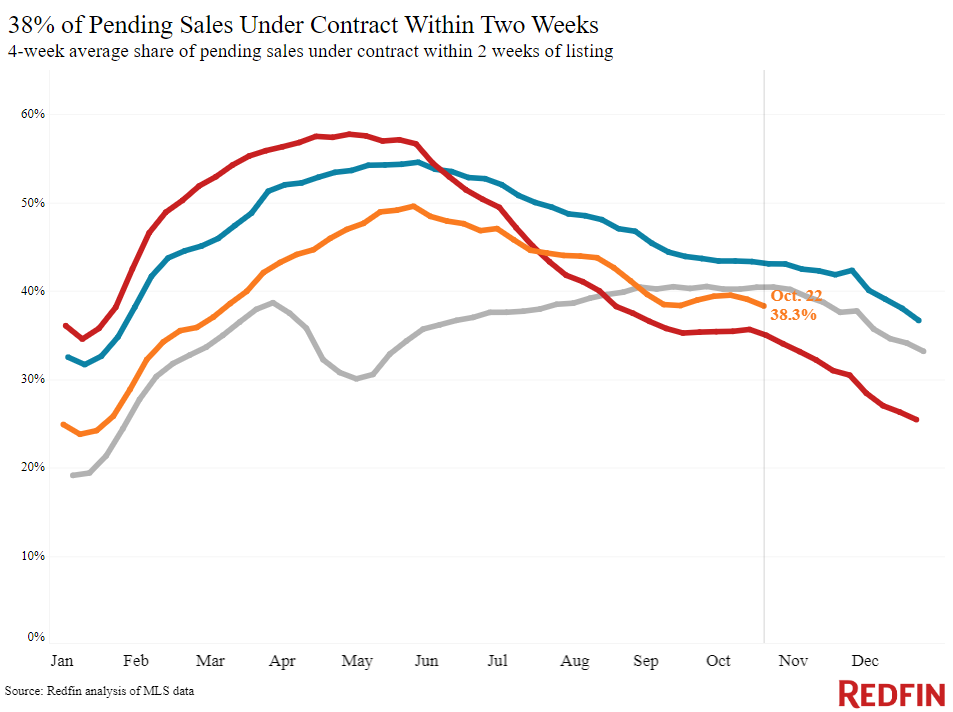

| Share of homes off market in two weeks | 38.3% | Up from 35% | |

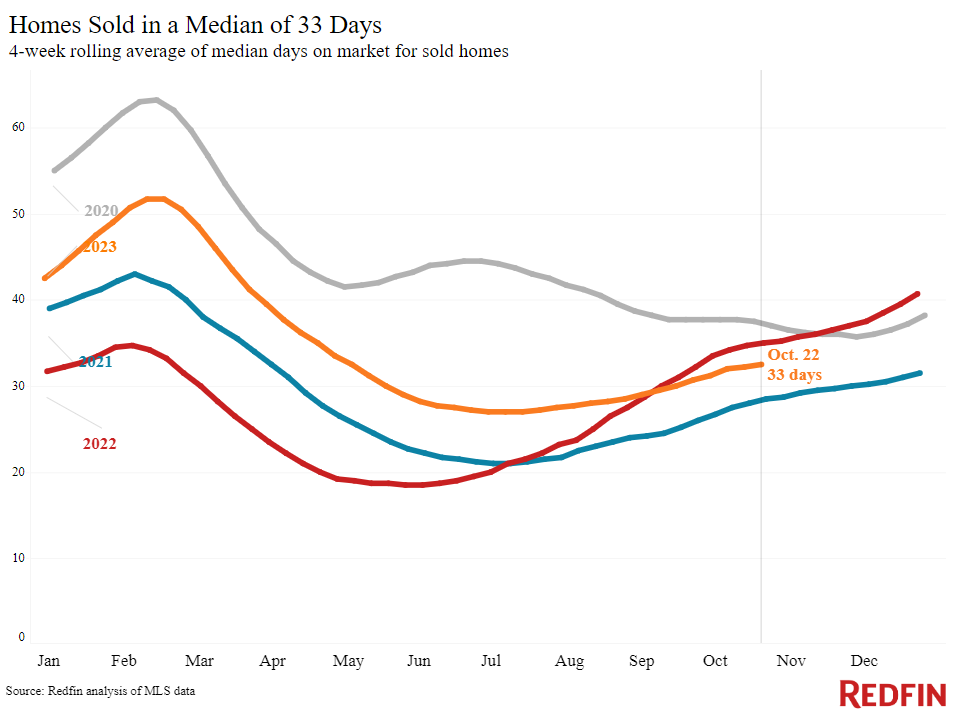

| Median days on market | 33 | -3 days | |

| Share of homes sold above list price | 29.8% | Up from 28% | |

| Share of homes with a price drop | 6.8% | +0.1 pt. | Record high |

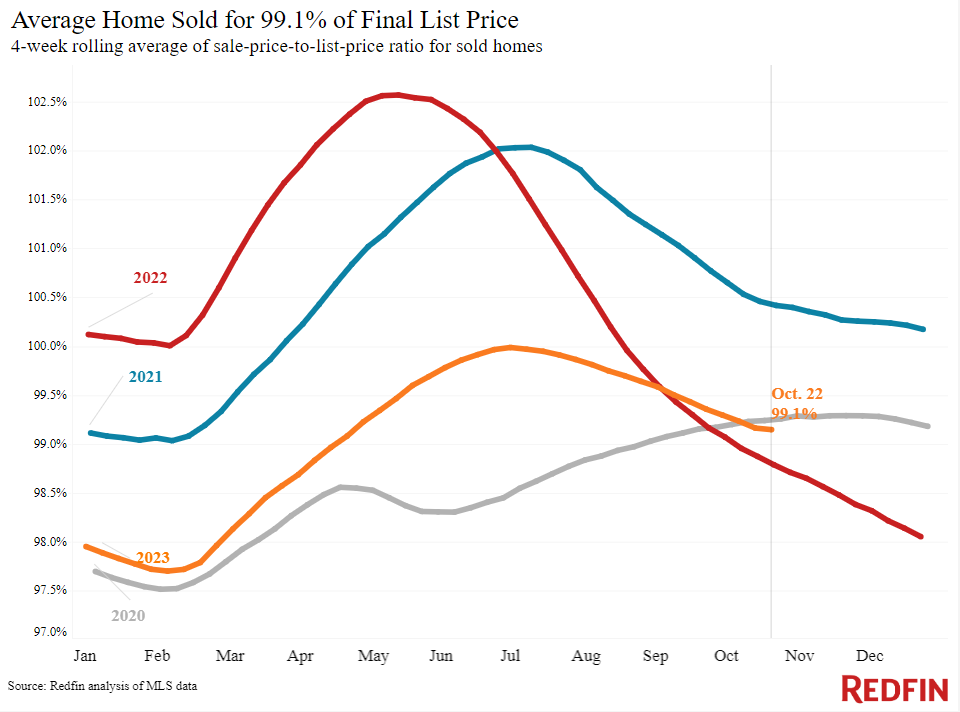

| Average sale-to-list price ratio | 99.1% | +0.3 pts. | |

| Metro-level highlights: Four weeks ending October 22, 2023 Redfin’s metro-level data includes the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy. | |||

| Metros with biggest year-over-year increases | Metros with biggest year-over-year decreases | Notes | |

| Median sale price | West Palm Beach, FL (13.1%) Newark, NJ (13%) Anaheim, CA (12.2%) New Brunswick, NJ (11.4%) San Jose, CA (11%) | Austin, TX (-5.9%) Fort Worth, TX (-2.2%) Houston, TX (-1.6%) San Antonio, TX (-1.6%) Tampa, FL (-1.3%) Portland, OR (-1.2%) Phoenix (-0.4%) | Declined in 7 metros |

| Pending sales | West Palm Beach, FL (9.8%) Orlando, FL (7.5%) Jacksonville, FL (3.7%) Fort Lauderdale, FL (2.6%) Cleveland, OH (1.2%) | Portland, OR (-21.2%) Sacramento, CA (-18.7%) Virginia Beach, VA (-18.3%) Newark, NJ (-16.6%) Atlanta (-16.4%) | Declined in all but 7 metros |

| New listings | Orlando, FL (18.7%) West Palm Beach, FL (13.7%) Miami, FL (13.6%) Jacksonville, FL (11.4%) Fort Lauderdale, FL (11.3%) | Atlanta (-24.9%) Portland, OR (-14.5%) Nashville, TN (-13.2%) Columbus, OH (-12.7%) Chicago (-12.1%) | Increased in 14 metros (5 biggest increases all in Florida) |

Refer to our metrics definition page for explanations of all the metrics used in this report.