What were the employment trends in December?

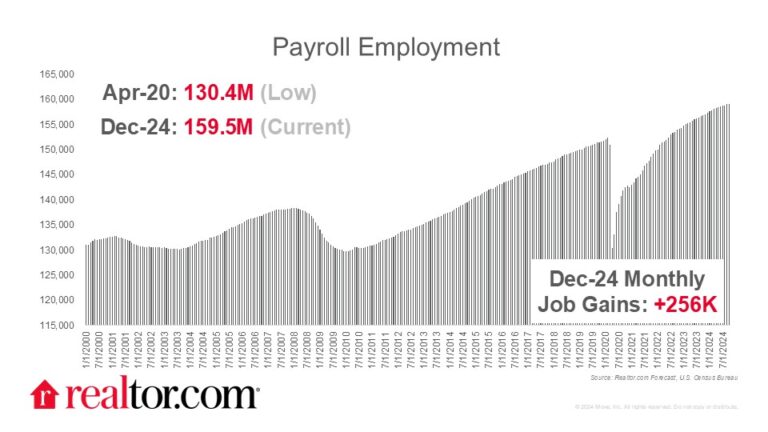

The December jobs report showed ongoing payroll job creation of a net 256,000 in December, a step up from November’s downwardly revised 212,000 jobs added. The unemployment rate stepped down from 4.2% to 4.1%, continuing in a narrow range at or above 4% for an eighth month. Wage growth continued, coming in at 3.9%, a very healthy, but modestly slower pace than in recent months.

What else do we know about today’s job market?

Other recent job market data showed a sizable number of job openings in November. Job openings tallied 8.1 million, climbing for a second straight month, but remained down from 8.9 million in November 2023. The job openings rate also rose for a second month, but at 4.8% was lower than 5.3% one year ago and tied the pre-pandemic high reached in December 2018 and January 2019. Job quits, which can be a gauge of worker confidence, slipped to 3.1 million in November, down from 3.5 million one year ago. The job quits rate of 1.9% was similarly down in November, and from one year ago (2.2%) and continues to hover below pre-pandemic highs (2.4%). Together, these data paint a mixed picture. Despite robust hiring and growing job openings in November, workers appear to be somewhat less confident about making changes, consistent with a gradually cooling labor market.

What does today’s data mean for homebuyers, sellers, and the housing market?

Although we’ve rung in the new year and cleared the confetti and champagne glasses, the next month or so of data will help close out our picture of 2024 and shape actual conditions and expectations for the year ahead. The labor market ended the year on a steady note, largely in line with or exceeding expectations. This should bolster confidence in monetary policy but suggests, as markets and the Fed have come to expect, that not as much additional monetary easing is needed. Mortgage rates, which have climbed recently, have largely priced in this reality, but policy remains a wild card as inauguration nears.

Ongoing wage growth will be important for home shoppers, especially first-time homebuyers who generally do not have equity from a previous home to use and tend to rely on savings, generally accumulated from earnings. Those ready to make a purchase in 2025 will find pockets of opportunity in areas like Harrisburg, Pennsylvania which joined 9 other markets in the Northeast, Midwest, and South as the Best Markets for First-time Homebuyers in 2025 according to a recent Realtor.com report.

Subscribe to our mailing list to receive updates on the latest data and research.