Mortgage giants will be allowed to back loans of up to $1.2 million in high-cost markets, providing ammo to critics who say goverment backing for mortgages adds to affordability woes.

Whether it’s refining your business model, mastering new technologies, or discovering strategies to capitalize on the next market surge, Inman Connect New York will prepare you to take bold steps forward. The Next Chapter is about to begin. Be part of it. Join us and thousands of real estate leaders Jan. 22-24, 2025.

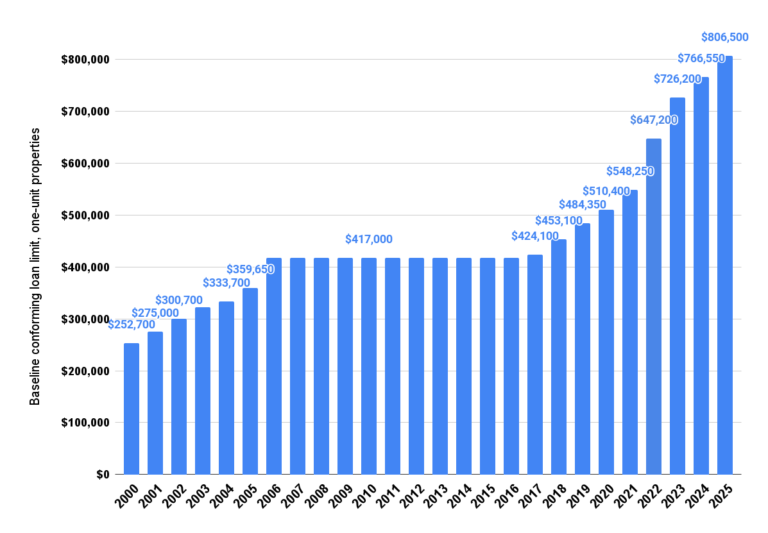

Rising home prices are pushing the baseline conforming loan limit for mortgage giants Fannie Mae and Freddie Mac to $806,500 in most parts of the country next year, which will help more homebuyers avoid having to take out a jumbo mortgage.

The $39,950 increase in Fannie and Freddie’s baseline single-family loan limit is the smallest since 2021, but pushes the ceiling in high-cost markets to $1,209,750, the Federal Housing Finance Agency (FHFA) announced Tuesday.

That provides ammunition to critics like the Housing Policy Council, a mortgage industry trade association that claims federal backing for mortgages makes housing affordability problems worse.

TAKE THE INMAN INTEL INDEX SURVEY FOR NOVEMBER

“After a lengthy period where loan limits remained unchanged during and after the Great Financial Crisis, the subsequent rapid rise in house prices has fueled a growth in loan limits that exceeds the growth in household income,” the HPC said in a statement. “As a result, more and more upper-end borrowers have access to federal support for financing mortgages, which puts upward pressure on house prices.”

The higher limits will be welcomed by many homebuyers who will no longer be subjected to the more stringent underwriting standards and higher rates that often apply to “jumbo mortgages” that are too big for Fannie and Freddie to buy.

Although the new limits don’t take effect until Jan. 1, lenders can start implementing them now if they’re willing to wait until the New Year to sell loans that exceed the current limit to Fannie and Freddie.

Some of the nation’s biggest mortgage lenders have been pricing jumbo loans of up to $802,650 as if they were conforming since September, knowing that home prices continue to go up and the limit would be raised.

Congress has tied the conforming loan limit to the average U.S. home price, as measured by the FHFA’s House Price Index. The latest reading of that index, also released Tuesday, showed U.S. house prices rose 4.3 percent during the year ending Sept. 30.

But the conforming loan limit is indexed to the expanded-data FHFA HPI, which measured annual home price appreciation at 5.21 percent.

Baseline conforming loan limit, 2000-2025

Source: Federal Housing Finance Agency

On a percentage basis, the 5.21 percent increase from the 2024 baseline conforming loan limit of $766,550 is the smallest since 2017, when the limit was bumped up for the first time in a decade by 1.7 percent.

When mortgage rates hit historic lows during the pandemic, soaring home prices pushed the conforming loan limit up by a record $98,950 in 2022, an 18 percent increase from the year before.

Conforming loan limits for multi-unit properties

Source: Federal Housing Finance Agency

The baseline conforming limits for multi-unit properties for 2025 will be $1,032,650 for two-unit homes, $1,248,150 for three-unit homes, and $1,551,250 for four-unit properties.

The ceiling in high-cost markets will be $1,548,975 for two-unit properties, $1,872,225 for three-unit homes, and $2,326,875 for four-unit properties.

In higher-cost markets, Fannie and Freddie are allowed to purchase bigger mortgages based on a multiple of the median home value, up to a ceiling that’s equal to 150 percent of the baseline conforming loan limit.

Next year, the conforming loan limit for one-unit properties will exceed $1 million in 114 counties and Census areas concentrated in nine metro areas, and all of Alaska and Hawaii. The conforming limit will also be higher than the $806,500 baseline, but less than $1 million, in 40 counties and Census areas nationwide.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.