What happened to mortgage rates this week

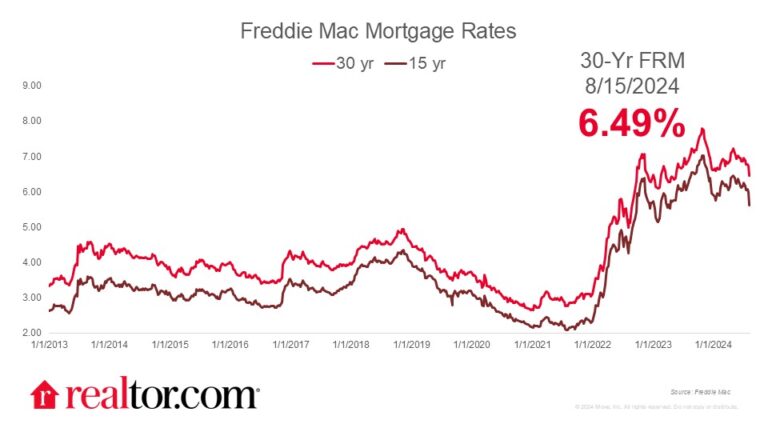

The Freddie Mac rate for a 30-year mortgage rose just 2 basis points to 6.49% this week as the latest consumer price index data reported the lowest level of inflation since 2021. The July inflation data came in near expectations, boosting investor confidence that a rate cut will be on the table for the September FOMC meeting.

Despite overall inflation trending in a positive direction, shelter inflation remains stubbornly high. Homebuyers and renters continued to face challenges in July as rents, home prices, and mortgage rates showed little downward progress. However, inventory levels have trended higher on an annual basis over the past nine months, suggesting that housing conditions are set to improve, especially on the heels of the recent downward mortgage rate trend.

What it means for the housing market

Though the housing market is likely to see a boost from falling mortgage rates, a recent analysis found that renting was still more affordable than purchasing a starter home in July in all 50 of the country’s largest metros. Rents remain near pandemic-era highs in many areas, but the combined effect of elevated mortgage rates and price growth meant that the cost of purchasing a home far outpaced rent growth over the past few years.

Both buyers and sellers have been hesitant to jump back into the housing market as high prices and mortgage rates proved untenable. Roughly 86% of outstanding mortgages have a rate of 6% or below, meaning rates will need to continue to trend lower to see a fully reenergized housing market.

The recently updated 2024 Realtor.com Housing Forecast predicts mortgage rates to fall to 6.3% by the end of the year, and inventory to climb by 14.5% annually in 2024. Lower rates and more for-sale inventory spell opportunities for buyers. The summer is typically the busiest time of year in housing, but this fall may see an extra boost from shifting housing conditions.