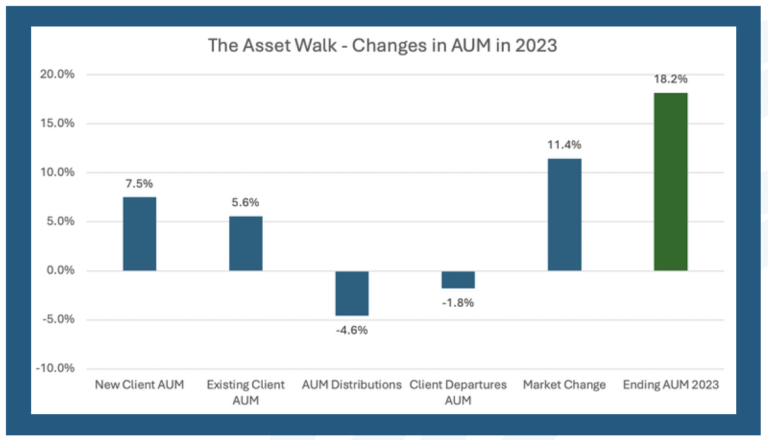

While firms grew their assets under management by 18% in 2023, that figure doesn’t account for market growth, which was at 11.4%, according to a new study conducted by Ensemble Practice and BlackRock.

However, new client AUM, which grew on average 7.5% in 2023, speaks more about the health of an advisor’s business, said Ensemble Practice CEO Philip Palaveev. And when you factor in client departures (-1.8%), organic growth was just 5.7%. That’s low considering most firms he talks to say they expect 10-15% growth.

“For a long time, in many conferences, in many conversations, even in research papers, we’ll point to the growth that’s created by the markets and call it ‘organic growth,’” Palaveev said. “It’s time to separate the markets out of the equation and face the reality that, at least in the last five years, we have not been growing well. We have a growth problem.”

The True Ensemble Data Insights 2024 Survey was conducted in April and May 2024, with BlackRock and Ensemble Practice collecting data from 240 advisory firms about their business growth, profitability and employee compensation. This first report focuses on organic growth.

Palaveev says the average organic growth rate doesn’t tell the whole story; if you look at the distribution of growth results, you have 21% of firms growing new AUM at 11%. Yet more than half of firms are growing at 3% or less.

“If we take those [fast-growing firms] out of the equation, the rest of the firms are actually growing at no faster than 3%.”

To grow, firms need to realize that marketing, like investing, should be a vital function of the firm, he says.

“In most industries, that will be elementary,” Palaveev said. “You don’t need an MBA to come to that conclusion. But in our industry, we don’t trust marketing, and we don’t invest in marketing nearly enough. You will see in this report that firms are spending a minimal amount of money on both marketing budgets as well as marketing staff. Marketing as a function is barely emerging, even at the largest of firms.”

Survey respondents said they spend just 1.4% of their revenue on marketing and 0.7% on compensating marketing employees, on average.

On average, advisory firms spent 1.4% of their revenue on marketing and 0.7% on compensating marketing employees. Even large firms (those with $1 billion-plus in AUM) spend just 0.9% of revenue on marketing department compensation, which comes out to about $114,000.

A good rule of thumb in many industries is that roughly 5% of the revenue should be invested in growth—essentially marketing.

Palaveev says there is data that shows that firms that spend more on marketing actually grow faster.

The report also looked at the sources of leads coming into advisory firms, with the winner being referrals from existing clients, at nearly 58%.

“That’s the way it should be,” he said. “That’s the sign of strong relationships. That’s the sign of a firm doing a very good job for its existing clients. That’s a firm that really really creates strong connections. This is great. But once again, this is slow.”

That was followed by referrals from centers of influence, networking, and marketing leads, at 9.5%.

“These are basically leads generated that are not associated with a person,” he said. “Rather than someone calling and saying, ‘Hey, can I talk to Philip.’ They call and say, ‘Hey, can I talk to the Ensemble Practice, whoever’s available?’ That’s a marketing lead.”

The importance of those marketing leads is slowly but gradually increasing. Palaveev said he’s seen that number grow from about 0% in the 1990s to nearly 10% now.

“I suspect that this is the number that’s going to be the most important industry trend,”

“They say in elections, ‘every party should gets its own party members to go and vote, and then try to win as many of the independents as possible.’ This is almost the same. Every firm should get its members—in other words existing clients—to refer as much as they can. And then try to get as much as they can of the independents. That’s the marketing part.”

These marketing leads shouldn’t replace referrals from existing clients, but it will be the vehicle of accelerating growth, he said.

If you look at the organic growth rates by size, the study found that small firms grew new client AUM by 12.9%, while large firms grew by 5.2%. Palaveev attributes that to the ‘denominator problem.’

“The denominator problem is simply, if you’re $100 million in assets, to grow 10% you need $10 million; $10 million is, let’s say, 10 clients, $1 million each. Sounds doable. If you’re $1 billion in assets, to grow by 10% you need to bring $100 million. That’s 100 clients. Suddenly to grow by the same rate, because we’re measuring growth by percentages, you have to bring so many more clients.”

At the same time, large firms have larger marketing budgets, more existing clients to refer and more advisors out there networking and referral relationships with the custodians.

Palaveev argues that the lower growth rate is likely also related to larger firms’ focus on mergers and acquisitions, at the expense of organic growth.

“Large firms today have fallen too much in love with acquisitions as a growth strategy, and perhaps neglected organic growth, because all of the large firms are chasing acquisitions,” he said. “The denominator problem is a problem, but then again that large truck should have a much larger engine. And perhaps that engine is currently busy with M&A.”