What happened to mortgage rates this week

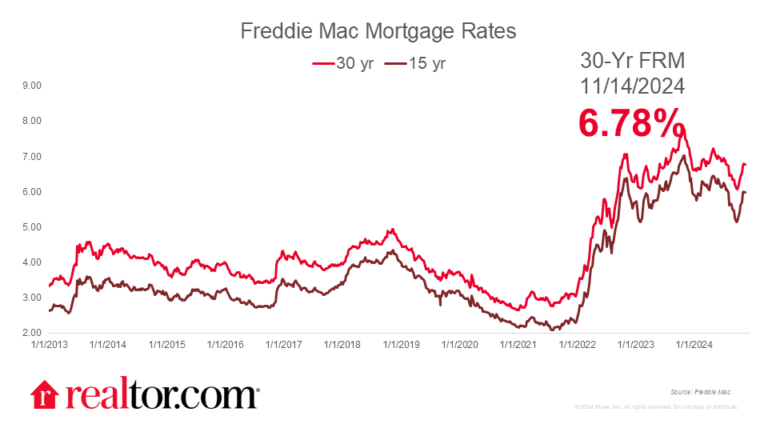

The Freddie Mac rate for a 30-year mortgage dropped 1 basis point, to 6.78%, over the week, remaining higher than many initially expected, as the 10-year U.S. Treasury yields continued to climb. Investors were adjusting to the potential economic impacts of Donald Trump’s victory, especially concerns over inflation from proposed tariffs and the rising labor costs due to reduced immigration. These factors led markets to keep focusing on how Trump’s win might affect interest rates moving forward.

Meanwhile, October’s moderate uptick in the consumer price index could indicate a slower pace of monetary policy normalization, suggesting a potential rate pause in December instead of another cut. As longer-term rates have been quick to adjust to an improved economic outlook and the potential implications of the election results, for now, this means higher long-term rates than many initially expected, including for mortgage rates

What it means for the housing market

The recent bounce-back in mortgage rates might be disappointing for homebuyers hoping for a year-end dip, especially since over 80% of homeowners with a mortgage have a rate below 6%, well below current market levels. However, instead of focusing on high rates, buyers could focus on other buyer-friendly market trends—like the highest inventory since December 2019, the slowest seasonal market in five years, and nearly 20% of listings offering price cuts. In the meantime, exploring the most suitable loan products such as VA loans could put many homebuyers in a more advantageous position in today’s market.