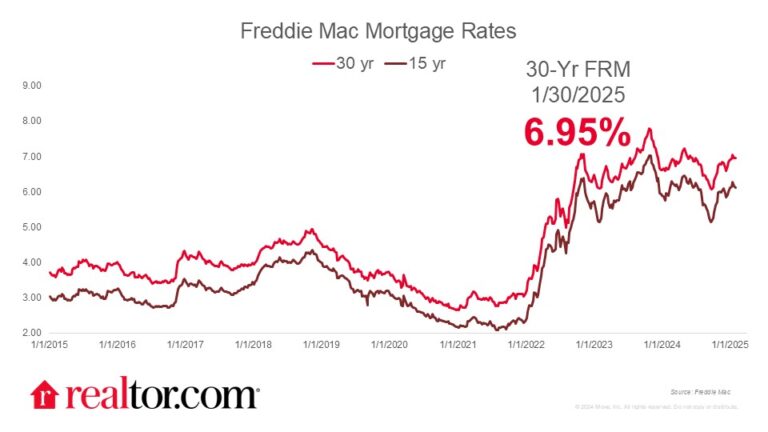

What happened to mortgage rates this week

The Freddie Mac rate for a 30-year mortgage held steady, falling by 1 basis point to 6.95% this week in the wake of the Federal Reserve announcement that rate cuts have been put on pause. The central bank is approaching rate-cutting cautiously in the early months of 2025, as inflation remains higher than its 2% target. The 10-year Treasury has remained within a relatively tight range over the past week, despite some significant volatility in tech stocks, and mortgage rates held steady in response.

What it means for the housing market

Though this is not a particularly eventful week when it comes to mortgage rates, the future is far from certain. The Fed’s decision on Wednesday will not put any downward pressure on mortgage rates in the near term, and the new Trump administration’s agenda, which continues to emphasize tariffs as a tool of geopolitical aggression, will almost certainly be inflationary. Rising inflation will further tie the hands of the Federal Reserve, preventing direct decreases to interest rates, and indirectly will pull mortgage rates up as debt market investors demand greater future returns in response.

The current environment of high mortgage rates is bogging down the housing market, and fewer existing homes were sold in 2024 than any year since 1996. Prospective homebuyers are stuck trying to work out a budget that can accommodate high home prices and high interest payments at the same time that the rental market continues to become more tenant-friendly after 17 consecutive months of year-over-year rent decreases nationwide. The math is difficult to work out for renters to become first-time homeowners.