What happened to mortgage rates this week

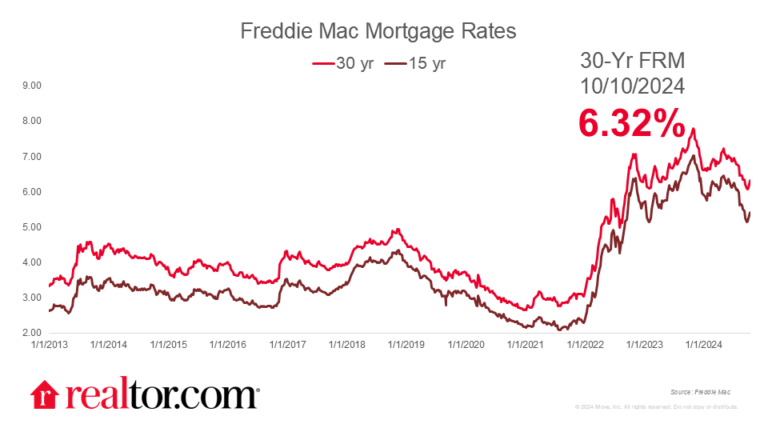

Mortgage rates climbed for the fifth consecutive week, rising by 18 basis points to 6.72%, the highest since August 1st on the heels of the 10-year treasury marching higher, remaining above 4.25% and at the highest levels since July. This quick rise in mortgage rates stymied some of the momentum that was brought to the housing market in September, when rates dropped to near 6%. While we expect rates to settle back down to around 6.3% by the end of the year, it has been a combination of robust employment data combined with increasing uncertainty over the outcome of next week’s election that have prevented downward progress in mortgage rates

What it means for the housing market

While September brought us a surge in pending home sales due to troughing mortgage rates, we expect a reversal of this momentum in the coming months as rates climbed back up to near 7% throughout October. Though we saw evidence that the “lock-in” effect was easing, as noted in our October housing report released today we expect it to tighten as home sellers – who often are future buyers – decide to wait out both high mortgage rates along with the uncertainty surrounding the results of the U.S. presidential election. The trajectory of rates over the coming months will be largely dependent on three key factors: (1) the performance of the labor market, (2) the outcome of the presidential election, and (3) any possible reemergence of inflationary pressure. While volatility has been the theme of mortgage rates over the past several months, we expect stability to reemerge towards the end of November and into early December.