In total, real estate technology entrepreneurs landed $15.1 billion in funds for their ideas on how to improve the industry, according to CRETI’s 2024 Proptech Venture Capital Analysis.

Whether it’s refining your business model, mastering new technologies, or discovering strategies to capitalize on the next market surge, Inman Connect New York will prepare you to take bold steps forward. The Next Chapter is about to begin. Be part of it. Join us and thousands of real estate leaders Jan. 22-24, 2025.

Venture capitalists wrote the greatest number of checks to proptech companies in October this year, according to the Center for Real Estate Technology and Innovation (CRETI). In total, real estate technology entrepreneurs landed $15.1 billion in funds for their ideas on how to improve the industry, according to CRETI’s 2024 Proptech Venture Capital Analysis.

The organization’s findings hammer into place a discussion point that’s been heard on stages, in webinars and typed into rejected pitch emails countless times over during the post-pandemic real estate market: money requires maturity.

“Investors increasingly favored companies with robust financials and a clear ROI narrative,” the report said. “Gone are the days of growth at all costs. Instead, the focus has shifted toward sustainable, scalable solutions with clear ROI. This shift is not merely a reaction to economic conditions; it represents the maturation of an industry that has grown increasingly sophisticated over the past decade.”

In short, a great idea isn’t going to get it done moving forward, at least not without revenue to show for it. But that doesn’t mean that a promising young company can’t find its financial footing. What the industry is now calling the “Sapling Stage” has come to light that, according to one VC executive, represents “funding rounds at revenue levels between $500,000 and $1.5 million.”

Anyone who has paid close attention to the real estate market for the last decade or more understands that there is no stronger root holding the market in place than inventory. In response, money has been poured into construction technology to the tune of $4.5 billion, CRETI reports, making it the most funded branch of proptech.

When it comes to specific products gaining attention, that money is going to “… technologies like 3D modeling, AI-powered project management, and advanced supply chain and logistics that address the sector’s historic inefficiencies,” CRETI said.

Companies that built tools to better the consumer homebuying experience were more likely than others to get a chunk of the more than $3 billion that went into residential proptech, the report found. This niche may find room to grow in a post-NAR settlement world as agents struggle to find ways to get paid directly and sellers become less likely to pay the buyer agent.

As if the buyer representation agreement hassles aren’t enough to challenge agent-consumer dynamics, industry winds of change are generally growing stronger, and starting to gust in new directions.

Clear Cooperation — the rule that states a listing must be advertised publicly 24 hours after signing an agreement — is under fire, as is NAR’s very purpose. More brokerages are opting out of membership and, thus, may seek new avenues of public and industrial support, something technology entrepreneurs can find methods to exploit.

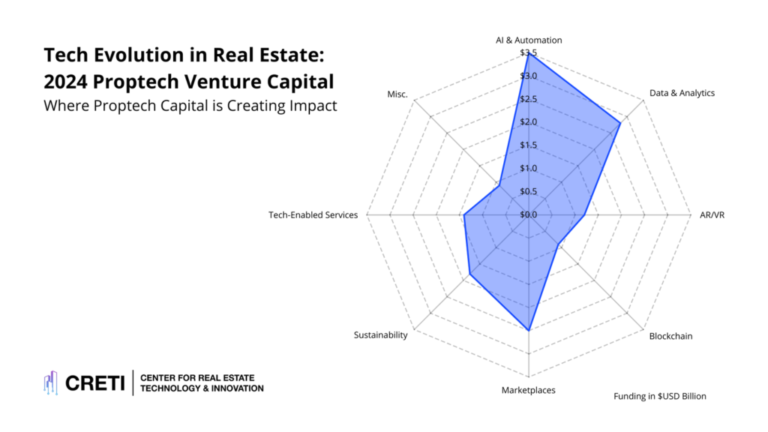

Artificial intelligence and data-empowerment solutions topped the funding list, according to CRETI, and the multifamily sector was quick to put the target of that money to work.

Software providers in property management and apartment marketing moved quickly in 2024 to integrate AI into lead cultivation, applicant quality, maintenance processes and even credit and fee delinquencies.

“The surge in AI-focused funding underscores investor confidence in its cross-sectoral applications and long-term growth potential, positioning the category as a cornerstone of the proptech ecosystem,” CRETI said.

One notable AI-driven investment is the one made by Camber Creek in SERHANT. Technologies. The popular industry fund put an equity stake of $45 million into the software offshoot of a career brokerage largely on the strength of its AI marketing and business workflow solution, S.MPLE.

The next 12 months should see more of the same, with a focus on quality investments.

“Deal volumes contracted by 15 percent compared to 2023, but the average deal size increased by 12 percent, reflecting a shift toward fewer but higher-quality investments,” CRETI said.

While seed and startup cash is harder to find, it’s all to the benefit of the industry, which has matured quickly in the past five years. Software founders have looked past surface-level lead generation gimmicks and rehashes of existing solutions to offer new forms of internal efficiency and a focus on making search, escrow and lending better for the consumer.