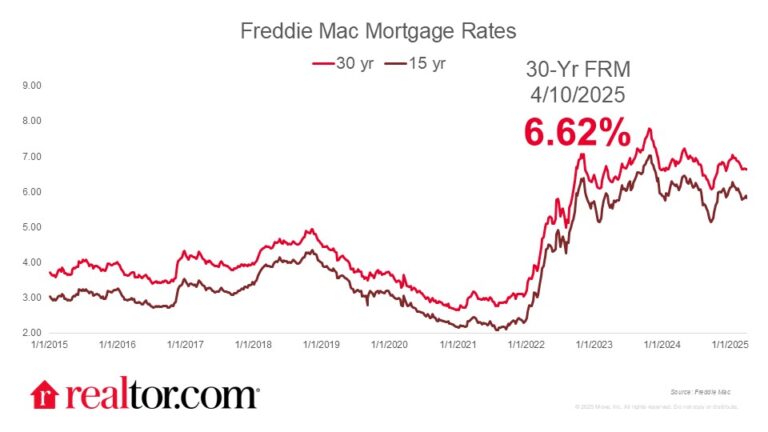

What happened to mortgage rates this week

The Freddie Mac rate for a 30-year loan moved mostly sideways this week, dropping just 2 basis points to 6.62% as markets reacted to the ever-changing news around tariffs. The 10-year treasury dipped below 4% last week as investors fled the stock market in search of higher ground after President Trump announced widespread tariffs. However, the 10-year surged this week as investors weighed the impact of hostile international relations and the potential slowdown in international trade. On Wednesday, President Trump paused some of the tariffs announced one week prior, citing the bond market as one reason for the about-face. All of the back-and-forth over the last week has left the market and consumers reeling, but mortgage rates have held relatively steady so far.

What it means for the housing market

Uncertainty is the latest buzzword in the housing market and economy more generally as consumers try to navigate the impact of recent tariff policy changes. A pause on the most severe tariffs is certainly welcome news, but consumers may be feeling justifiably fatigued. Households considering buying or selling might be hesitant to make this big financial decision unless absolutely necessary. The latest Fannie Mae Home Purchase Sentiment Index highlights the uncertainty that many respondents feel around their job security. Almost one-third of respondents cited concern over losing their job in the next year, up 9 percentage points annually. A period of predictability could return some confidence to consumers. The housing market has been in a bit of a holding pattern as still-high home prices and mortgage rates stifle buyer demand. A retreat in mortgage rates has not yet come to fruition, but could grease the wheels of the housing market.