What happened to mortgage rates this week

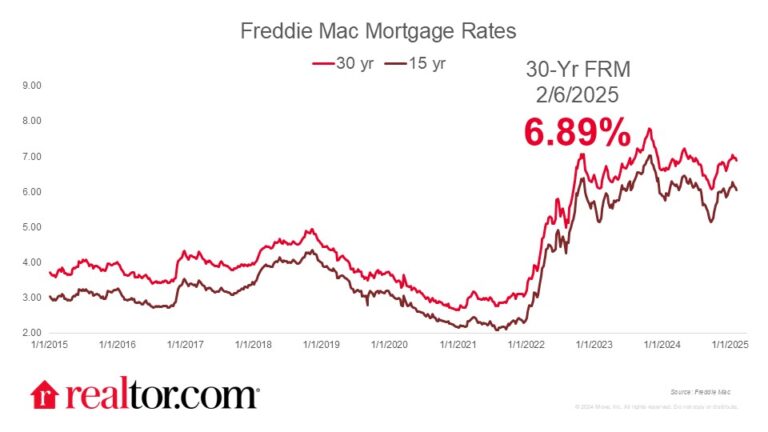

The Freddie Mac rate for a 30-year loan fell 6 basis points to 6.89% this week. Rates remained stubbornly high in recent weeks as markets adjusted to the seemingly ever-changing economic environment. The recent announcement of, then pause in, tariffs had the potential to jostle the market confidence, which could have negatively impacted mortgage rates, but the timing managed to keep things rather uneventful.

What it means for the housing market

The 10-year treasury moved lower over the last couple of weeks, which allowed mortgage rates to fall as well. Nevertheless, for the time being, near-7% mortgage rates, stubborn home prices, and general economic uncertainty mean that many would-be home shoppers are staying on the sidelines. Incoming data, including Friday’s jobs report, will be important for mortgage rates as markets look for indications of cooling inflation and employment.

Though housing costs remain eye-wateringly high, for-sale inventory continues to build, offering home buyers more options. Climbing inventory levels have created a bit more slack in the housing market, which is important for market balance. Homeowner vacancy ticked slightly higher in the fourth quarter of 2024, reaching the highest level since early 2020. Though the homeowner vacancy rate has improved from its recent historic low, it remains below the long-run norm due in part to the existing housing supply gap. More than a decade of underbuilding relative to household formations has resulted in climbing home prices, dwindling inventory, and falling vacancy rates. Easing mortgage rates and climbing housing supply will both be important in improving housing affordability in the U.S.