Alaris Acquisitions, a sell-side M&A consultancy to the wealth management industry, has launched The Alaris Lens Application, a technology platform to help match buyers and sellers in the registered investment advisor space.

“The M&A landscape, in our view, just feels like a bunch of noise,” said Allen Darby, founder and CEO of Alaris. “What we’re trying to create is a better way to cut through all the clutter and hopefully take dealmaking to a new level, ushering in some much-needed transparency and clarity for anyone who’s thinking about transacting with a larger firm.”

Prior to launching Alaris in 2019, Darby led the outbound M&A activities for United Capital. Darby created Alaris to bring the model he used at United Capital to the broader RIA M&A arena. Jacqueline Martinez, who previously co-led the M&A team at United Capital and one of WealthManagement.com’s Ten to Watch in 2025, jumped on board with Darby in 2021 as managing partner.

Darby believes the existing matchmaking process in this industry is flawed. Historically, advisors had two suboptimal processes for finding a buyer: going solo, negotiating with the buyers on their own or hiring a sell-side advisor, like Alaris.

While most RIAs are looking for a good cultural fit, the typical sell-side advisor still uses the financial auction to match buyers and sellers.

“They go through a few rounds eliminating buyers based on the insufficiency of the offer,” Darby said. “That’s their process for narrowing the field. It’s entirely math-centric. And the problem with that is, it’s treating this transaction, which is frankly more like a marriage, like selling a piece of real estate or a car. There’s zero attempt to try to measure compatibility between the firms.”

Lens goes about the process differently, Darby said. For the last four years, Darby and his team have been cataloging some of the biggest buyers in the industry, from Edelman Financial Engines and Prime Capital Investment Advisors to regional buyers like Modern Wealth. They now boast 70 buyers on their roster, with whom they’ve spent at least 30 hours each, often in their offices conducting qualitative interviews with their leadership teams. They’ve collected about 150 different data points on each buyer and compiled all of this into the Lens application.

“Inviting 50 or more buyers into the process is, in my opinion, utterly absurd,” Darby said in a statement. “With that many potential buyers involved, it becomes impossible to devote the necessary time to truly connect with your future partner and reach a place of genuine cultural alignment.”

The app is built into two parts. The first is a “knowledge center,” a live marketing site where sellers can get educated on all things M&A in the wealth management space.

The second piece is an AI matching algorithm, which runs a two-way compatibility screen between buyers and sellers.

For the sellers, Alaris captures the firm’s staffing, client segmentation, client experience, technology stack, operations and financials—all of the data a buyer would want to know to evaluate the business. It also captures qualitative information, such as why the RIA is seeking a partnership, what they want the buyer to bring to the table, the type of autonomy profile they’re seeking, their growth profile and calendar needs.

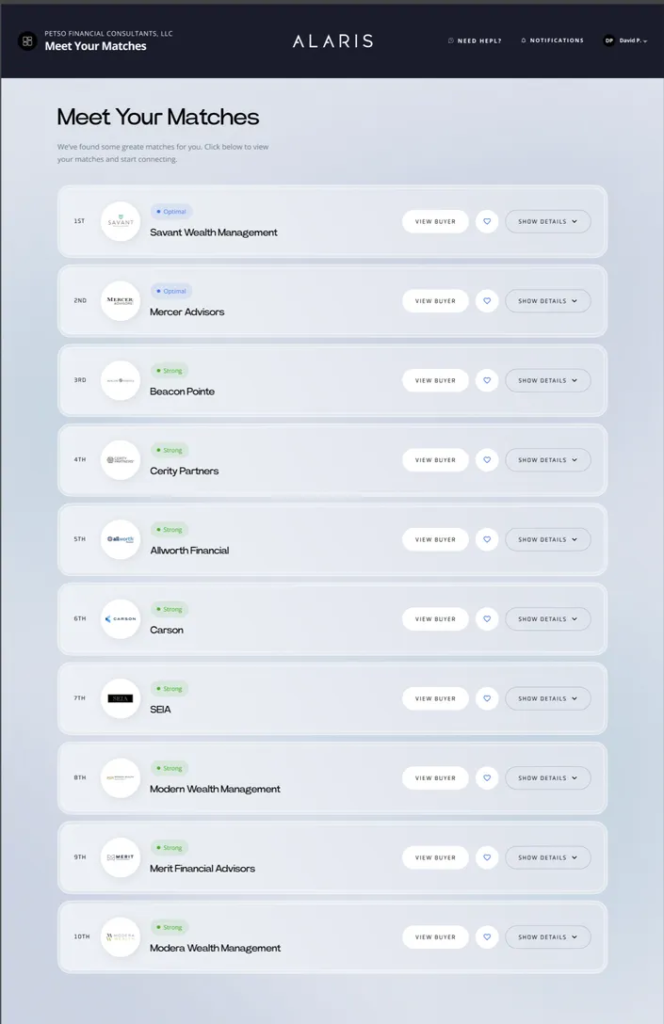

The algorithm takes all the data points and context around those data points to find matches, ranked by optimal match, strong match, moderate match and weak match. Now, instead of putting 50 potential buyers in front of the seller, Lens narrows it down to the top 10 matches.

“This is a large data set of information that we are reasoning to a match on this broad set of objectable measurable points of alignment,” Darby said. “And so that’s why when we go to match make, rather than do this shotgun email blast to the entire industry, we can tell the seller, ‘Here are your top 10 matches.’”

The seller then narrows it down to their top three choices that they will actually bring to the table and spend time with.

“We’re measuring compatibility because, culture you can only experience, but we’ve got to clear the decks and not have 50 buyers at the table,” Darby said. “When you have that many at the table, you have no time to get to know them, no time to get to that point of cultural conviction, which can only come through experiencing and spending time with people.”