What happened to mortgage rates this week

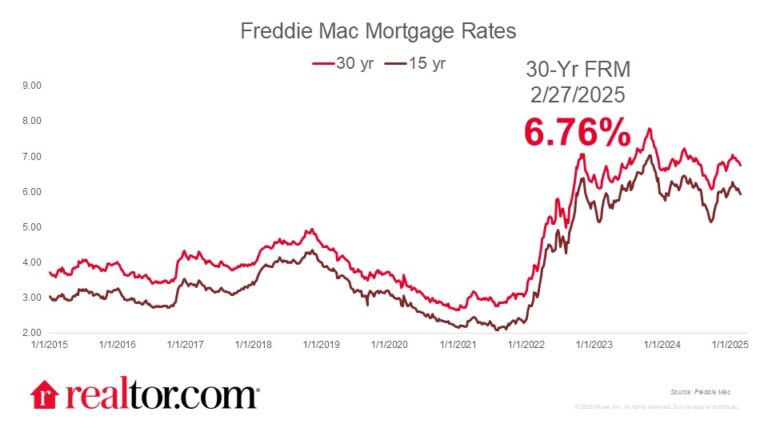

The Freddie Mac rate for a 30-year mortgage fell from 6.85% last week to 6.76% this week as the 10-year Treasury yield slid into the low 4% range. Though consumer inflation remains above the Federal Reserve target rate of 2% and tariff threats continue to be put out by the Trump administration, the financial markets are settling down and mortgage rates should continue to hover just below 7%. A tough week in the stock market is pulling investors into the bond space, decreasing debt yields and giving mortgage rates some breathing room.

What it means for the housing market

Though mortgage rates have fallen over the past several weeks and look more promising to prospective homebuyers, we are far from the home finance environment of the post-pandemic homebuying frenzy when rates were below 4%, and we are unlikely to return to that environment. Existing-home sales, new-home sales, and pending sales have all struggled to kick off 2025 with much momentum, as high mortgage rates negatively affect home affordability. Buyers, who are doing the budget math to find how much home they can afford under the pressure of high mortgage rates, and sellers, many of whom are unmotivated to move because of the favorable rates they purchased at a few years ago, are stuck in the mud early in 2025. The good news is that for-sale inventory continues to grow and sellers are adjusting their expectations and prices, so continued relief from mortgage rates might spur a strong spring buying season.