Every year has its own risks, and 2025 is no exception. But before reacting to recent market turbulence, let’s step back to understand how we got here and what it means for your investments.

Doom and Gloom Headlines

Over the last 10 days, investors have faced a wave of unsettling news. The University of Michigan Consumer Sentiment Index dropped to its lowest since November 2023. Warren Buffet’s annual letter revealed that he has increased his cash holdings. U.S. consumer spending declined in January for the first time since March 2023. The Federal Reserve Bank of Atlanta’s GDPNow model projects a decline in the first quarter, which, if accurate, would be the first contraction in GDP since 2022. Adding to the uncertainty, after a 30-day delay, President Trump announced that his administration would implement a 25% tariff on imports from Mexico and China starting March 4, with an additional 10% tariff on Chinese goods.

This level of uncertainty is unsettling for investors, as markets don’t like uncertainty. As a result, the S&P 500 has declined 6 percent in just a few weeks, with last year’s top-performing stocks leading the decline. While these drops impact portfolios, stepping back and putting things in perspective is important. Despite the negative headlines, the market is still only 6% below its all-time high and is back at levels seen in early January of this year.

Pockets of Strength

Despite the negative headlines, not all parts of the market are struggling. While technology and consumer cyclical stocks—last year’s big winners—have led the recent decline, other sectors are holding up well. Consumer staples, health care, and financial services have had stronger mid-single-digit returns. As measured by the ACWI ex-USA Index, international stocks are up 6.3%. In addition, the U.S. Aggregate Bond Index is also up 2.7% this year. In short, diversification is proving its value again after a long period where it didn’t seem to help as much.

Market Corrections Happen Every Year

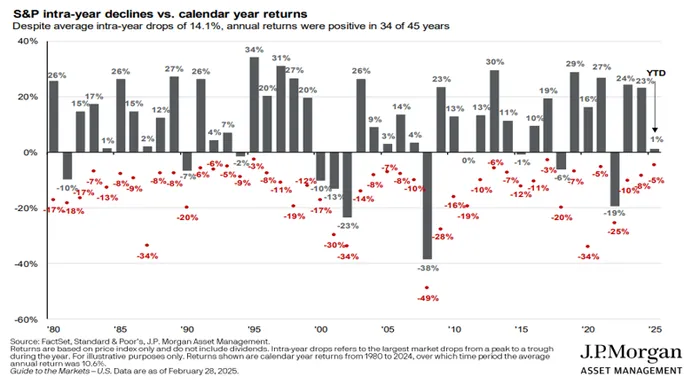

While market pullbacks never feel great, they do happen regularly:

Click here for a larger version

Even in strong years, stock markets tend to experience declines in the 5%-10% range, and these corrections can be healthy.

Looking at history provides some perspective. In 2018, the S&P 500 declined in the first quarter, rallied mid-year, and declined again in the fourth quarter amid trade wars and increasing interest rates. However, that set the stage for a strong recovery in 2019. Similarly, in 2022, the markets fell for three consecutive quarters before rallying in the fourth quarter, kicking off two years of strong returns. These examples highlight that short-term declines don’t necessarily indicate long-term trouble.

Opportunities in Volatility

Timing the market is extremely difficult, but periods of volatility often create opportunities. Warren Buffett famously advised investors to “be fearful when others are greedy and greedy when others are fearful.” While this advice sounds simple, emotional reactions make it hard to follow. However, history shows that the best times to invest occur when market sentiment is at its worst.

While volatility can continue and even increase, upcoming economic data could help reassure investors that the economy remains solid. Lower 10-year U.S. Treasury rates could lead to lower mortgage rates, providing additional support.

Now is a good time to revisit your investment strategy. The market will always be dynamic, but staying adaptable, tuning out short-term noise and focusing on your long-term goals are key. If market fluctuations create opportunities that don’t reflect actual economic fundamentals, investors should use them to enhance portfolios. Keep on keeping on.