What happened to mortgage rates this week

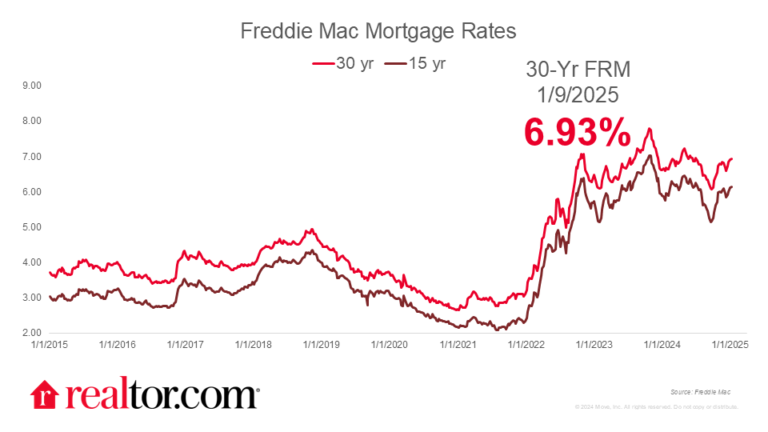

The Freddie Mac rate for a 30-year mortgage climbed to 6.93% this week as the 10-year Treasury surged higher and the market prepared for Friday’s employment report. More rate volatility is possible in the coming days, depending on how close Friday’s jobs report mirrors expectations.

The highly anticipated jobs data will be an important input for the FOMC meeting at the end of the month. A strong, but not too strong, employment report could help settle some economic uncertainty going into the new year. Convincing evidence of cooling job growth and easing inflation will be important in bringing mortgage rates lower.

What it means for the housing market

The housing market softened more than is seasonally typical in December, due in large part to climbing mortgage rates. More than three-quarters of consumers said it was a bad time to buy in December as mortgage rates reached their highest level since July. However, an uptick in new-home, existing-home, and pending home sales in November suggest that buyers have started to adjust to higher mortgage rates. Nevertheless, more significant market recovery hinges on falling rates. We expect housing conditions to improve in 2025, with slightly lower mortgage rates and more for-sale inventory.