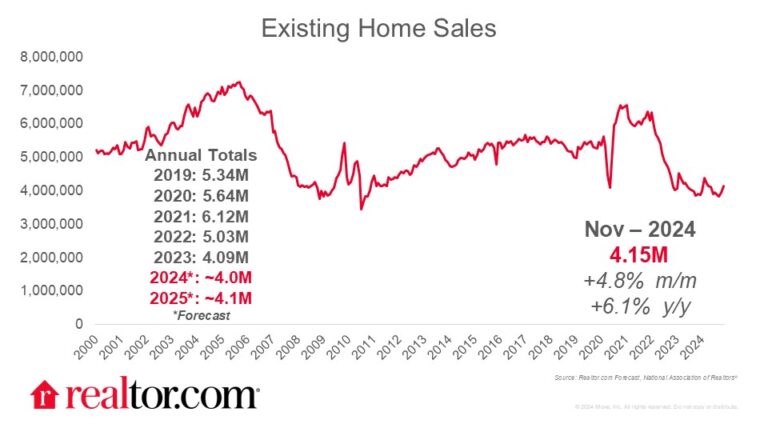

Existing-home sales picked up

Existing-home sales picked up in November to 4.15 million, notching a second consecutive year-over-year gain after a streak of declines stretching back to August 2021. This is the first time in six months that home sales exceeded the 4 million mark. Home sales rose 6.1% from last year and were also 4.8% higher than in October.

Homes with November closings generally went under contract in September and October, when shoppers benefited from an uptick in newly listed for-sale homes. Increased buying power, as mortgage rates declined to a two-year low in September, brought shoppers to the market, and the late September surge in rates created a sense of urgency that likely contributed to the uptick.

Home prices rose while months supply tightened

The median home sales price likely moved higher compared with one year ago, climbing 4.7% to $406,100, notching an eighth straight month above $400,000. Unsold housing inventory rose 17.7% from a year ago, pushing months supply up relative to that point. But at 3.8 months, supply relative to sales slipped back into seller’s market territory for the first time in six months.

All regions saw year-over-year gains in sales and prices

Home prices climbed in all four regions year over year, with home sales climbing by double digits in the West (+14.9%). From one month ago, home sales were strongest in the Northeast (+8.5%) and flat in the West. Home price growth was strongest in the Northeast (+9.9%) and Midwest (+7.3%), regions where demand has outpaced supply according to the Realtor.com November Hottest Housing Markets report. Home price growth was more modest in the West (+4%) and South (+2.8%).

The availability of homes for sale is likely at play. According to the Realtor.com November Housing Trends report, the South and West have seen the biggest gains in available housing inventory and have recovered the most relative to the pre-pandemic inventory, coming within 5% of that benchmark.

Mortgage rates still matter

We could see home sales falter again in the months ahead as fall’s higher rates are felt, but mortgage rates have already turned the corner, dropping back to 6.6% as of mid-December. While Fed policy and inflation trends might lead to upticks in interest rates from time to time, as the reaction to the December Fed meeting and updated Fed projections shows, in the medium run, more mortgage rate declines are expected.

Modest housing recovery ahead

This mortgage rate outlook has already boosted buyer sentiment and is likely to propel modest home sales growth in the year ahead, according to the Realtor.com 2025 Housing Forecast. These gains won’t be distributed evenly across markets. Recent sales momentum, relatively lower costs, more plentiful inventory in areas where builders can build, and more younger households are commonalities across markets in the South and West that are expected to see outsized home sales and price growth, according to the Realtor.com 2025 Top Housing Markets report.