What happened to mortgage rates this week

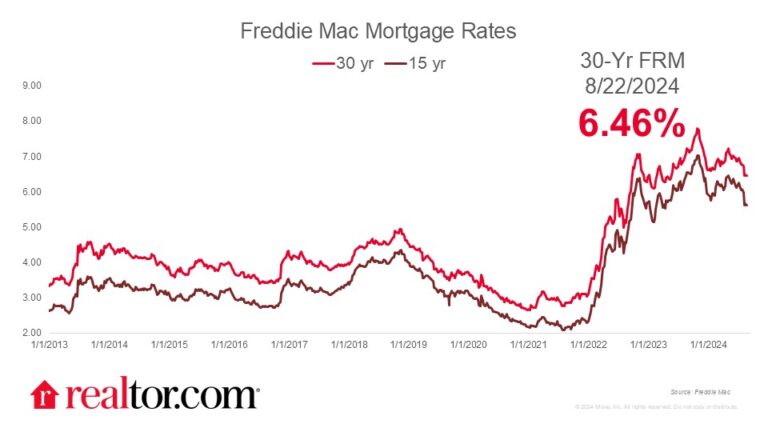

The Freddie Mac rate for a 30-year mortgage declined slightly by 0.03 percentage points to 6.46% this week as the financial market is waiting for Fed Chair Jerome Powell’s speech on the central bank’s upcoming monetary policy on Friday.

In July, inflation dropped below 3% for the first time since 2021, fueling widespread expectations that the Federal Reserve will initiate its first interest rate cuts in September. A lower Fed benchmark rate would lower consumer borrowing costs across the board, including mortgages.

Meanwhile, the timing and extent of these cuts will also depend on the health of the labor market, the second key component of the Fed’s dual mandate. With the unemployment rate rising to 4.3% in July, concerns about a potential recession are prompting the Fed to pay closer attention to labor conditions. Policymakers are aiming to time the cuts carefully, seeking to curb inflation without triggering a sharp increase in unemployment.

What it means for the housing market

While investors have already factored in potential rate cuts, most homebuyers and sellers may be holding off on decisions until the Federal Reserve formally announces the cuts. As a result, we expect to see an additional boost this fall due to changing market conditions.

In our recent midyear housing forecast update, we’ve revised our year-end mortgage rate expectations down to 6.3% and predict a 14.5% annual increase in inventory for 2024. Lower rates and increased inventory present opportunities for buyers. However, with approximately 86% of existing mortgages locked in at rates of 6% or lower, mortgage rates will need to drop further to fully revitalize the housing market