15% ROI, 5% down loans!”,”body”:”3.99% rate, 5% down! Access the BEST deals in the US at below market prices! Txt REI to 33777 “,”linkURL”:”https://landing.renttoretirement.com/og-turnkey-rental?hsCtaTracking=f847ff5e-b836-4174-9e8c-7a6847f5a3e6%7C64f0df50-1672-4036-be7b-340131b43ea4″,”linkTitle”:”Contact Us Today!”,”id”:”65a6b25c5d4b6″,”impressionCount”:”1008113″,”dailyImpressionCount”:”124″,”impressionLimit”:”1500000″,”dailyImpressionLimit”:”8476″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/01/720×90.jpg”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/01/300×250.jpg”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/01/300×600.jpg”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/01/320×50.jpg”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”Premier Property Management”,”description”:”Stress-Free Investments”,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/02/PPMG-Logo-2-1.png”,”imageAlt”:””,”title”:”Low Vacancy, High-Profit”,”body”:”With $2B in rental assets managed across 13 markets, weu0027re the top choice for turnkey investors year after year.”,”linkURL”:”https://info.reination.com/get-started-bp?utm_campaign=Bigger%20Pockets%20-%20Blog%20B[u2026]24%7C&utm_source=Bigger%20Pockets&utm_term=Bigger%20Pockets”,”linkTitle”:”Schedule a Call Today”,”id”:”65d4be7b89ca4″,”impressionCount”:”709167″,”dailyImpressionCount”:”73″,”impressionLimit”:”878328″,”dailyImpressionLimit”:”2780″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/08/REI-Nation-X-BP-Blog-Ad-720×90-1.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/08/REI-Nation-X-BP-Blog-Ad-300×250-1.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/08/REI-Nation-X-BP-Blog-Ad-300×600-1.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/08/REI-Nation-X-BP-Blog-Ad-320×50-1.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”Center Street Lending”,”description”:””,”imageURL”:null,”imageAlt”:null,”title”:””,”body”:””,”linkURL”:”https://centerstreetlending.com/bp/”,”linkTitle”:””,”id”:”664ce210d4154″,”impressionCount”:”424249″,”dailyImpressionCount”:”64″,”impressionLimit”:”600000″,”dailyImpressionLimit”:”2655″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/05/CSL_Blog-Ad_720x90-1.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/05/CSL_Blog-Ad_300x250-2.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/05/CSL_Blog-Ad_300x600-2.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/05/CSL_Blog-Ad_320x50.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”BiggerPockets Lender Finder”,”description”:””,”imageURL”:null,”imageAlt”:null,”title”:””,”body”:””,”linkURL”:”https://www.biggerpockets.com/business/finder/lenders”,”linkTitle”:”Find a Lender”,”id”:”664e38e3aac10″,”impressionCount”:”193687″,”dailyImpressionCount”:”19″,”impressionLimit”:”10000000000″,”dailyImpressionLimit”:”10000000″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/05/Lender-Blog-720×90-1.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/05/Lender-Blog-300×250-1.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/05/Lender-Blog-300×600-1.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/05/Lender-Blog-320×50-1.png”,”r720x90Alt”:”BiggerPockets lender finder”,”r300x250Alt”:”BiggerPockets lender finder”,”r300x600Alt”:”BiggerPockets lender finder”,”r320x50Alt”:”BiggerPockets lender finder”},{“sponsor”:”CV3 Financial”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/07/Logo-512×512-1.png”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://cv3financial.com/financing-biggerpockets/?utm_source=biggerpockets&utm_medium=website&utm_campaign=august&utm_term=bridge&utm_content=banner”,”linkTitle”:””,”id”:”66a7f395244ed”,”impressionCount”:”224994″,”dailyImpressionCount”:”43″,”impressionLimit”:”636364″,”dailyImpressionLimit”:”4187″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/07/CV3-720×90-1.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/07/CV3-300×250-1.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/07/CV3-300×600-1.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/07/CV3-320×50-1.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”Baselane”,”description”:”Ad copy A”,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/09/SquareLogo-MidnightOnWhite-1.png”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://www.baselane.com/lp/bigger-pockets?utm_source=partner_biggerpockets&utm_medium=Content&utm_campaign=bp_blog_ad&utm_term=rebranded_v3″,”linkTitle”:””,”id”:”66b39df6e6623″,”impressionCount”:”193008″,”dailyImpressionCount”:”37″,”impressionLimit”:”250000″,”dailyImpressionLimit”:”1713″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/11/720×90.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/11/300×250.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/11/300×600.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/11/grow_business_not_to_do_320x50.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”Baselane”,”description”:”Ad copy B”,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/09/SquareLogo-MidnightOnWhite-1.png”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://www.baselane.com/lp/bigger-pockets?utm_source=partner_biggerpockets&utm_medium=Content&utm_campaign=bp_blog_ad&utm_term=rebranded_v4″,”linkTitle”:””,”id”:”66b39df70adac”,”impressionCount”:”208832″,”dailyImpressionCount”:”52″,”impressionLimit”:”250000″,”dailyImpressionLimit”:”1713″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/11/Copy-of-720×90-1.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/11/Copy-of-300×250-1.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/11/Copy-of-300×600-1.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/11/Copy-of-320×50-1.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:””,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/08/REI-Nation-Logo.png”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://hubs.ly/Q02LzKH60″,”linkTitle”:””,”id”:”66c3686d52445″,”impressionCount”:”226094″,”dailyImpressionCount”:”53″,”impressionLimit”:”500000″,”dailyImpressionLimit”:”6173″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/08/REI-Nation-X-BP-Blog-Ad-720×90-1.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/08/REI-Nation-X-BP-Blog-Ad-300×250-1.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/08/REI-Nation-X-BP-Blog-Ad-300×600-1.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/08/REI-Nation-X-BP-Blog-Ad-320×50-1.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”1-800 Accountant”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/12/Logo_Square_No-Brand-Name.png”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:” https://1800accountant.com/lp/online-business-tax-preparation?utm_source=biggerpockets&utm_medium=cpc&utm_campaign=tof&utm_content=banners_feb”,”linkTitle”:””,”id”:”67572ea6e4db7″,”impressionCount”:”81335″,”dailyImpressionCount”:”52″,”impressionLimit”:”89616″,”dailyImpressionLimit”:”5389″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/720x90BPver1.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/300x250BPver1.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/300x600BPver1.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/320x50BPver1.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”1-800 Accountant”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/12/Logo_Square_No-Brand-Name.png”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:” https://1800accountant.com/lp/online-business-tax-preparation?utm_source=biggerpockets&utm_medium=cpc&utm_campaign=tof&utm_content=banners_feb”,”linkTitle”:””,”id”:”67572ea706256″,”impressionCount”:”50866″,”dailyImpressionCount”:”35″,”impressionLimit”:”89616″,”dailyImpressionLimit”:”7872″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/720x90BPver2.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/300x250BPver2.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/300x600BPver2.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/320x50BPver2.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”RentRedi”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/12/rentredi-logo-512×512-1.png”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://rentredi.com/biggerpockets/?utm_source=biggerpockets&utm_medium=partner&utm_campaign=banner&utm_content=pro_300x600″,”linkTitle”:””,”id”:”67747625afd7b”,”impressionCount”:”55261″,”dailyImpressionCount”:”54″,”impressionLimit”:”150000″,”dailyImpressionLimit”:”6201″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/12/BP-Blog-Banner-Ad-720×90-1.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/12/BP-Blog-Banner-Ad-300×250-1.png”,”r300x600″:null,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/12/BP-Blog-Banner-Ad-320×50-1.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:null,”r320x50Alt”:””},{“sponsor”:”RentRedi”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/12/rentredi-logo-512×512-1.png”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://rentredi.com/biggerpockets/?utm_source=biggerpockets&utm_medium=partner&utm_campaign=banner&utm_content=bp2025_300x600″,”linkTitle”:””,”id”:”67747625c36bd”,”impressionCount”:”57770″,”dailyImpressionCount”:”56″,”impressionLimit”:”150000″,”dailyImpressionLimit”:”6201″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/12/720×90-BP-CON-RentRedi.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/12/BP-Blog-Banner-Ad-300×250-2.png”,”r300x600″:null,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2024/12/BP-Blog-Banner-Ad-320x50_1.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:null,”r320x50Alt”:””},{“sponsor”:”NREIG”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/NREIGLogo_512x512-1-1-1.png”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://go.nreig.com/l/1008742/2024-12-19/53l7gf”,”linkTitle”:””,”id”:”677c225a7b017″,”impressionCount”:”57681″,”dailyImpressionCount”:”52″,”impressionLimit”:”1000000″,”dailyImpressionLimit”:”2874″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/NREIG-720×90-1.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/NREIG-300×250-1.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/NREIG-300×600-1.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/NREIG-320×50-1.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”Equity Trust”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/1631355119223.jpeg”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://www.trustetc.com/lp/bigger-pockets/?utm_source=bigger_pockets&utm_medium=blog&utm_term=banner_ad”,”linkTitle”:””,”id”:”678fe1309ec14″,”impressionCount”:”37602″,”dailyImpressionCount”:”24″,”impressionLimit”:”244525″,”dailyImpressionLimit”:”758″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/Maximize_RE_Investing_Ad_720x90.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/Maximize_RE_Investing_Ad_300x250.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/Maximize_RE_Investing_Ad_300x600.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/Maximize_RE_Investing_Ad_320x50.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”Equity Trust”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/1631355119223.jpeg”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://try.trustetc.com/bigger-pockets/?utm_source=bigger_pockets&utm_medium=blog&utm_campaign=awareness_education&utm_term=ad”,”linkTitle”:””,”id”:”67acbacfbcbc8″,”impressionCount”:”27330″,”dailyImpressionCount”:”29″,”impressionLimit”:”244525″,”dailyImpressionLimit”:”758″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/ET_15-Min_RE_Guide_720x90.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/ET_15-Min_RE_Guide_300x250-1.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/ET_15-Min_RE_Guide_300x600-1.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/ET_15-Min_RE_Guide_320x50-1.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”Equity 1031 Exchange”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/1631355119223.jpeg”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://getequity1031.com/biggerpockets?utm_source=bigger_pockets&utm_medium=blog&utm_term=banner_ad”,”linkTitle”:””,”id”:”678fe130b4cbb”,”impressionCount”:”44058″,”dailyImpressionCount”:”36″,”impressionLimit”:”500000″,”dailyImpressionLimit”:”1446″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/E1031_Avoid_Taxes_Ad_720x90.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/E1031_Avoid_Taxes_Ad_300x250.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/E1031_Avoid_Taxes_Ad_300x600.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/E1031_Avoid_Taxes_Ad_320x50.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”RESimpli”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/Color-Icon-512×512-01.png”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://resimpli.com/biggerpockets?utm_source=bigger_pockets&utm_medium=blog_banner_ad&utm_campaign=biggerpockets_blog”,”linkTitle”:””,”id”:”679d0047690e1″,”impressionCount”:”42960″,”dailyImpressionCount”:”28″,”impressionLimit”:”600000″,”dailyImpressionLimit”:”3315″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/720×90-2.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/300×250-2.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/300×600-2.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/01/320×50-2.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”Rent to Retirement”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/Logo_whtborder_SMALL-2.png”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://landing.renttoretirement.com/og-turnkey-rental?hsCtaTracking=f847ff5e-b836-4174-9e8c-7a6847f5a3e6%7C64f0df50-1672-4036-be7b-340131b43ea4″,”linkTitle”:””,”id”:”67a136fe75208″,”impressionCount”:”47589″,”dailyImpressionCount”:”47″,”impressionLimit”:”3000000″,”dailyImpressionLimit”:”9010″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/720×90.jpg”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/300×250.jpg”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/300×600.jpg”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/320×50.jpg”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”Fundrise”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/512×512.png”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://fundrise.com/campaigns/fund/flagship?utm_medium=podcast&utm_source=biggerpockets&utm_campaign=podcast-biggerpockets-2024&utm_content=REbanners”,”linkTitle”:””,”id”:”67a66e2135a2d”,”impressionCount”:”40334″,”dailyImpressionCount”:”34″,”impressionLimit”:”1000000″,”dailyImpressionLimit”:”3049″,”r720x90″:null,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/Fundrise-300×250-1.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/Fundrise-300×600-1.png”,”r320x50″:null,”r720x90Alt”:null,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:null},{“sponsor”:”Kiavi”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/Kiavi-Logo-Square.png”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:”https://app.kiavi.com/m/getRate/index?utm_source=Biggerpockets&utm_medium=Content%20Partner&utm_campaign=Biggerpockets_CP_blog-forum-display-ads_Direct_Lead&utm_content=202502_PR_Display-Ad_Mix_mflow&m_mdm=Content%20Partner&m_src=Biggerpockets&m_cpn=Biggerpockets_CP_blog-forum-display-ads_Direct_Lead&m_prd=Direct&m_ct=html&m_t=Display-Ad&m_cta=see-rate”,”linkTitle”:””,”id”:”67aa5b42a27c3″,”impressionCount”:”39139″,”dailyImpressionCount”:”43″,”impressionLimit”:”500000″,”dailyImpressionLimit”:”1539″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/BP_blog_AdSet-720×90-1.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/Untitled-1.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/BP_Blog_AdSet_300x600.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/02/BP_Blog_AdSet_320x50.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””},{“sponsor”:”Realbricks”,”description”:””,”imageURL”:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/03/ga8i9pqnzwmwkjxsmpiu.webp”,”imageAlt”:””,”title”:””,”body”:””,”linkURL”:” https://realbricks.com?utm_campaign=9029706-BiggerPockets&utm_source=blog&utm_medium=banner_ad”,”linkTitle”:””,”id”:”67c5c41926c9f”,”impressionCount”:”24536″,”dailyImpressionCount”:”50″,”impressionLimit”:”500000″,”dailyImpressionLimit”:”5556″,”r720x90″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/03/Blog-Banner-720×90-2.png”,”r300x250″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/03/Blog-Banner-300×250-1.png”,”r300x600″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/03/Blog-Banner-300×600-1.png”,”r320x50″:”https://www.biggerpockets.com/blog/wp-content/uploads/2025/03/Blog-Banner-320×50-1.png”,”r720x90Alt”:””,”r300x250Alt”:””,”r300x600Alt”:””,”r320x50Alt”:””}])”>

A secret blacklist? It sounds like something from a Netflix thriller. However, that’s the scenario unfolding when some condo owners have attempted to sell their homes and investments, according to a report in the Wall Street Journal.

Described as a Fannie Mae-maintained “secret mortgage blacklist,” it refers to a list compiled by the government-funded mortgage backer in the wake of the Surfside condo collapse in Florida in 2021 that killed 98 people. Properties on the list are, in the eyes of Fannie Mae, in need of considerable repairs or do not have adequate insurance. A property on the list makes it harder for a buyer to get a mortgage for it.

The Journal article mentions real estate agent Paul Gangi, who was on the verge of closing his listing in Shadow Ridge, a 440-unit townhouse and condo complex in Ventura County, California, in December. “I got a panicked call from the lender saying, ‘Sorry, we’ve just found out Shadow Ridge has been blacklisted,’” he said. After trying other options for the loan, the buyer had to back away.

Developers and Homeowners Are Suffering

The list has mushroomed to 5,175 properties nationwide from a few hundred before the Surfside collapse. Unsurprisingly, the states with the most properties on the list (1,400) are based in Florida, with California next, followed by Colorado, Hawaii, and Texas.

Fannie Mae and its sister government-sponsored enterprise, Freddie Mac, buy roughly half of the country’s home loans from lenders and package them to sell to investors, then guarantee payments on them. They have increased their insurance guidelines to such an extent that lenders now have to check whether a property in the two government entities will accept loans on a specific project. Although Fannie refused to classify its property data as a “blacklist,” in theory, that’s what it is.

Insurance Costs Are Crippling

The advice is simple for investors interested in transacting a property that could be affected by the new guidelines: Do your research and consult with your lender before attempting to get a loan. Even if your condo is not on the list, the transaction could still run into trouble when monthly association costs are calculated. Condo association board members say insurers have aggressively raised prices due to the new Fannie and Freddie guidelines.

In the case of Shadow Ridge, the LA complex blacklisted in December, a Fannie-compliant policy was quoted at $2.6 million per year, 10 times its current amount, making it virtually impossible to sell through a Fannie-backed lender and making it prohibitive to for people to live there. However, the specter of another Surfside or natural disaster has Freddie and Fannie wanting to cover their bases with ramped-up insurance.

Reasons a Condo Could Be Blacklisted

There can be many different reasons a condo could be on the Fannie Mae mortgage blacklist, including:

- Structural or safety issues that have not been addressed

- Insufficient financial reserves to cover ongoing maintenance or repairs

- Legal issues: Pending litigation could pose financial risks

- High investor ownership: When a condo development is owned by a large number of investors, it is less appealing to lenders.

- Inadequate insurance: Fannie Mae’s heightened insurance demands mean a building might fail to meet requirements.

How to Navigate the List

If you have done your due diligence, had a condo inspected, and wish to proceed with a purchase—only to discover it’s on a mortgage blacklist—a few options are available to you:

- Buy the property for cash or seek alternative financing.

- Ask the owner to self-finance, explaining that they would find it difficult to sell otherwise, as it is on a mortgage blacklist.

- Approach Fannie or Freddie to discuss their concerns and ask for clear criteria for blacklist reinstatement.

- If the issue is repairs, see if the seller is willing to undertake these for a new price.

The Insurance Conundrum

While repairs and financing can be mitigated to a degree, increased insurance is the one area for which it is hard to find a workaround. There are only so many insurance companies; without them, getting a loan is impossible.

However, in disaster-prone areas like Florida, where most of the properties on Fannie Mae’s “no lend” list are located, alternative insurance types have surfaced. In an article titled “The Quiet Rise of Lightly Regulated Insurance,” Bloomberg revealed that homeowners are turning to a type of insurance more commonly used in commercial real estate to protect companies with unique risks, such as fireworks factories and nuclear waste projects.

Referred to as non-admitted policies, they are lightly regulated, not backed by the state (i.e., if the company fails, the state won’t step in), and far more pricey than traditional insurance—which may defeat the purpose of using them. However, in the face of a refusal of coverage, a

complete lack of an alternative, or sky-high rates, they could be an alternative for some.

According to the article, between 2022 and 2023, non-admitted home insurance premiums grew 27.5% compared to 13.8% in the admitted market. In Florida, between 2009 and 2023, non-admitted insurance used by homeowners grew by 73% to more than 92,000 homes.

Surplus lines insurance is similar to non-admitted insurance in that it is an alternative to state-run insurance programs and is from highly specialized insurance companies. The market for this type of insurance is growing, particularly in California.

Final Thoughts

If you plan to buy or sell a condo, you’ll need to do some research, particularly if you live in one of the states most affected by the mortgage blacklist. As the list isn’t publicly available, checking a property’s status will mean contacting the condo association or lender.

Also, check the HOA financials to ensure there are cash reserves and that maintenance issues are being taken of. If an investor plans to buy a development, check to see if the owner has a recent structural report. If not, it is worth investing in one.

The price of insurance will remain an issue for investors and homeowners alike. Costs are spiraling out of control, making affordability and cash flow difficult. Solving the crisis will require some type of federal or state intervention; otherwise, the housing market in at-risk states like Florida and California could be in big trouble. However, given the current climate surrounding government funding and Fannie Mae itself, that’s far from a certainty.

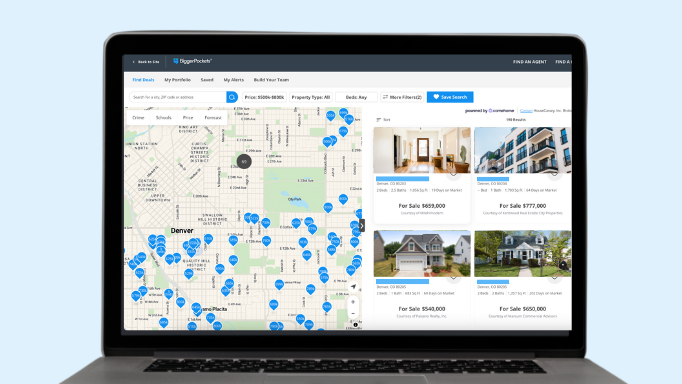

Find the Hottest Deals of 2025!

Uncover prime deals in today’s market with the brand new Deal Finder created just for investors like you! Snag great deals FAST with custom buy boxes, comprehensive property insights, and property projections.

![A Secret Mortgage Blacklist From Fannie Mae is Blindsiding Condo Owners and Killing Deals 2]()