Recent headlines paint a dire situation for the American consumer. Consumer debt has exceeded $17 trillion, credit card debt is at an all-time high, and sentiment is declining. If true, this is a concerning situation. The American consumer drives the American economy, accounting for roughly 70% of gross domestic product (GDP).

But are things as bad as they seem? Digging into the data reveals a more nuanced story that real estate investors should fully understand. Consumer behavior is a crucial driver of our current and future economic situation, so let’s uncover what’s really going on.

Spending and Sentiment

The one clear part of the consumer behavior picture is that American consumers have not slowed their spending. According to the U.S. Bureau of Economic Analysis, spending, as measured by personal consumption expenditures (PCE), continues to reach all-time highs.

This is a bit surprising, given where we are in the economic cycle and given how Americans, generally speaking, feel about their current and future economic prospects.

According to the University of Michigan’s Consumer Sentiment Index, Americans are not feeling great about the economy. Yes, the index did rise for much of the last 12 months, but it’s down notably from the long-term average, and perhaps more importantly, it declined month over month from August to September. This could signal a pessimistic shift.

Similarly, according to the Conference Board’s survey, perceived recession risk is back on the rise after a few months of improved optimism. It hasn’t been a huge shift, but consumer sentiment is an important lead indicator, as it tells us how spending and behavior may change in the near future. So, while consumer spending is up, there seems to be a risk of a decline in the near future.

All That Debt

Further complicated the picture is Americans’ continued reliance on debt. Consumer debt hit an all-time high in the second quarter, reaching a whopping $17.6 trillion.

Seeing giant debt numbers is never encouraging, but it’s worth noting that 70% of that is mortgage debt. However, given the persistence of high home prices, it’s not shocking to see total debt go up.

In order to get a better indicator of what’s happening with consumer debt without mortgages, we can look at credit card debt, which is also at all-time highs. And unlike mortgages, which can be used to buy an appreciating asset, credit card debt doesn’t generally have any benefit, so higher numbers are more concerning—at least to me.

When you isolate credit card debt, the picture isn’t good. Debt has topped $1 trillion, and perhaps more notable is that it’s shown no sign of slowing down. That line continues to point almost straight up.

Fortunately, at least for now, delinquencies on credit card debt have remained stable, as have delinquency rates on all forms of consumer debt. Americans are currently paying their debt as agreed, at the same rates they have for the last several decades. But this could certainly change if the labor market or other economic drivers go south.

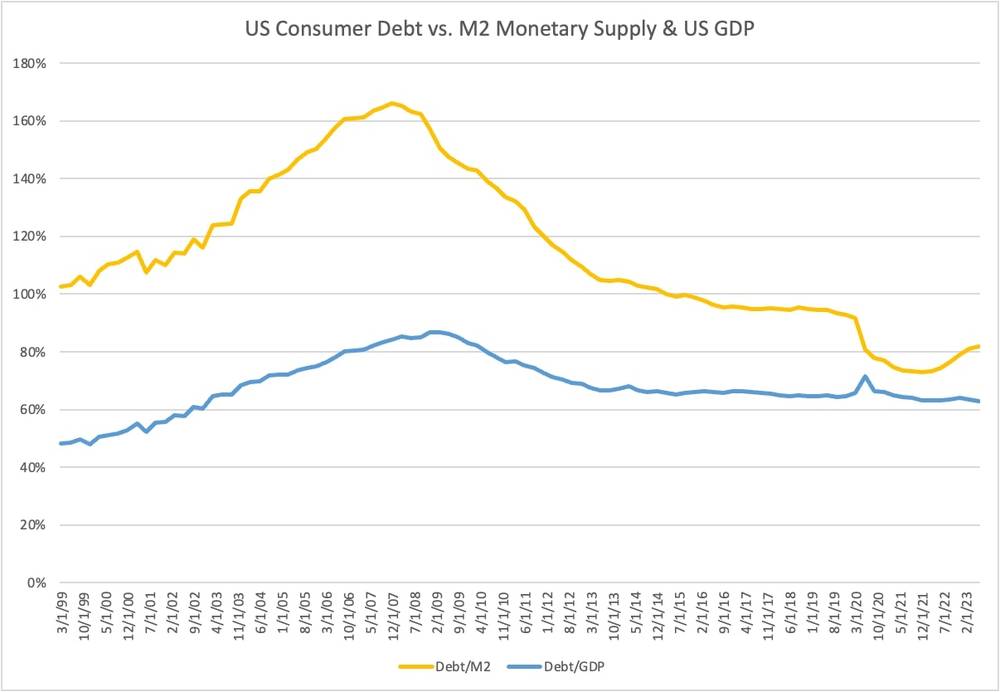

If you’re wondering how debt is so high, but delinquencies are so low, you need to zoom out a bit. Instead of just looking at the total amount of debt, we should look at debt in relation to other economic indicators like household income, GDP, and the monetary supply (as measured by the M2 indicator).

When you look at consumer debt as a percentage of disposable income, it has climbed up above pre-pandemic levels but is leveling off and is still well below pre-financial crisis numbers. So, it’s not like consumers are spending that much more of their disposable income on debt than they have in the past. Note the scale of this graph. The share of income going to debt payments has only risen 0.2% from 2019 to now—not a lot.

And in the broader economic context, this makes sense. Over the last several years, U.S. GDP has grown, and a lot of money has been created. Money printing and inflation are obviously detrimental to the economy and spending power, but it also means the debt is devalued as well. So when we look at consumer debt as a share of M2, it’s actually down from pre-pandemic levels (although rising).

What It Means

Is the American consumer in dire straits? As is usually the case, the answer is not so cut-and-dried.

American consumer behavior is nuanced and a bit contradictory, but when you look at all this data together, I see a few important conclusions:

- The current situation isn’t dire, but economic sentiment is starting to deteriorate. A pullback in consumer sending and subsequent drag on GDP is increasingly likely.

- Although debt is at all-time highs, it is not currently an acute problem. Don’t get me wrong—huge amounts of non-mortgage debt is a long-term issue, in my opinion. But, Americans are not currently in any worse of a position to service their debt than they have been for the last decade or so. It just hasn’t changed that much.

- Right now, things are relatively stable, but they could change with the labor market. As of this month, hiring is still strong, but things could change relatively quickly. Most economists believe we will see unemployment numbers start to creep up in the coming months. If this happens, seeing if and how much consumer spending and debt service is impacted will tell us a lot about the severity of the economic fallout.

- The U.S. economy still looks strong at the moment. Hundreds of thousands of jobs were added to the economy in September, and there are still about 9.6 million job openings. GDPNow estimates GDP close to 5%—and it’s a fairly reliable indicator. This means that the U.S. does have some cushion to help absorb any future declines in the labor market, should that come to be.

Final Thoughts on the State of the American Consumer

What are your thoughts on the state of the American consumer? Let me know in the comments below. I’d also love feedback on this article. This is a foray into an area of economics that is not directly related to real estate investing but is certainly going to impact the investing landscape in the coming years. Do you find this type of article helpful? What else do you want to know?

Ready to succeed in real estate investing? Create a free BiggerPockets account to learn about investment strategies; ask questions and get answers from our community of +2 million members; connect with investor-friendly agents; and so much more.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.