(Bloomberg) — Demand for State Street Corp. and Apollo Global Management Inc.’s hotly anticipated private credit exchange-traded fund has virtually dried up, at a time when asset managers have keyed in on reaching retail investors.

No new money has flowed into the SPDR SSGA IG Public & Private Credit ETF (ticker: PRIV) since March 4, according to data compiled by Bloomberg. The vehicle now has around $54.6 million in assets, including about $5 million clinched during its first two weeks of existence and initial funding.

“It’s been surprising that demand hasn’t been stronger for PRIV right out of the gate,” said Cinthia Murphy, an investment strategist at data provider VettaFi. “I believe appetite for access to private assets is real, but I think we’ve learned that so are the concerns about the difference in liquidity between the ETF wrapper and the underlying private assets.”

“We are very pleased and satisfied with PRIV’s performance, both in terms of returns, trading volume and spreads,” a representative for State Street said in an email. A representative for Apollo declined to comment.

Right after the ETF started trading, the Securities and Exchange Commission took the unusual step of sending a strongly worded letter post-launch voicing concern over the fund’s liquidity, valuation and even its name. Although the firms have since addressed the regulator’s worries, the concern may have left a sharper impact on buyers than initially expected, given demand has vanished.

Private credit firms are increasingly searching for ways to raise funds from individuals, as institutional fundraising has slowed. But ETFs, which trade on a public stock exchange, have proved hard to implement, given the natural mismatch between the underlying illiquid private debt assets and liquid nature of the wrapper.

For more coverage of private markets, subscribe to the Going Private Newsletter

The ETF caps investments deemed illiquid at 15% to conform with SEC requirements, but its private credit exposure is expected to comprise 10% to 35% of the portfolio, the fund’s registration statement shows.

However, most of PRIV’s holdings have so far been in public corporate debt, Treasuries, or agency mortgage-backed securities pass-throughs, according to CFRA’s Aniket Ullal. Only around 3% of the fund is in true private credit, according to Ullal.

“We have to remember that PRIV is a pioneer here, so in some ways, we are all learning what the ETF structure can do in the private asset space in real time, together,” Murphy said.

Other firms are turbo-charging their approach to retail buyers without ETFs. KKR & Co. and Capital Group also plan to launch hybrid public-private funds in 2025, while Blackstone Inc. and Blue Owl Capital Inc. are both launching vehicles geared toward smaller investors.

Both have opted for interval funds, which offer quarterly withdrawals rather than intraday liquidity. Blackstone’s fund is planning to invest at least 80% of its assets in private credit.

Read More: Private Credit Doubles Down on Interval Funds for Main Street

Earlier this week, Blackstone Inc. said it was teaming up with Vanguard Group and Wellington Management Co. as part of a bid to offer private assets to more individual investors. The move is part of a broader bid for retail money and retirement savings as it gets harder to raise from traditional investors such as insurance firms and pension funds.

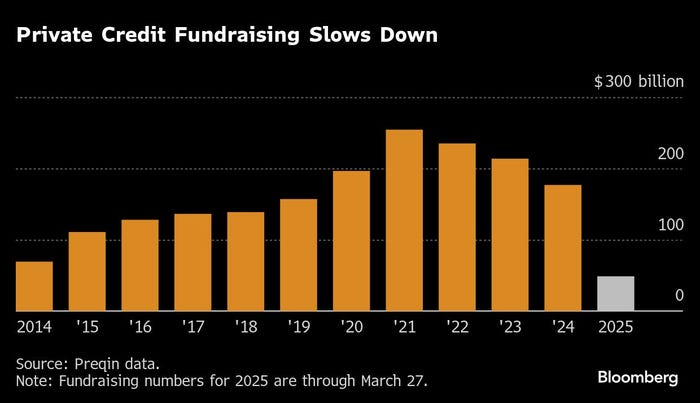

Private credit funds raised about $177 billion in 2024 compared to a peak in 2021 of $254 billion, according to data compiled by Preqin. The numbers are slower for 2025 so far, with under $50 billion being raised through March 27, the data show.

Regardless of demand, the fund has outperformed other ETFs dedicated to corporate debt since its launch. It has slipped 0.98% since its Feb. 26 inception, less than drops seen by iShares iBoxx $ Investment Grade Corporate Bond ETF and iShares iBoxx High Yield Corporate Bond ETF, according to data compiled by Bloomberg.

Some of the more established corporate and structured debt ETFs have seen large outflows over the past two weeks amid tariff-induced volatility.

Read More: Cracks Are Forming in CLO Market as ETFs on Record Selling Spree

“It could be that time is all that’s needed for PRIV to find traction,” Murphy said. “When demand hits, it will probably be sticky because investors will be comfortable with the value proposition here.”