What happened

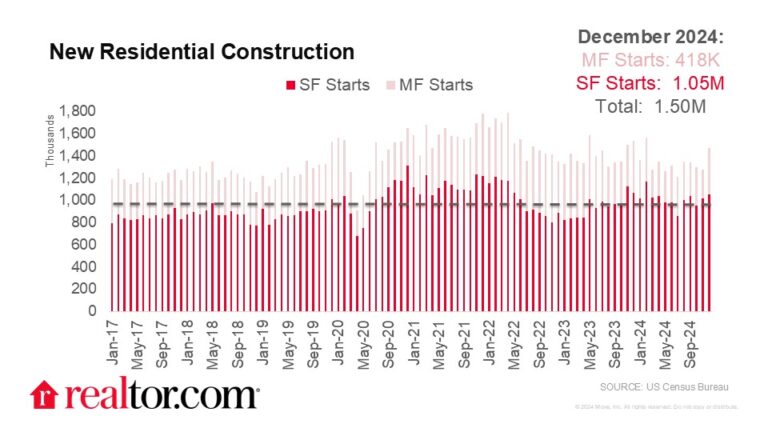

New residential construction activity slowed month over month in December, with permits falling by 0.7% from November and housing completions falling by 4.8%. Housing starts, meanwhile, picked up 15.8% month over month but still trail year over year by 4.4%. The fresh data for the final month of 2024 allows us to look at the year as a whole, in which permits trailed 2023 by 2.6%, starts trailed by 3.9%, but completions increased by 12.4%. This result speaks to some uncertainty holding strong among builders, who have worked hard in 2024 to finish projects and get new homes online, but are holding back from pushing new projects into the murky landscape of construction in 2025. Questions about the policy initiatives of the incoming Trump administration, which has promised tariffs on imported goods that include construction materials and mass deportations that will impact builders’ labor forces, surely have come into play as builders slow down in terms of initiating new building projects.

Where it happened

Though year-over-year and month-over-month permitting fell nationally overall, the retreat is primarily focused in the multifamily space. Single-family permits actually picked up 1.6% from November and are down 2.5% from December 2023, while permits for units in buildings of 5 or more units were down 5.8% month over month and 5.4% year over year. Given the softness of the rental market over the past year and half and the known shortage of homes for sale across the US, it’s understandable that builders would respond in this way. The bright spot for permitting comes in the 2-4 unit space, where permits grew 1.9% month over month and 5.9% year over year. Strength in this duplex/triplex/townhome segment is consistent with builder trends of prioritizing smaller, more affordable units for sale. Regionally, the Northeast has continued its strong showing in recent months, with overall permits up 14.0% and single-family permits up 19.2% compared to last December. Permitting cooled year over year in the South, with total permits falling by 6.5% and single-family permits falling by 2.8% year over year. Still though, over half of permits issued are in the South region.

Multi-family starts rebounded strongly from a very weak November, leading the month-over-month pickup, but still trail December 2023 by 11.3%. Single-family starts similarly picked up by 3.3% from November but trail last December by 2.6%. The Northeast leads the charge again, with a +40.2% mark for month-over-month total starts, while the West dropped by 0.7% from November to land at 26.2% below last December. Completions were actually strongest in the West, up 20.9% from November and 34.7% from last December, and focused in the multi-family space as single-family completions were down 13.1% month over month and only up 1.9% year over year.

What does this mean for homebuyers, sellers, homeowners, and the housing market

Builders are facing their fair share of challenges, from political uncertainty to 7+% mortgage rates slowing down the market. They’ve done well in the last half of 2024 to spread out their projects regionally, where before there was a hyper focus on the South. We showed that inventory levels in the South and West are nearly back to pre-pandemic levels, while they still trail significantly in the Northeast and Midwest, so there’s still room to grow in these less-served regions. Buyers should take notice of the strong completions number for 2024 as a whole. 1,627,900 new homes, including 1,020,600 single-family homes, hit the market this year. Buyers who have been frustrated with the stock of existing homes for sale may find that new builds offer them more affordable options for brand-new homes.