A new survey has found that most single-family rental landlords are cautious in 2024 – neither bullish or bearish about investment, according to the data analytics company Resiclub.

The survey of landlords who own at least one investment rental property between June 25 and July 18, 2024, showed the following:

- 60% of single-family landlords say they’ll likely buy at least one investment property over the next 12 months.

- 39% of single-family landlords say they’ll likely sell at least one investment property over the next 12 months.

- 76% of single-family landlords expect to raise their rents over the next 12 months—including 35% who say the increase will be over 4.0%.

- 2% of single-family landlords expect to decrease their rents over the next 12 months.

- 72% of single-family landlords expect home prices to increase in their core housing market over the next 12 months. But only 31% expect an increase of over 4.0%.

- 86% of single-family landlords expect interest rates to fall over the next 12 months. However, just 10% of those landlords expect a decline of more than 1 percentage point.

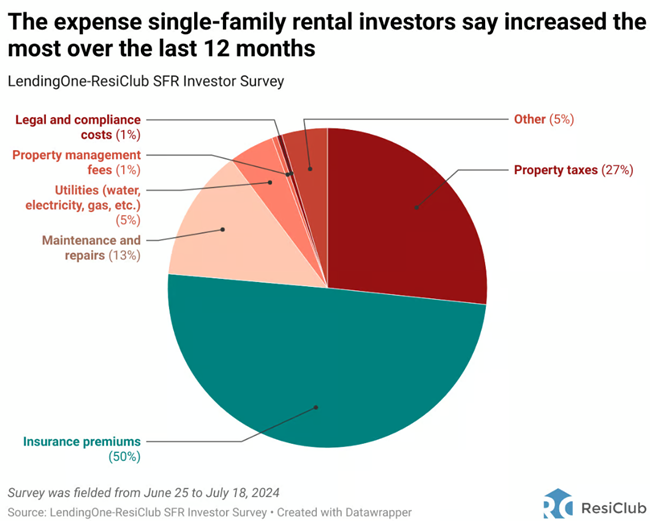

- 50% of single-family landlords say home insurance was the expense that increased the most over the past 12 months.

The survey says rapidly rising insurance rates for rental properties are a big concern among the group. According to the results, most single-family landlords “aren’t super bullish or bearish; instead, they are cautiously optimistic, expecting a balanced single-family rental market over the next 12 months.”

The survey says many plan to buy properties, raise rents, and anticipate rising home prices and falling interest rates. However, they only expect a mild increase in rents and home prices, as well as just a slight drop in interest rates.

The survey was done by Resiclub and Lending One.

“The survey result generally aligns with what we have heard and thought over the last 12 months and how we see this shaking out,” said LendingOne CEO Matthew Neisser in a release.

“We saw apartment rents starting to stall months ago; apartment rents were already leveling out in most markets and becoming more competitive with concessions. So, on the single-family side, it’s a function of affordability. And people can afford only so much at certain price points. So, it seemed obvious there’s only so much more to run on rents, within reason.”