Turn up the volume on your real estate success at Inman On Tour: Nashville! Connect with industry trailblazers and top-tier speakers to gain insights, cutting-edge strategies, and invaluable connections. Elevate your business and achieve your boldest goals — all with Music City magic. Register now.

Workforce reductions reportedly in the works at the Department of Housing and Urban Development (HUD) and the Federal Housing Administration (FHA) would “severely undermine” the federal government’s capacity to help low- to moderate-income families buy homes and manage rental assistance programs, a union representing affected workers claims.

The Trump administration has disputed the accuracy of a Feb. 18 report by Bloomberg Law that at least 40 percent of FHA’s workforce are set to be laid off as part of cost-cutting initiatives being implemented across multiple federal agencies — including HUD, the Department of Veterans Affairs, the Internal Revenue Service and the Department of Homeland Security.

TAKE THE INMAN INTEL INDEX SURVEY FOR FEBRUARY

Bloomberg Law had previously reported that HUD, which oversees the FHA and its massive mortgage insurance program, was planning to cut its workforce of 9,600 by half.

About three in four HUD employees work at the FHA, Bloomberg Law reported Tuesday, citing two anonymous sources said to be “familiar with the agency’s plans” for job cuts.

A spokeswoman for HUD Secretary Scott Turner told Bloomberg Law that its reporting was “not accurate,” but did not say how. HUD did not respond to Inman’s requests for comment on reports that HUD and FHA will be drastically downsized.

Questions that remain unanswered include how many HUD employees accepted “Fork in the Road” deferred resignation offers (the White House has said a total of 77,000 federal workers resigned), or how many HUD workers the Trump administration might try to fire because they are recently hired or promoted “probationary employees.”

ABC News reported Thursday that more than 200,000 federal workers at more than a dozen agencies have been fired, including 6,000 IRS workers, 2,300 employees at the Department of the Interior, and 2,000 Department of Energy workers.

Unions representing many of those employees have filed court cases challenging their legality — and questioned their wisdom.

The American Federation of Government Employees (AFGE) National Council 222, which represents 5,300 HUD employees, said in a press release that cutting the Department of Housing’s staffing by half would result in a “significant loss of expertise and institutional knowledge.”

HUD’s “capacity to manage rental assistance, provide funding to house homeless individuals, help low- to moderate-income families buy homes, and build and repair affordable housing will be severely undermined, making it tough to carry out the agencies’ mission,” the union warned.

Many probationary employees have technical backgrounds and bring new skills that HUD needs, the union said, pointing to alleged failures of IT infrastructure (including a “woefully inadequate” inspection app, NSPIRE) as examples of “dysfunction” in HUD’s executive ranks.

The union said it’s been working with whistleblowers for more than a year “to expose fraud, waste, and abuse within HUD,” and that HUD employees “are being scapegoated for decades of mismanagement by HUD senior executives.”

FHA premium watch

In addition to how staffing cuts at HUD and FHA might affect the delivery of services, mortgage and housing industry leaders have been watching for potential changes to programs like the FHA’s popular mortgage insurance program.

Saying FHA’s capital reserves have recovered from the 2007-2009 housing downturn, the Mortgage Bankers Association has called for cuts to FHA mortgage insurance premiums (“the MIP”) as a way to help low- and middle-income buyers cope with housing affordability issues.

“We have called for the Biden and Trump administration to consider lowering the MIP and will continue to do so as long as the MMIF [Mutual Mortgage Insurance Fund] remains strong and delinquencies low,” an MBA spokesperson told Inman Thursday.

FHA-backed mortgages lets homebuyers put as little as 3.5 percent down and borrow at least $524,225 in low-cost markets and as much as $1.2 million in high-cost markets like New York, San Francisco and Washington, D.C. The ceiling for single-family homes in Alaska and Hawaii is more than $1.8 million, in recognition of higher construction costs in those states.

In its annual report to Congress, HUD said 82 percent of FHA purchase mortgages were taken out by first-time homebuyers and that in 2023, FHA lenders did more than twice as much business than their competitors with Black borrowers (16.7 percent) and Hispanic borrowers (22.8 percent).

Private mortgage insurers — who provide a backup to lenders who sell loans to Fannie Mae and Freddie Mac when homebuyers put less than 20 percent down — have been working for more than a decade to win back market share they lost to FHA during the 2007-09 housing crash.

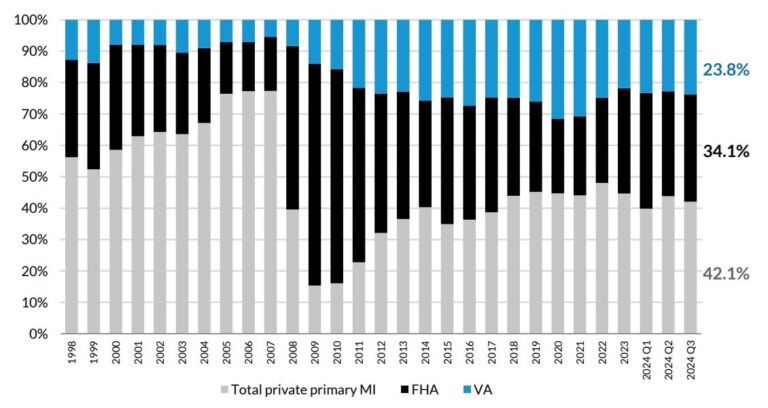

FHA, VA and private mortgage insurer market share

Source: Inside Mortgage Finance and the Urban Institute.

Premium cuts announced by the Biden administration in 2023 made FHA mortgages more attractive than Fannie and Freddie mortgages for most homebuyers making down payments of less than 5 percent.

FHA’s market share among borrowers required to have some type of mortgage insurance has bounced back from 29.9 percent in Q1 2023 to 34.1 percent in Q3 2024, according to data tracked by Inside Mortgage Finance and the Urban Institute.

Analysts at the Urban Institute calculate that borrowers with a FICO score of less than 740 will find FHA financing to be a better deal when putting 3.5 percent down. But borrowers with FICO scores of 740 and above will do better taking out a conventional Fannie- or Freddie-eligible mortgage with private mortgage insurance.

Project 2025, the 922-page policy document put together by the Heritage Foundation and an advisory board of more than 100 conservative organizations detailing policy positions they hoped Trump would embrace, called for raising FHA mortgage insurance premiums.

The chapter of Project 2025 focused on HUD — authored by Trump’s previous Secretary of Housing, Ben Carson — also called for halting efforts to address appraisal bias and climate change issues, and shutting down the Housing Supply Fund, which provides grants to state and local governments to build more affordable housing.

Project 2025 called for a “reset” of HUD, “to include a broad reversal of the Biden Administration’s persistent implementation of corrosive progressive ideologies across the department’s programs.”

Trump disavowed Project 2025 on the campaign trail, calling some of its proposals “abysmal,” but since then has appointed several of its contributors to his Cabinet or to key leadership positions, including Stephen Miller (Assistant to the President and Deputy Chief of Staff for Policy and Homeland Security Advisor), Russell Vought (director of the Office of Management and Budget) and Brendan Carr (chairman of the Federal Communications Commission).

HUD did not respond to Inman’s requests for comment about whether HUD intends to raise FHA mortgage insurance premiums or take up other recommendations put forward in Project 2025.

In separate announcements on social media Thursday, Turner boasted that “$4 Million in diversity, equity, and inclusion contracts were just cancelled at HUD,” and that “President Trump signed an executive order to uphold biological truth and HUD is ensuring that access to HUD funded facilities and shelters is based off an individuals sex assigned birth — male or female.”

Last week the Department of Government Efficiency (DOGE) claimed to have “recovered” $1.9 billion in HUD funds it claimed had been “misplaced.” One of the companies under contract with HUD told Inman that the money allocated to it under an expired contract was never spent.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.