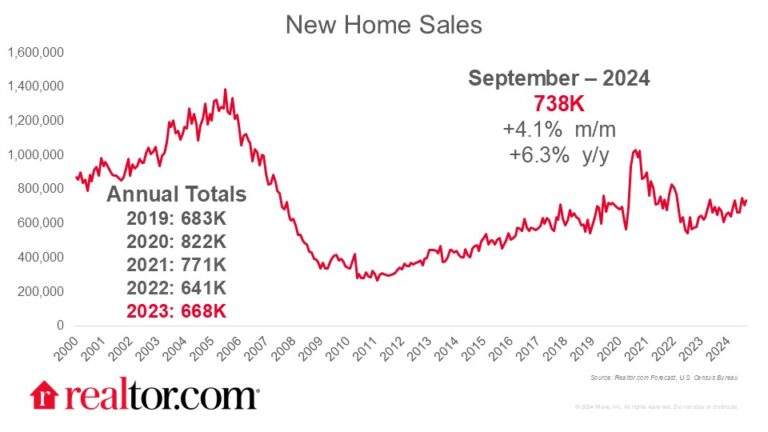

September 2024 New Home Sales

What Happened This Month:

New home sales rebounded in September, outpacing August by 4.1% and September of last year by 6.3% with a seasonally adjusted annual rate of 738,000 homes. Strong new construction activity throughout the year with a concerted focus on offering smaller and more affordable homes has put more buyers in a position to choose new construction this fall even as mortgage rates swing back up and the existing home market continues to decline. Though sales activity continues to pick up in the new home space, prices have remained level. This month, the median new home sold for $426,300 compared to $426,100 a year ago.

New home sales continue to grow the strongest in the Midwest and South regions, which saw 14.9% and 14.7% growth year-over-year respectively. A whopping 64.6% of all new home sales took place in the South this month, the region where new home construction has been the most active in recent years. The Northeast saw a major pickup (21.7%) in new home sales in September compared to August, but remains well below the pace (-22.2%) of September 2023. The West remained flat month-over-month but still trails by 10.9% year-over-year.

New Home Share of Inventory Falling:

The inventory of new homes for sale reached its highest level of the year and marked an 8.0% increase from last year, reaching a seasonally adjusted annual level of 470,000 homes. The inventory growth has been just outpaced by the growth of sales volume, and so the months of supply of new homes dipped slightly to 7.6, the lowest level since September of last year. The share of all homes for sale that are new builds dropped as well, to 25.4%. This is primarily a result of existing homes spending longer on the market and building up more inventory relative to new homes.

More Completed New Homes are on the Market than Non-Started Ones:

Of the available new homes for sale at the end of September, 21% were not started, 55% were under construction, and 23% were completed. The share of completed new homes on the market has been steadily increasing this year, surpassing the share of non-started homes in a reversal of the trend since the peak of the COVID-19 pandemic. Now, the mix of new homes on the market by stage of construction looks more similar to how it did from 2014 to 2020.

What does this mean for buyers and builders?

Buyers have far more options than they did a couple of years ago, when the post-pandemic buying frenzy was at its full height. The stock of homes for sale has finally rebounded to the level of April 2020, but prices have remained sticky and high in recent years. With little relief from the only slightly lower mortgage rates, buyers aren’t seeing as many homes that fall into their budget range as the inventory growth suggests there should be. Many, as we have seen, are turning to new construction, taking advantage of builder promotions like mortgage rate buydowns and focusing on the more affordable listings that builders offer. Builders can count on the continued success of selling these more affordable homes if they continue to offer them and the incentives that attract new home buyers.