In this article, we will explore the history of Federal Reserve interest rates, including some of the major changes and their effects on the economy. The Federal Reserve is the central bank of the United States, charged with managing the nation’s monetary policy and ensuring the stability of the financial system. One of the key tools that the Federal Reserve uses to fulfill this mandate is the manipulation of interest rates.

Federal Interest Rates History

Over the years, the Federal Reserve has set interest rates at various levels in response to changing economic conditions and policy goals. The history of Federal Reserve interest rates is a complex and evolving one, reflecting changes in economic conditions, policy goals, and political realities.

In the early days of the Federal Reserve, interest rates were quite stable, with the federal funds rate hovering around 3-4% in the 1920s and 1930s. However, this changed dramatically during World War II, when the Federal Reserve was tasked with keeping interest rates low to help finance the war effort. As a result, rates remained near 0.38% for much of the 1940s and 1950s.

After the war, interest rates began to rise, reaching a peak of 15.84% in 1981 as the Federal Reserve tried to combat inflation. This was part of a larger effort to tighten monetary policy, which also included reducing the money supply and raising the discount rate (the rate at which banks can borrow directly from the Federal Reserve). While these actions did help to bring inflation under control, they also led to a severe recession in the early 1980s.

The Fed continued to lower interest rates throughout the 1980s and 1990s, in response to both economic conditions and changes in its own operating procedures. One significant shift occurred in the early 1990s when the Fed began using a new approach to a monetary policy known as inflation targeting. This involved setting explicit targets for inflation and adjusting interest rates accordingly, with the goal of keeping inflation low and stable over the long term.

Another major change came in the wake of the 2008 financial crisis when the Fed lowered interest rates to near-zero levels in an effort to stimulate economic growth. It also engaged in a program known as quantitative easing, in which it purchased large amounts of government bonds and other securities in order to inject additional liquidity into the financial system.

Federal Reserve Interest Rates History [1910s-2020s]

Here’s a look at the history of Federal Reserve interest rates by decade, from the 1910s to the 2000s. The Federal Reserve, which was created in 1913, has the responsibility of setting monetary policy and controlling the nation’s money supply. One of the key tools the Federal Reserve uses to achieve its objectives is the setting of interest rates.

The interest rate policies of the Federal Reserve have had a significant impact on the US economy and have played a crucial role in shaping the economic landscape of the country over the past century. Let’s take a closer look at the key trends and events that have shaped the Federal Reserve’s interest rate policies over the years.

Federal Reserve Interest Rates in the 1910s-1920s

In the early 1910s, the Federal Reserve Act of 1913 established the Federal Reserve System as the central bank of the United States. The system was designed to provide stability to the country’s financial system by regulating the money supply and controlling inflation. However, during World War I, the Federal Reserve was forced to finance the war effort by expanding the money supply, which led to higher inflation and increased interest rates.

In response, the Federal Reserve raised the discount rate to 6% in 1917. After the war, the Federal Reserve was faced with the task of restoring stability to the economy. Interest rates remained relatively stable in the early 1920s, with the discount rate hovering around 4%. However, the Federal Reserve’s policies contributed to the stock market boom of the late 1920s, which eventually led to the Great Depression.

Overall, the 1910s and 1920s were a period of relative stability for interest rates, but also a time of experimentation for the Federal Reserve as it established its role in setting monetary policy.

Federal Reserve Interest Rates in the 1930s-1940s

During the 1930s, the United States was hit by the Great Depression, which led to massive unemployment and widespread economic hardship. In an effort to combat the economic downturn, the Federal Reserve lowered the discount rate to 1.5% in 1932, the lowest level in its history. However, the move had little effect on the economy, and interest rates remained low throughout the decade.

In the 1940s, the United States entered World War II, and the government began financing the war effort through massive borrowing. The Federal Reserve kept interest rates low in order to help fund the war effort and encourage investment in war bonds. This policy of keeping rates low continued even after the war ended, as the government sought to rebuild the economy and deal with the challenges of transitioning back to a peacetime economy.

Federal Reserve Interest Rates in the 1950s-1960s

The 1950s and 1960s were a time of economic growth and expansion in the US, with the post-war boom and the rise of consumer culture. The Federal Reserve responded by raising interest rates to keep inflation in check. The discount rate, which is the rate at which banks can borrow money from the Federal Reserve, was raised several times during the 1950s, reaching a peak of 3.5% in 1959.

In the 1960s, the Federal Reserve took a more proactive role in managing the economy, using interest rates as a tool to control inflation and unemployment. The discount rate was raised to 4.5% in 1969, in response to concerns about rising inflation. However, this approach was not always successful, and the decade saw several periods of both inflation and recession, leading to a challenging economic environment for policymakers.

Federal Reserve Interest Rates in the 1970s-1980s

During the 1970s and 1980s, the Federal Reserve faced significant challenges as the US economy experienced both high inflation and economic recessions. The high inflation in the 1970s led the Federal Reserve to adopt a more hawkish monetary policy, raising interest rates to curb inflationary pressures. This led to a period of stagflation, where high inflation and high unemployment persisted.

The Federal Reserve then shifted its focus to reducing inflation, raising the discount rate to a peak of 12% in 1979. However, this led to a recession in the early 1980s. The Federal Reserve then gradually lowered interest rates throughout the decade, in response to the recession and to support economic growth. By the end of the 1980s, the discount rate had fallen to 6%, marking the end of a period of high-interest rates.

Federal Reserve Interest Rates in the 1990s-2000s

The 1990s saw a period of relative stability in interest rates, with the discount rate ranging between 3% and 6%. The Federal Reserve focused on maintaining low inflation and promoting economic growth. In the early 2000s, the Federal Reserve lowered interest rates in response to the dot-com bubble burst and the 9/11 attacks, with the discount rate reaching a low of 1% in 2003.

Following the 9/11 attacks, the Federal Reserve cut interest rates aggressively in an attempt to stabilize the economy and prevent a recession. The Federal Reserve lowered the federal funds rate, the interest rate at which banks lend and borrow from each other overnight, from 6.5% in May 2000 to 1% in June 2003.

However, this period of low-interest rates contributed to the housing market boom and the subsequent financial crisis in 2008. Low-interest rates made it easier for people to borrow money, which drove up demand for housing and pushed home prices to unsustainable levels. As a result, when the housing bubble burst in 2007, many homeowners found themselves with mortgages that exceeded the value of their homes, leading to a wave of defaults and foreclosures.

The Federal Reserve responded to the financial crisis by lowering interest rates even further to stimulate economic growth, with the discount rate reaching a record low of 0.25% in December 2008. Additionally, the Federal Reserve implemented a number of unconventional policy measures, such as quantitative easing, to try to jumpstart economic growth.

Throughout the 1990s and 2000s, the Federal Reserve was able to maintain relatively low inflation, which helped to support economic growth. However, the period was also marked by several significant events that challenged the Federal Reserve’s ability to manage the economy, such as the dot-com bubble burst and the 9/11 attacks. The Federal Reserve responded to these challenges by lowering interest rates to stimulate economic growth, but this ultimately contributed to the housing market boom and subsequent financial crisis.

Federal Reserve Interest Rates in the 2010s-2020s

The 2010s saw the Federal Reserve continue to keep interest rates low in response to the Great Recession. The discount rate remained near zero for much of the decade, with a slight increase to 0.25% in 2015. In 2019, the Federal Reserve began raising interest rates again but cut them back in 2020 due to the economic impact of the COVID-19 pandemic.

In September 2019, the Federal Reserve cut the interest rate by 25 basis points to a range of 1.75% to 2%. This was the second reduction of the year, following a 25 basis point cut in July. The central bank cited weak global growth and trade tensions as reasons for the rate cut.

However, the COVID-19 pandemic had a significant impact on the global economy, and the Federal Reserve was forced to take swift action to support the US economy. In March 2020, the Federal Reserve cut interest rates to near zero, reducing the target range from 0% to 0.25%. This was the first emergency rate cut since the 2008 financial crisis.

In addition to the interest rate cuts, the Federal Reserve implemented a range of measures to support the economy during the pandemic. This included purchasing Treasury securities and mortgage-backed securities, providing liquidity to financial markets, and establishing lending facilities to support small businesses, state and local governments, and households.

Recent Federal Reserve Interest Rates 2021-2023

In recent years, the Federal Reserve has begun to gradually raise interest rates again, as the economy has recovered and inflation has started to pick up. As the US economy began to recover from the pandemic in 2021, the Federal Reserve signaled its intention to begin raising interest rates again. In November 2021, the central bank raised the target range for the federal funds rate by 25 basis points to 0.25% to 0.50%.

This was the first increase in interest rates since December 2018. The Federal Reserve has signaled its intention to continue gradually raising interest rates in the coming years to keep inflation in check and maintain a healthy economy. However, the path of interest rate increases will depend on a range of factors, including inflation, employment, and economic growth.

Here’s the chronology of interest rates in 2023:

In March 2023, the federal funds rate stands at 4.50% – 4.75%, up from a low of 0.25% in 2009. However, the pace of rate hikes has been gradual, with the Fed taking a cautious approach in order to avoid disrupting the economic recovery or causing financial instability.

The Board of Governors of the Federal Reserve System unanimously voted to increase the interest rate paid on reserve balances to 5.15 percent, effective May 4, 2023. This decision aims to influence the overall interest rate environment and control the availability of funds in the financial system. By adjusting the interest rate on reserve balances, the Federal Reserve can influence borrowing costs and encourage or discourage lending activity.

As part of its policy decision, the Federal Open Market Committee directed the Open Market Desk at the Federal Reserve Bank of New York to undertake open market operations as necessary to maintain the federal funds rate within a target range of 5 to 5-1/4 percent. This range represents the desired level of interest rates for interbank lending and serves as a benchmark for other short-term interest rates.

The Desk will conduct standing overnight repurchase agreement operations with a minimum bid rate of 5.25 percent and an aggregate operation limit of $500 billion. These operations involve the purchase of securities from financial institutions with an agreement to sell them back in the near future, providing temporary liquidity to the market. Get more details Here.

The Federal Reserve recently left interest rates unchanged at its June meeting, facing a critical decision on whether to continue raising rates to combat inflation or take more time to assess the economy’s health. Examining past instances, between 2004 and 2006, the Fed raised rates 17 times but paused in August 2006 amid signs of a housing downturn and inflation above the 2% target.

They emphasized maintaining the pause but left the option open for future rate hikes if needed. The Fed did not raise rates again until 2015, believing the economy had sufficiently recovered. However, historical analogies may not entirely apply to the current unique economic situation, and the future path will depend on various factors like economic recovery, inflation trends, and external influences.

In July, the Federal Reserve approved a much-anticipated interest rate hike, raising benchmark borrowing costs to their highest level in over 22 years. The Federal Open Market Committee (FOMC) increased the funds rate by a quarter percentage point to a target range of 5.25%-5.5%, marking the 11th rate hike since March 2022. This decision was driven by the Federal Reserve’s efforts to combat inflation and assess the impact of previous rate increases on the economy.

- Interest Rate Hike: The FOMC raised the benchmark interest rate by 0.25 percentage points to a target range of 5.25%-5.5%. This is the highest level for the benchmark rate since early 2001.

- Inflation Concerns: Federal Reserve Chairman Jerome Powell acknowledged that inflation has moderated somewhat since the middle of the previous year. However, reaching the Fed’s 2% target remains a significant challenge.

- Economic Resilience: Despite the rate hikes, the U.S. economy has shown resilience, with second-quarter GDP growth tracking at a 2.4% annualized rate. Employment figures have also remained positive, with nonfarm payrolls expanding by nearly 1.7 million in 2023.

- Future Monetary Policy: The FOMC’s approach remains data-dependent. Chairman Powell indicated that further rate increases are possible if the data warrants it. The Fed will carefully assess the incoming economic data and its implications before making future rate decisions.

Current Interest Rate and Forecast for the Remainder of 2023:

As of the latest rate hike, the current interest rate is in the range of 5.25%-5.5%. The Federal Reserve’s stance on future rate hikes for the remainder of 2023 is not explicitly mentioned in the provided text. However, based on the FOMC’s data-dependent approach, any future rate decisions will depend on economic conditions and inflation trends. Investors and markets will closely monitor the Fed’s communication and economic indicators to anticipate potential changes in interest rates in the coming months.

Note: The forecast for the remainder of 2023 is not explicitly provided in the given text, and therefore, any statements about the future interest rate changes in 2023 would be speculative and beyond the scope of the provided information.

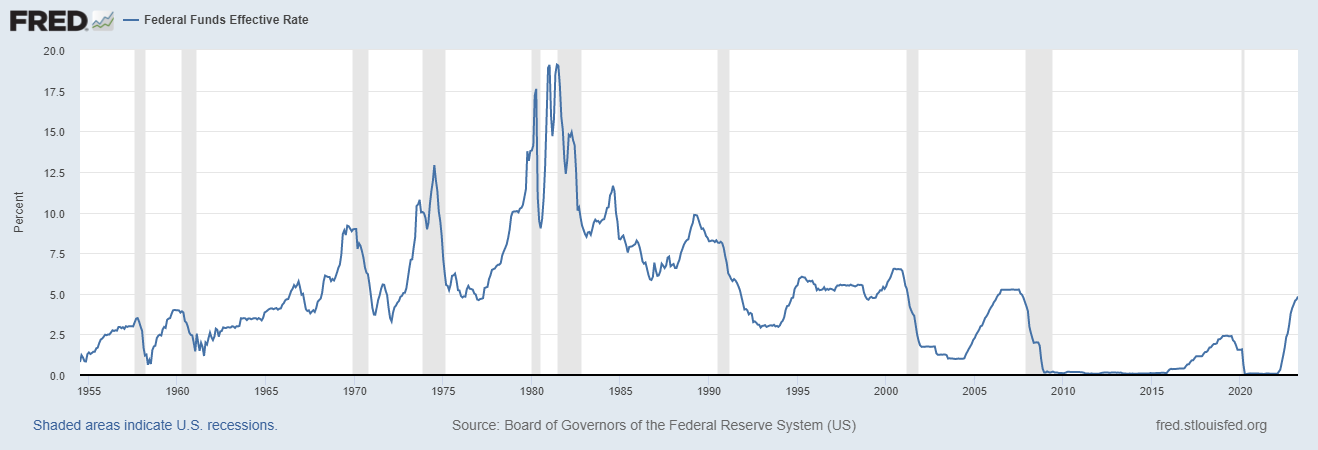

Fed Interest Rates Chart

To better understand the history of Federal Reserve interest rates, it can be helpful to view this information in a visual format. The Federal Reserve Economic Data (FRED) website offers a chart of the effective federal funds rate, which is the interest rate that banks charge each other for overnight loans. This chart provides a comprehensive view of how interest rates have fluctuated over time, allowing for a deeper understanding of the impact of policy decisions on the economy.

The Federal Reserve Interest Rates Chart provides a visual representation of the Federal Funds Effective Rate from July 1954 (0.80%) to June 2023 (5.08%).

- Interest Rate in Jun 2023: 5.08%

- Interest Rate in May 2023: 5.06%

- Interest Rate in Apr 2023: 4.83%

- Interest Rate in Mar 2023: 4.65%

- Interest Rate in Feb 2023: 4.57%

- Interest Rate in Jan 2023: 4.33%

- Interest Rate inDec 2022: 4.10%

The chart is sourced from the Federal Reserve Economic Data (FRED) database, which is maintained by the Federal Reserve Bank of St. Louis. Users can visit the FRED website to download the entire dataset in CSV or PDF format. The chart can be a valuable resource for investors, policymakers, and others who are interested in understanding the historical trends and fluctuations of Federal Reserve interest rates.

Sources/References:

- https://www.federalreserve.gov/Releases/H15/data.htm

- https://fred.stlouisfed.org/series/FEDFUNDS

- https://home.treasury.gov/policy-issues/financing-the-government/interest-rate-statistics

- https://www.forbes.com/advisor/investing/fed-funds-rate-history/

- https://www.bankrate.com/banking/federal-reserve/history-of-federal-funds-rate/

- https://seekingalpha.com/article/4503025-federal-reserve-interest-rate-history