A Florida-based financial advisor pleaded guilty to his role in designing tax shelters for clients (and fabricating the tax returns to go along with it), claiming over $100 million in false deductions.

Stephen T. Mellinger, a Delray Beach-based advisor, insurance salesman and securities broker, pleaded guilty in Mississippi federal court to charges of defrauding the Internal Revenue Service and committing wire fraud, as well as aiding in the preparation of false tax returns. He faces five years in prison.

According to FINRA records, Mellinger is no longer registered. He was primarily based in Indiana and Michigan before moving to Florida in 2015 and worked at Baird and Northwestern Mutual before joining NYLife Securities in 2009. According to BrokerCheck, he spent six years there before being fired in 2016 for exceeding “the scope of approved business activities.”

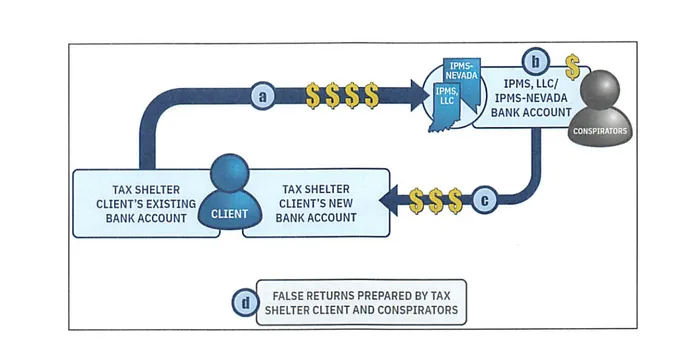

The Justice Department revealed in court documents that in 2013, Mellinger began marketing his “royalty shelter” to prospective clients, which created the “false appearance” that clients could claim federal income tax deductions for business expenses (framed as royalties for intellectual property use).

These so-called “royalty payments” were paid to the shelters Mellinger set up. However, they were almost immediately returned to the clients at a different bank account that they controlled. Mellinger and his unnamed co-conspirators (including one family member) took fees on each transfer ranging from 1% to 15%. According to the DOJ, clients could always retain control of the money they transferred.

Mellinger and his co-conspirators would help clients prepare false federal income tax returns by directing clients to deduct the fake business expenses and report them as “royalties.”

Mellinger and his crew helped clients falsely deduct over $106 million, leaving the IRS with a tax loss of about $37 million. During the scheme, Mellinger and his unnamed co-conspirator pocketed about $3 million in fees.

By 2016, investigators were closing in, and Mellinger learned that several of his Mississippi clients were being investigated, with the IRS seizing some clients’ funds.

According to court documents, Mellinger and his relative “took advantage of the ensuing confusion” by transferring some of his tax shelter clients’ unseized funds for their use. The DOJ found he stole over $2.1 million, using some of the money to buy a home in Delray Beach.

Mellinger is scheduled to be sentenced on Sept. 16.