Highlights

- List prices for newly built homes are down year over year, and the premium charged compared with existing homes is at the lowest point for fourth-quarter data since 2020 at the latest.

- New-construction inventory levels continue to improve, though existing-home inventory is growing faster and diluting its share of inventory.

- The South and West are the most attractive regions for prospective new-construction buyers, offering larger shares of new-construction homes on the market, lower new-construction premiums, and more opportunities for mortgage rate buydowns.

As 2025 gets into full swing, we take a look back at 2024 and how the market for newly constructed homes has changed. 2024 was a strong year for new construction, with 1,020,600 new single-family homes hitting the market, according to housing completions data from the U.S. Census Bureau, up from 998,900 in 2023. We showed last quarter that newly built homes are becoming smaller and more affordable, as builders work to chip away at the supply gap that has plagued the United States since the Great Recession and get more buyers into new homes. That trend carried on in the fourth quarter of 2024, as the median listing price for newly built homes fell year over year and remained competitive on a per-square-foot basis with existing ones.

Mortgage rates, however, continue to cause issues for prospective buyers, creeping back up above the 7% mark this month and making home purchases more challenging. As we will show below, though, alternative financing options such as mortgage rate buydowns are one solution that builders (as well as sellers of existing homes) can implement to get their inventory sold in this high-mortgage rate environment.

Market Summary

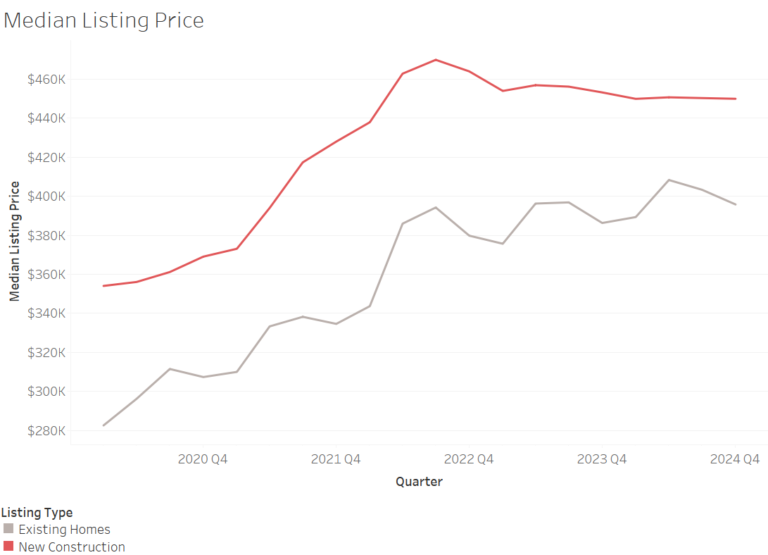

The median listing price for a newly constructed home in the United States was $449,967 in the fourth quarter of 2024, down 0.7% from the same period in 2023. The premium on new construction compared with existing homes (whose median listing price was $395,800 in 2024Q4) dropped 3.6 percentage points year over year to land at 13.7%, the lowest fourth-quarter new-construction premium in our data history back to 2020.

Not only has the premium on new construction fallen in recent years, but the share of new-construction listings on the market remains elevated. This share has retreated in the past year as more existing listings are hitting the market and staying on the market for longer, but at 18.1% in 2024Q4, it exceeds 2021Q4 when the share of new construction was 15.1% and the new-construction premium was 27.9%, as well as 2020Q4 when the share of new construction was 14% and the new-construction premium was 20.1%.

Though the share of new-construction listings on the market has dipped slightly from its peak in the first quarter of 2023, the number of new-construction listings has continued to grow. Below is a chart showing the percentage difference in the gross number of listings compared with 2019Q4 for new builds and existing homes. Existing listings have nearly rebounded to where they were at the beginning of the COVID-19 pandemic, still trailing the fourth quarter of 2023 by 12.5%. New-construction listings have recovered much faster and continue to grow in number, exceeding 2019Q4 by 25.6% in 2024Q4.

How do the new-construction markets vary from region to region? The plot below shows each of the four regions of the United States (as defined by the U.S. Census Bureau) on two important dimensions—new-construction share of the market and new-construction premium—and compares them with the national figure. The size of the circles corresponds to the number of new-construction listings in each geography.

The South is not only the largest regional market in terms of the number of new-construction listings, but also the most buyer-friendly, with a higher share of new-construction listings (23%) on the market and a lower new-construction premium (8.9%) than the country at large. The West has the lowest premium on new builds at 5.8%, but newly built homes make up a smaller share of the market (14.4%) than the national figure. The smallest new-construction markets, the Northeast and Midwest, also have lower shares of the market (9.9% and 13.5%, respectively) dedicated to newly built homes than the country as a whole and significantly higher new-construction premiums (76.2% and 64.8%, respectively). This is due in part to a significant difference in the age of the average home in the existing segment between the two pairs of regions. The average existing home on the market is just 39 years old in the South and 40 in the West; it’s 60 in the Midwest and 69 in the Northeast. We showed that the South and West are the regions in which for-sale inventory has returned to above or slightly below the levels they were at before the COVID-19 pandemic, and new builds are a major reason for that recovery.

Mortgage Rate Buydowns More Available in New Construction

Mortgage rates have spent the past two years at above 6% on a quarterly average for 30-year fixed mortgages, gumming up the gears of the housing market. Sales have been slow as buyers struggle to find a mortgage that meets their monthly budget, and inventory has lagged as sellers, locked into lower rates from previous years, are reluctant to give up their relatively favorable financing. Builders, as well as sellers of existing homes, have responded by offering mortgage rate buydowns to sweeten the deal.

A mortgage rate buydown is a type of discount on a monthly mortgage payment in which the homebuyer (or builder or seller on their behalf) pays a sum of cash to the mortgage originator at the time of origination to lower the interest rate on the loan for a set number of months or the entire life of the loan, decreasing the monthly obligation. The chart below shows mortgage rates in yellow bars and the share of existing-home listings (gray) and new-construction listings (red) that offer buydowns on Realtor.com.

As mortgage rates shot up through 2022, the share of listings offering buydowns for both existing and new listings rose in response. New builds are far more likely to offer buydowns (4.6% of them in 2024Q4) than existing homes (1.2%), as builders have more flexibility to offer proprietary or alternative-rate financing options than existing-home sellers do. Changes to the share of listings offering buydowns have followed mortgage rates quite closely until buydowns started falling in the second half of 2024 while mortgage rates held relatively steady. With rates surpassing the 7% mark in January 2025, there may be an opportunity for more buydowns to be offered in the market to attract prospective buyers.

What types of listings have mortgage rate buydowns offered on them? In the existing-home segment, it tends to be larger and more expensive homes. The typical existing home offering a buydown had a median listing price of $467,600 and an average of 3.5 bedrooms, compared with the $390,967 listing price and 3.2 bedrooms of the typical home that doesn’t. New construction, meanwhile, is much more likely to offer mortgage rate buydowns on more affordable listings. The 19.6% gap in median listing price between the existing homes offering buydowns and those not offering buydowns is far greater than the gap among new builds. The median listing price of new builds with a buydown offered is $457,938, compared with $439,953 for those without (a 4.1% gap). Both homes with and without buydowns in the newly built segment have an average bedroom count of 3.6. Buyers searching for a deal on their monthly payment should look to new construction, where they can find more mortgage rate buydowns on lower-priced homes.

Regionally, the West has the highest share of new-construction listings with mortgage rate buydowns offered, at 6%. The South (4.5%) is basically on par with the national rate, while the Midwest (2.9%) and Northeast (1.3%) trail the United States as a whole. The Northeast was the only region to see a quarter-over-quarter increase (from 1.2% in 2024Q3).

Methodology

Realtor.com housing data as of December 2024. Listings include the active inventory of newly built single-family homes and condos/townhomes/row homes/co-ops for the given level of geography on Realtor.com. Realtor.com data history goes back to July 2016. Buydowns are identified by parsing text in listing descriptions and promotions on Realtor.com listings.