Introduction

After easing in the early fall, mortgage rates picked up once again in the latter months of 2024. The results of the election, stubborn inflation and still-strong jobs growth made the Fed’s rate path less certain. The FOMC indicated higher-for-longer interest rates in their latest Summary of Economic Projections, which put upward pressure on mortgage rates. In mid-January, mortgage rates hit their highest level in eight months, surpassing 7% once again. As mortgage rates climbed, the housing market slowed more than is seasonally typical, and shoppers set their sights on the new year, hoping for better conditions in 2025.

Despite their recent uptick, rates are expected to ease later this year. The latest employment and inflation data fell in-line with expectations, which should take some pressure off of rates in the coming weeks. Inventory levels were just 16.5% below pre-pandemic in December, the smallest gap in years. Building inventory and easing mortgage rates could tee up more favorable buying conditions in coming months, especially in relatively affordable areas.

Winter 2025 Housing Market Ranking

Today’s home shoppers have more options than in any month back to mid-2020. However, stubborn home prices and elevated mortgage rates have kept a lid on buyer enthusiasm nationally. Though buyers remain hesitant in many markets across the country, the Wall Street Journal/Realtor.com Housing Market Ranking highlights in-demand metros that offer shoppers a lower cost of living, including for homes, in or near economic hubs. This quarter’s top market, Canton-Massillon, Ohio, is at the helm for the second month in a row. Canton is affordable, priced more than $150,000 lower than the national median in December.

As has been the trend in recent quarters, only four of the top 20 markets were priced higher than the U.S. median in December. Buyer demand has held up considerably well in areas that offer considerable bang for your buck. The ranking identifies markets that those considering a home purchase should add to their shortlist–whether the goal is to live in it or rent it as a home to others.

We reviewed data for the largest 200 metropolitan areas in the United States. The Winter 2025 ranking surfaced the following top areas:

| Rank | Metro | Population | Unemployment Rate (%) | Median Home Listing Price Dec 2024 |

| 1 | Canton-Massillon, Ohio | 399,316 | 4.7% | $239,900 |

| 2 | Rockford, Ill. | 335,342 | 6.3% | $242,450 |

| 3 | Toledo, Ohio | 640,384 | 5.3% | $242,425 |

| 4 | Manchester-Nashua, N.H. | 426,594 | 2.6% | $557,000 |

| 5 | Akron, Ohio | 697,627 | 4.7% | $209,950 |

| 6 | Kalamazoo-Portage, Mich | 261,173 | 4.1% | $302,425 |

| 7 | South Bend-Mishawaka, Ind.-Mich | 323,637 | 4.8% | $229,950 |

| 8 | Milwaukee-Waukesha-West Allis, Wis. | 1,559,792 | 3.2% | $357,450 |

| 9 | Springfield, Mass. | 694,523 | 4.3% | $365,000 |

| 10 | Worcester, Mass.-Conn. | 980,137 | 3.9% | $499,900 |

| 11 | Dayton, Ohio | 812,595 | 4.7% | $229,850 |

| 12 | Trenton, N.J. | 380,688 | 4.3% | $422,000 |

| 13 | Harrisburg-Carlisle, Pa. | 603,493 | 3.1% | $334,398 |

| 14 | Fort Wayne, Ind. | 426,076 | 4.1% | $288,000 |

| 15 | Columbus, Ohio | 2,161,511 | 4.2% | $349,450 |

| 16 | Lancaster, Pa. | 556,629 | 2.7% | $414,950 |

| 17 | Appleton, Wis. | 244,845 | 2.5% | $402,425 |

| 18 | Reading, Pa. | 430,449 | 3.5% | $329,950 |

| 19 | Hartford-West Hartford-East Hartford, Conn. | 1,221,725 | 3.4% | $399,900 |

| 20 | Green Bay, Wis. | 330,292 | 2.7% | $449,950 |

The Midwest Boasts Climate-Resilient Housing Markets

Climate risk and weather events are top-of-mind for many Americans this winter in light of the devastation from wildfires in southern California. Though no one can perfectly predict future weather events and be perfectly prepared, climate data can be a useful tool to understand potential risk. The Midwest is not only the most affordable of the U.S. regions, thereby attracting cash-conscious buyers, it also comes with the lowest climate risk among the studied challenges, two factors which contribute to the majority of the top 20 housing markets being in the Midwest.

In recent quarters, we have introduced climate data to the ranking parameters, leveraging data provided by First Street that is currently part of the Realtor.com experience. This data captures the share of properties in a given metro that are affected by severe or extreme exposure to any combination of 5 climate risks– extreme heat, wind, air quality, flood and wildfire– over the next 30 years. Nationwide, more than 2 in 5 homes confront at least severe or extreme exposure to at least one of these climate risks.

This quarter’s ranking only considers housing data through December 2024, before the wildfires broke out in the Los Angeles area. The Los Angeles metro area ranks 108th on this quarter’s ranking, solidly middle-of-the-pack. It is possible that the area could move up in ranking in next quarter’s data due to an increase in housing demand relative to a curtailed supply. Households impacted by the wildfires looking at housing options that allow them to stay local while they rebuild could increase demand. Meanwhile, home listings that were damaged by the fire will likely be taken off market while others that might have been listed for sale will remain off-market until remediation or rebuilding is complete.

Areas in the Midwest tend to be less impacted by these risks, giving buyers some peace of mind when taking on a home purchase. In the top ranked market, Canton-Massillon, OH, just 2.7% of properties are at severe or extreme risk of experiencing one of the 5 risks considered, over the next 30 years. The top 20 markets saw an average of just 5.1% of properties at risk of damage from climate-related incidents.

Popular Markets Struggle to Keep Up with Demand

Nationally, inventory levels were up 25.9% year-over-year in the fourth quarter, but still down an average 22.8% compared to pre-pandemic levels. Only 2 of the top 20 markets fared better than the U.S. in Q4 relative to pre-pandemic: Fort Wayne, IN (-9.4%), and Columbus, OH (-15.8%). The rest of the top 20 markets were significantly worse off than the national picture would suggest, led by Hartford, CT, where inventory was 75.6% lower than pre-pandemic and Reading, PA where inventory was 67.3% lower.

Scarcity in the top markets was driven not only by limited supply, but also by climbing buyer demand. In fact, compared to pre-pandemic, the top markets drew an average 42.9% more viewership per listing in Q4, and homes sold an average 19 days faster.

Though the vast majority of the top-ranking markets were more affordable than the national market in Q4, demand for affordability has led to falling inventory and rapid price growth. On average, prices were 57.5% higher in Q4 2024 compared to five years prior. For comparison, prices rose 42.7% nationally in the same period.

Buyers Find Affordability in Well-Located Secondary Metros

Many of this quarter’s top markets are either in bustling secondary metros, or located within commuting distance from one of the country’s largest metro areas. The ever-popular Manchester-Nashua metro, along with Worcester, MA and Springfield, MA, are all within commuting distance of Boston. Trenton-Princeton, NJ is within-range of New York City and Philadelphia. Rockford, IL is near Chicago, and Toledo, OH is less than 60 miles from Detroit. The other four Ohio metros on the list, Dayton, Columbus, Akron and Canton, all have strong local economies and are within commuting distance of larger metros nearby, or each other.

Many of the highest-ranked markets offer buyers flexibility in terms of job location, which is highly sought-after in today’s easing job market. Importantly, more than half of these metro areas have an unemployment rate on-par with, or below, the national level. The unemployment rate in the top 20 metros is an average 4.0%, slightly below the U.S. level. Appleton, WI boasts the lowest unemployment rate (2.5%), followed by Manchester-Nashua (2.6%), Lancaster, PA (2.7%) and Green Bay, WI (2.7%).

This quarter’s mid-sized markets offer ample access to ‘nice to have’ amenities. While the cost of living in these metros is an average 1.8% below the 200-metro average, and 4.5% below the national standard, the top markets boast 32.1% more amenities per capita than the 200 largest metro average. Amenities are measured as the average number of stores per specific “everyday splurge” category (coffee, upscale/specialty grocery, home improvement, fitness) per capita in an area.

City Spotlight: Trenton-Princeton, NJ

Trenton-Princeton, NJ climbed 16 spots since last quarter, the most of any top market, to register as the 12th housing market in this quarter’s ranking. Trenton is located 30 miles outside of Philadelphia and 60 miles from New York City, highlighting the appeal for commuters. The median listing price in Trenton was $422,000 in December, more than $300,000 below the New York City median, but about $60,000 above the Philadelphia metro median.

Trenton is relatively small with just 380,000 residents, but pulled in significant buyer attention in the fourth quarter of 2024. The median listing price in Trenton climbed 11.1% compared to one year prior in December and homes spent 52 days on the market, almost three weeks less than the national median.

Active inventory was 60.2% lower than pre-pandemic in the 4th quarter of 2024. This scarcity drove price growth in the area and home prices climbed 60.7% versus pre-pandemic in the same time period. Homes in Trenton not only attracted more viewers than was nationally typical in Q4, but it also drew 23.3% more viewers per-property than typical in the area pre-pandemic.

As previously mentioned, Trenton is strategically located between Philadelphia and New York City, putting it in range for an easy commute to Philly and a rather hefty commute into the City, which may appeal to those who don’t have to be in the office everyday. The Trenton-Princeton metro area is also home to various universities, including Princeton University and Thomas Edison State University.

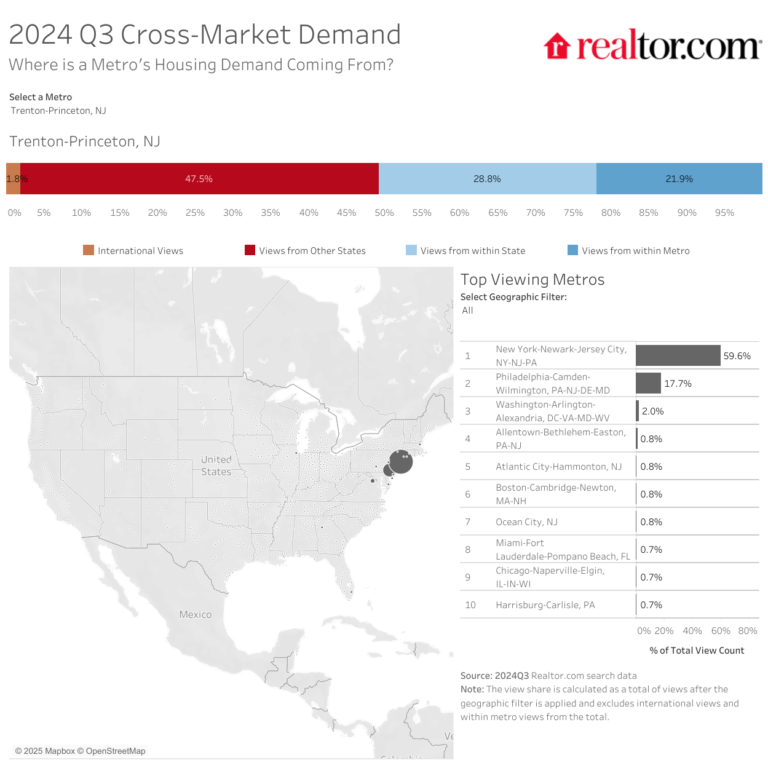

Highlighting the connection of the Philadelphia-Trenton-NYC corridor, 21.9% of home shopper traffic to Trenton comes from within the metro, 59.6% comes from New York City, and 17.7% comes from Philadelphia. The outsized share of views from New York City is both due to the metro’s size and perhaps to the relative savings that a NYC to Trenton-area move would yield.

Trenton-Princeton Housing Highlights

| Realtor.com – Trenton-Princeton, NJ: Dec. 2024 Inventory Metrics | ||

| YoY % Change | ||

| Median List Price | $ 422,000 | 11.1% |

| Active Listings | 442 | +36.4% |

| Days on Market | 52 | +6 days |

| New Listings | 146 | -24.0% |

Home Shoppers from Nearby Metros Drive Demand

Returning Markets

Sixteen of this quarter’s top 20 markets were also on last quarter’s list, highlighting the lack of significant change in the housing market of late. Among the metros that have remained on our list is the ever-popular Columbus, Ohio, as well as the fellow Ohio metros of Canton-Massillon, Toledo, Akron and Dayton. Only Midwest and Northeast locales stuck around this quarter.

| Market | Winter 2025 Rank | Fall 2024 Rank | Rank Change |

| Canton-Massillon, Ohio | 1 | 1 | 0 spots lower |

| Rockford, Ill. | 2 | 7 | 5 spots higher |

| Toledo, Ohio | 3 | 19 | 16 spots higher |

| Manchester-Nashua, N.H. | 4 | 4 | 0 spots lower |

| Akron, Ohio | 5 | 2 | 3 spots lower |

| Kalamazoo-Portage, Mich | 6 | 5 | 1 spots lower |

| South Bend-Mishawaka, Ind.-Mich | 7 | 11 | 4 spots higher |

| Milwaukee-Waukesha-West Allis, Wis. | 8 | 3 | 5 spots lower |

| Springfield, Mass. | 9 | 6 | 3 spots lower |

| Worcester, Mass.-Conn. | 10 | 8 | 2 spots lower |

| Dayton, Ohio | 11 | 13 | 2 spots higher |

| Fort Wayne, Ind. | 14 | 12 | 2 spots lower |

| Columbus, Ohio | 15 | 16 | 1 spots higher |

| Lancaster, Pa. | 16 | 10 | 6 spots lower |

| Appleton, Wis. | 17 | 20 | 3 spots higher |

| Hartford-West Hartford-East Hartford, Conn. | 19 | 15 | 4 spots lower |

Markets Falling Out of the Top 20

Four markets fell off of the list between last quarter and this quarter, dropping between 7 and 20 spots. The biggest mover was last quarter’s 18th-ranked market, Rochester, NY, which fell 20 spots to rank 38th this fall.

New Markets

Taking the places of the 4 descended markets are three Northeast locales, and the Midwest market Green Bay, WI All of the markets ascended from within the top 30. Though affordable metros reign supreme in today’s high-priced housing market, two of the four new markets, Trenton and Green Bay, were higher priced than the U.S. market in December, though by just 4.6% and 10.5%, respectively.

Methodology

The ranking evaluates the 200 most populous core-based statistical areas, as measured by the U.S. Census Bureau, and defined by March 2020 delineation standards for eight indicators across two broad categories: real estate market (60%) and economic health and quality of life (40%). Each market is ranked on a scale of 0 to 100 according to the category indicators, and the overall result is based on the weighted sum of these rankings. The real estate market category indicators are: real estate demand (15%), based on average pageviews per property; real estate supply (15%), based on median days on market for real estate listings; median listing price trend (15%), based on annual price growth over the quarter; property taxes (10%); and climate risk to properties (10%). The economic and quality of life category indicators are: unemployment (5%); wages (5%); regional price parities (5%); the share of foreign born (5%); small businesses (5%); amenities (10%), measured as the average number of stores per specific “everyday splurge” category (coffee, upscale/specialty grocery, home improvement, fitness) per capita in an area; and commute time (5%).